Budgeting and Savings are some of the oldest financial tools that we use. If we look around us, it is used by everyone at every level of the tire. Be it personal financing or public financing, both of these tools are used even after ages because they have proven their mantle time and time again. Humans are among the most evolutionary species out of all species.

- Human evolution shows the ability to adapt to their surroundings and utilize them for personal and social betterment.

- Whether in a developed economy such as the USA or an under-developed one such as Papua New Guinea, humans have “somehow” found a way to live and thrive. Maybe that’s why the saying goes, “Where there is a will, there is a way.”

More comprehensive utilization of financial principles and applications among/by humans has also helped achieve and afford modern marvels and comforts. Thus, economic strongholds and financial measures have become significant worth for human survival.

- Naturalist Charles Darwin said, “Survival of the fittest.” Maybe we humans have taken him a bit seriously.

Humans have shown tremendous development in living, from being gatherers in the initial stages to our comfortable homes in the current times. This also showcases the human ability to use its surroundings, not just for evolutionary and sustenance purposes but for the betterment of life in various aspects. Such as food, shelter, clothing, security, health, education, and many more. To better hold on to these multiple aspects, finances may have been developed to make the possible or desired exchange or trade-off. And thus comes budgeting and savings into the picture.

Budgeting and Savings are among the most practical and lucid tools of finances used by humans from the early ages until today. They stand of great significance as optimal decision-making and choices could be made per the circumstances.

- In Economics, a Budget is an estimation and re-evaluation for the revenue and expenditure of any individual, institution, or country for/during a specific period.

- And Savings is simply the part of income, which is not spent by the individual to fulfill their demands and rather kept aside.

- Both of these concepts are used by almost every per around us. For example, kids save money and prepare a budget when they go on a shopping spree or buy their favorite toy. Or adults are saving money and organizing budgets for utility services or fulfilling other demands.

Table of Content

1. What are Budgeting and Savings?

3. See Which Approach Suits You Best!

iii. Zero-Based Approach

5. Conclusion

1. What are Budgeting and Savings?

Budgeting and savings are used by humans on a practical basis for ages. Both budgeting and savings may have been a by-product of human necessities due to scarcity in nature and desires of conscience and intelligence.

- As per Cambridge university, budgeting is a process where you sum up all the revenue and expenditure receipts for the desired cause and utilize them accordingly.

- In simple words, as Tsh Oxenreider said, “The simplest definition of a budget is, telling your money where to go.”

Budgeting is one such magnificent tool, which assists us in fulfilling demands while managing the assets and liability ratios to their optimal returns level.

- Warren Buffet has said, “Do not save what is left after spending; instead, spend what is left after saving.”

Savings is a straightforward concept; think of a bear going into hibernation. Now all those things the bear has stored like food and other things. Now the bear will use these things during hibernation; that’s it, that’s how savings work too. Savings initially started out as a rainy day fund or money for emergencies. But, it can be used along with several approaches in today’s world. Often we get to experience how fast the out-flow of money actually is? Even today, an age-old mistake committed by us is that we look at savings as the last thing to do with money.

My father always said, “If you relax when you are young, you will have to work hard when you are old. Best id to work when you can, when you are young and relax when you can’t, in the old age.” From generation to generation, we have been told about the importance of saving money. It is one of the most basic and often the most repeated financial bits of advice out there. While most of us understand its importance, many of us aren’t following the advice diligently.

- Money only gives us freedom. It provides us with the power to relax and think without any hurry or prejudice when we are at our wit’s end.

- A right bank balance ensures we have enough to survive the storm and sleep soundly at night.

- While liquid saving gives us the freedom to keep cash for unexpected expenses and emergencies, a brokerage account can help you invest significant time in the future.

- Passions are brutal to pursue with a dry store.

Although, many people believe that if you save a few more bucks than usual at the end of the month, then what’s the point of saving! But Starting somewhere is necessary; it doesn’t matter how humble that beginning has to be?

Your destiny is easier to confront when comfortable, and you don’t have to act immediately. It is understood that money doesn’t solve everything, but it gives you an edge.

2. Income and Expenditure

Calculate your monthly salary after all the deductions. Your in-hand compensation determines how much you are left with at the end of the month. To spend money, you need to identify how much you actually have. List monthly expenses- it’s a brilliant idea to list all the monthly payments.- As per Economics, Income is the return/compensation for the work done or services provided by the labor force.

- Most financial problems arise, not because our demand is increasing but mainly due to a fall in our income levels. Even if it does, it may increase temporarily in the short run. In the long run, it may show a significant increment.

- Or when we surpass our expected income-expense ratio.

Try to pay attention to the feeling we get during additional expenditures. It is unsettling because it costs us more than just some monetary units/money. The economic principle of income elasticity measures the change in demand caused due to a change in income. It’s application can be used for most of our minor and major expenses and their effect on demand for specific goods and services. It also helps recognize whether the good or service being purchased is a need or desire?

- Charles Jaffe is correct, “It’s not your salary that makes you rich, it’s your spending habit.”

- The increasing cost of living is a pro duct of increased individual demands and the fall in required income levels compared to the prices and other indices.

Necessary monthly expenses are the ones you cannot possibly do without. For example:

i. Housing expenses like Rent/Mortgage, insurance, dues, and repairs.

ii. Essential Utilities like Water, gas (heat or cooking), electricity, and garbage pickup.

iii. Transportation like a Car payment, car insurance, gas, and repairs.

vi. Savings includes Emergency funds, vacation funds, and retirement funds.

v. Services like Babysitters, daycare, nanny.

vi. Medical expenses like insurance (health, life, vision, and dental) and other prescriptions.

vii. Personal Debt like Student loans, credit card debt, or additional bank loans.

viii. Household expenditure like Groceries, toiletries, and certain unavoidable services like lawn mowing, etc.

ix. Cellular expenses like mobiles, home phone, Internet and others.

Extra expenses include lunch outs, after-school treats, or extracurricular expenses. For example:

i. Entertainment includes Satellite, Cable, Internet upgrades, date nights, subscription services, streaming services.

ii. The wardrobe includes party dresses, replacement clothing, and matching shoes.

3. See Which Approach Suits You Best?

Adjust expenses to income- see if you’re living off the edge or making steady progress. If you’re living outside your means, it’s time to re-adjust your budget accordingly and cut expenses where unnecessary. Get rid of wants; keep your focus on the needs; if they’ve met satisfactorily, then nothing is best like it. If you possess some extra talent, try and make the most of it by working extra hours to earn some extra bucks.It is crucial to tap on the personal income-expenditure ratios, trends, habits, and patterns. The point here is not just about financial knowledge also about the effects of expenditure and income on each other and their aftermaths in our lives. As mentioned earlier, most financial problems arise mainly due to a fall in the expected income levels than the rise in expenditure.

Let’s Assume the scenario; suppose your income is 50 $. You buy food supplies or any other good or service. Usually, you buy 7 units for a week ( 1 unit per week ), it costs you 7 $ ( 1 $ per unit of food ).

- So your monthly budget is as given below. Now let’s add 2 more situations in the above scenario.

- Situation 1: You live alone, and all your expenses are per aggregate demand, consisting of individual needs and desires. Also, all the expenses and demands fall under the income.

- Situation 2: One of your friends or relatives comes to stay at your place for a week. And your income is still “50$” whereas your expenses increase due to a rise in the aggregate demand.

Goods and Services | Monetary Units |

1. Food Supply Unit’s | 7 $ 18 $ |

2. Rent | 20 $ 20 $ |

3. Utility and Other Services | 15 $ 20 $ |

4. Miscellaneous Expenditure | 5 $ 10 $ |

5. Savings | 3 $ 0 $ |

TOTAL | 50 $ 68 $ *18 $ + expenditure > income 50 $ |

- In the above table, it could be seen that that individual expense for food is 7$. However, the cost is more than doubled to 18$ for a week.

- There is almost like a crowding-in effect on expenses showing an increase in most of them. Food supplies cost has increased significantly, and there has been an increment in other costs apart from rent.

Above, it can be seen that some expenses have altered. Most alteration is in food supplies, part of essential goods and services. However, it’s not just food supplies that increase due to the proportionate rise in aggregate demand, but also others.

- Thus, it is vital to get serious about budgeting and savings. It could be seen in the above example that as a friend/relative came alone to stay, then how easily expenses can exceed income. It corners us in financial matters, significantly affecting other aspects of life.

- As Benjamin Franklin summoned it accurately, “Beware of little expenses. A small leak will sink a great ship.”

On the savings part, the following way could also be of great use:

- Choose a specific day of the month is chosen to transfer a set amount from your checking account to savings on a particular date or at a regular interval.

- It is specifically recommended for people with inconsistent income or who access their pay frequently.

- The setup is initially arduous in this saving type, but it’s easy peasy after some time.

- A saving account comes pretty handy while saving for short- and long-term goals, such as an extended vacation in Paris or buying your dream house.

Since most of it is liquid, Savings can be easily accessible during emergencies.

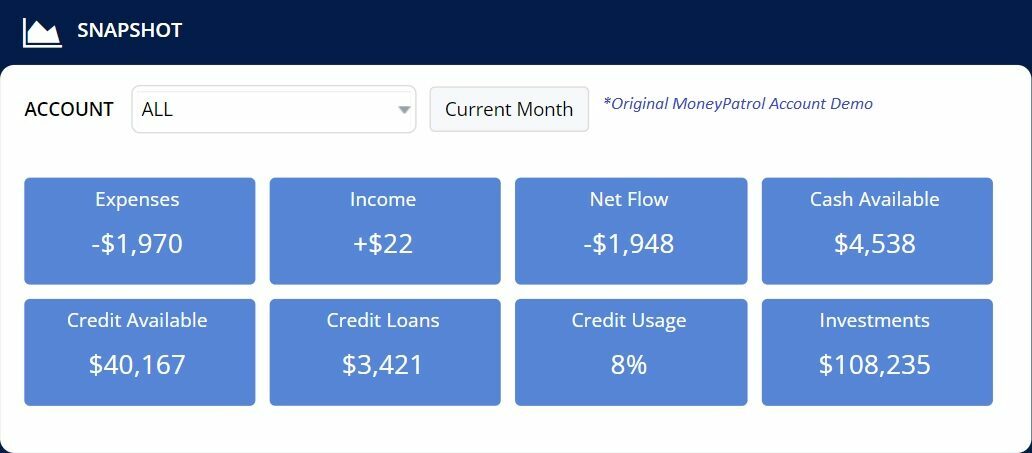

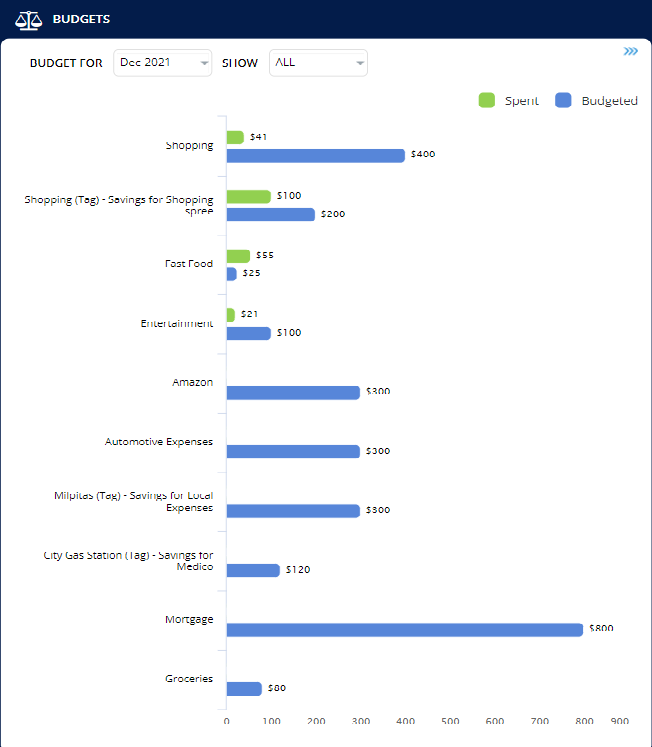

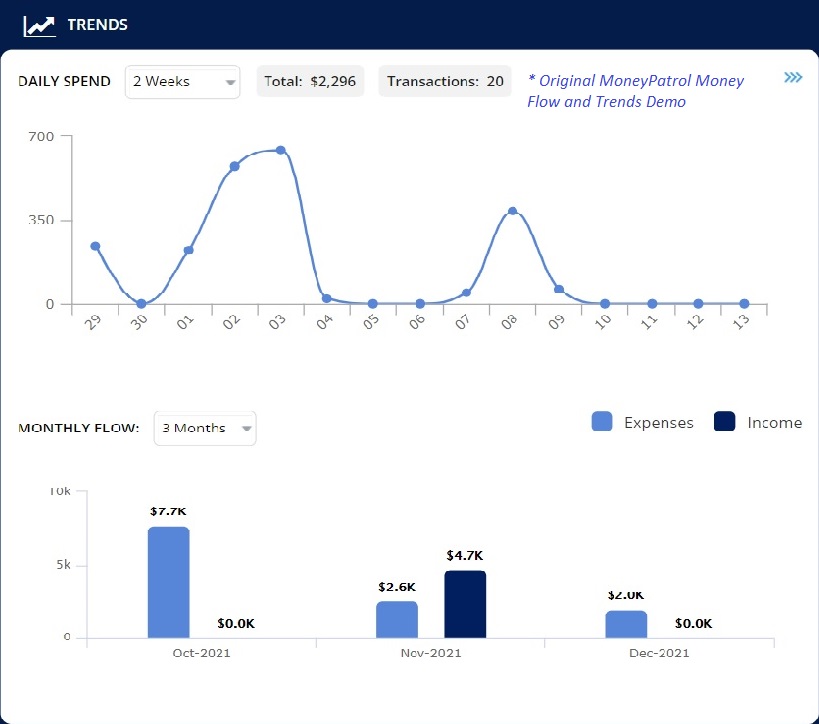

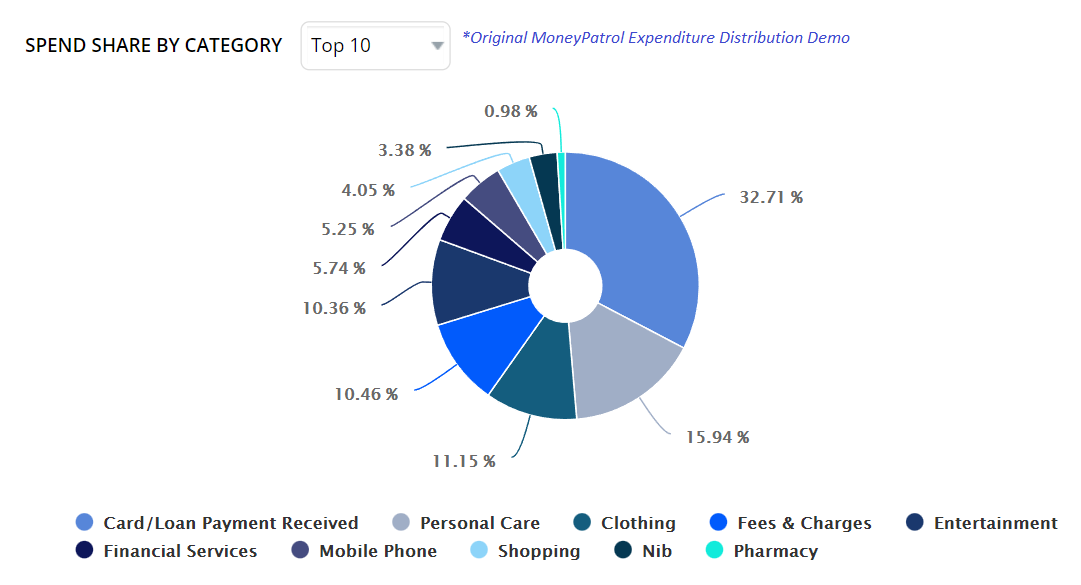

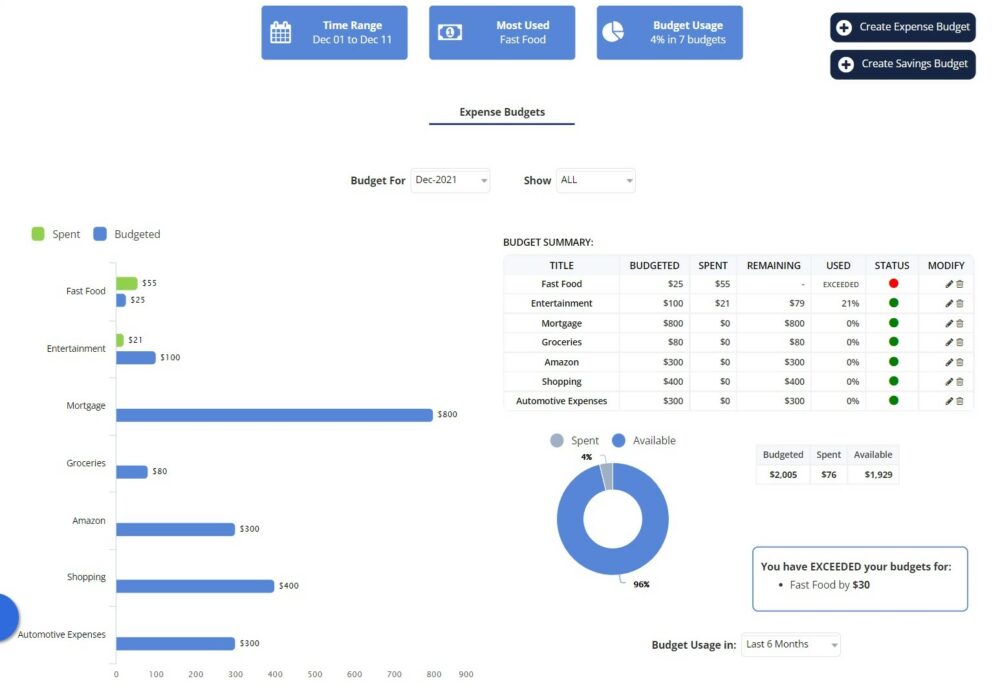

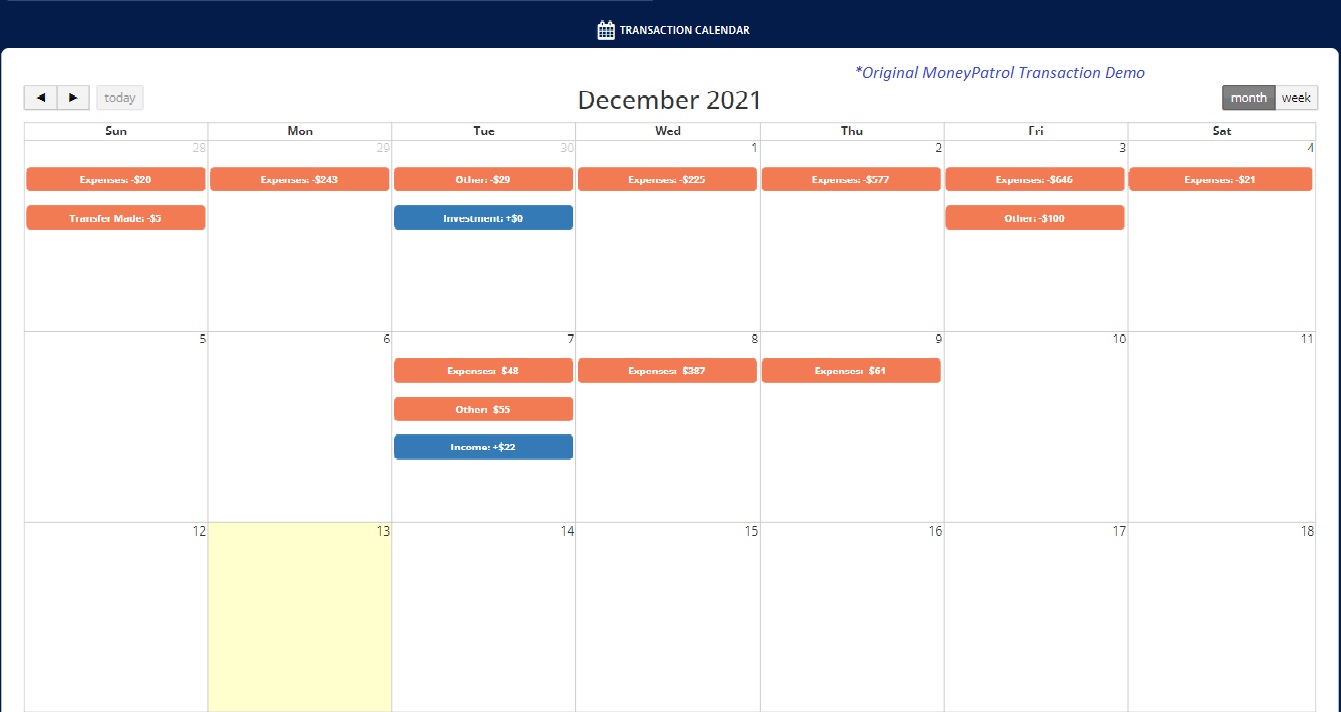

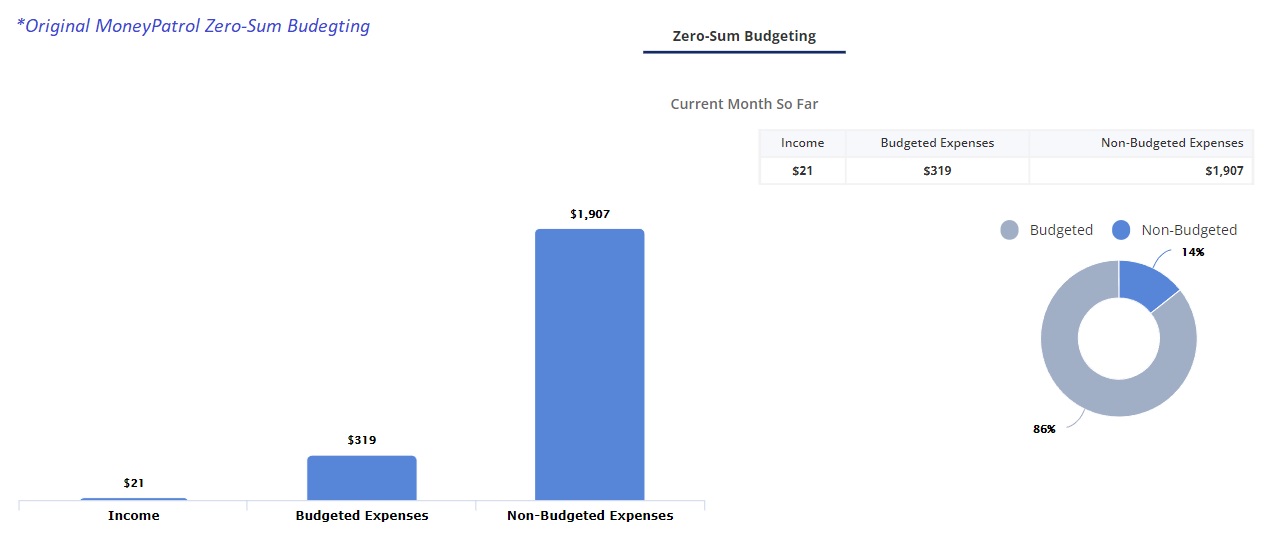

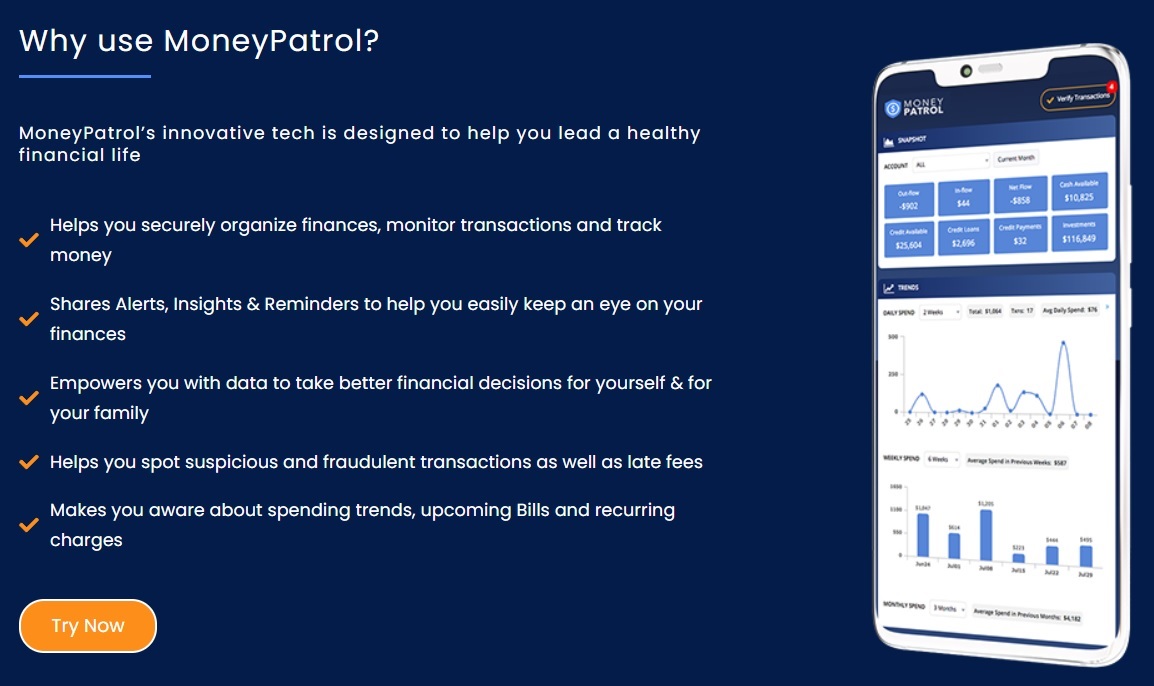

You can also try out MoneyPatrol, which is mainly designed for helping users/individuals to manage and monitor their finances. Aimed to help them improve their finances and individual expenditure patterns—especially assisting them in paying off the required and desired goods and services. There are several features made available by Money Patrol which help users/individuals compensate several of these costs.

The Balance Sheet section of Money Patrol shows detailed net worth, current account, savings account, investment account, budgeting for assets, credit loans, mortgage, and other debts. Thus, fully assisting you in making better financial decisions and improving your overall financial state.

i. The 50/30/20 Approach: It merely says that your needs must be limited to 50% of your after-tax income. While your wants should be limited to 30%, the 50% remaining 20% should be spent on savings and debt payments. For a novice, it’s a good and easy way to sort finances. A budget is never about just paying your bills on time. It is also a way to determine how much you should spend and otherwise. This approach helps you diversify your financial profile, reach those savings goals and foster overall financial health.

ii. The Envelope Approach: Before starting, it is essential to determine the discretionary income you have available after paying your bills and putting money aside for savings and investments. Decide how much money you have left and divide it into different budget categories. Like groceries, entertainment, dining out, household items, clothing, gifts, allowances for fun, etc.

Henceforth, get a few envelopes for each type and write the name of the expense on it. After getting the paycheck every month, you will put in the budgeted cash. This spending cash-only approach will ensure you can watch when the well’s drying up. Once you have no money left in the envelope, you have met your budget for the month. You now won’t be able to spend any more in this specific category until the next paycheck arrives.

Now there’s no debt left at the end of the month. You can simply use the money left over from any of the envelopes to pay it off, but if there’s no debt left, the extra cash goes into the savings account.

iii. The Zero-based Approach: it is one of the simplest forms of budgeting. You plan about the money, even before it comes into your account. Every last penny is purposefully allocated, and you have a zero balance in the end. There are slots for every expense, and every dollar needs to be distributed to one of these slots.

To simply put, it is adding up all your income, minus all your expenses. And allocating whatever is left over to categories such as savings, investments, or whatever your needs are. Now zero doesn’t mean you have nothing left at the end of the budget. It merely means that whatever surplus money one has to be allocated to emergency funds or short-term savings.

However, it is always good to have dedicated slots for emergency expenses for those months when something unexpected happens. But if a deficit is noticed, it’s vital to revisit each category. To ensure that you’re not overspending with your means and bill payments. The money left has to go towards savings and beef up the reserves.

4. Have You Found The One?

Chaos ultimately leads to nowhere but disaster. Most individuals experience lots of chaos while going through their finances, partially depending on some advice or leap of faith. It’s the individual who has to pay the cost for this chaos. Thus, reaching out for advice and add-ons is a wise call. Finances are practical, so even by getting in contact with.

It can be as simple as a DIY approach or as professional as technological assistance. Finance software is the new fad! Basically, they’re apps that let you automate access and update your savings instantly. However, technology isn’t everyone’s cup of tea; some are happy with the old-school pen and paper approach. Some are just paranoid about linking their bank accounts to electronic services for obvious reasons, so it is perfectly okay to manage an expense diary in that case.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances