Choosing the best personal finance program in 2026 is less about finding “the top app” and more about finding the system you will actually stick with. The right program should make your money clearer in minutes, reduce missed bills, and give you confidence that your budget, cash flow, and net worth are moving in the right direction.

In practice, most people quit a finance tool for one of three reasons:

- It takes too much manual work.

- It does not match how they make decisions (weekly cash flow vs monthly budget, debt payoff vs investing).

- They stop trusting the data (categorization errors, missing accounts, stale balances).

This guide gives you a practical way to evaluate options and pick a program you can commit to for the rest of 2026.

What “personal finance program” means in 2026

In 2026, “personal finance program” can refer to several categories:

| Type | Best for | Trade-offs to know upfront |

|---|---|---|

| Spreadsheet templates | Tight control, DIY forecasting, one-off scenarios | Manual entry, easy to abandon, limited alerts and automation |

| Envelope or single-purpose budget apps | Strict spending limits, category discipline | May not cover investments, credit, net worth, or reporting depth |

| Full personal finance platforms | One dashboard for spending, bills, debt, investments, credit, goals | Requires secure account connections and thoughtful setup |

If your goal is “see everything in one place” (cash flow, recurring bills, debt, investments, and credit), you are typically looking for a full personal finance platform.

Step 1: Decide what “success” looks like (before comparing tools)

The fastest way to pick the wrong program is to start with features. Start with outcomes instead.

Pick one primary outcome for the next 90 days:

- Stop overspending and control discretionary categories.

- Build a bill system so nothing is late.

- Pay down debt with a clear payoff plan.

- Raise savings rate and track progress automatically.

- Track net worth (including investments) with less spreadsheet work.

Then pick one supporting outcome (for example, credit monitoring or investment tracking). This helps you avoid switching tools every few weeks.

Step 2: Use a 10-point scorecard to evaluate the best personal finance program

Below are the criteria that matter most for most households in 2026, along with what to look for when you test an app.

1) Account coverage and connection reliability

A program is only as good as the data it can pull in consistently.

Look for:

- Connectivity to the institutions you actually use (checking, savings, credit cards, loans, brokerage, retirement accounts).

- Fast refreshes and clear connection error handling.

- A straightforward way to fix broken links without losing historical data.

If the tool cannot reliably connect to your main accounts, it does not matter how good the charts look.

2) Categorization quality (and how easy it is to correct)

Automatic categorization saves time, but every program makes mistakes.

A strong program should let you:

- Re-categorize in seconds.

- Create rules for repeat merchants.

- Split a transaction across categories (common for big-box stores).

When you test, look at the first 30 imported transactions and check how many you would need to fix.

3) Budgeting approach that matches your behavior

There is no single “best” budgeting method, only the one you will follow.

Common approaches include:

- Category limits (simple monthly caps)

- Zero-based budgeting (assign every dollar a job)

- Cash-flow planning (focus on timing of bills vs paychecks)

Choose a program that supports your preferred approach without forcing you into a workflow you dislike.

4) Bill tracking and reminders that prevent late fees

Bills are where finance tools either become life-changing or irrelevant.

A program is much more useful if it can:

- Track upcoming bills (recurring and one-off)

- Send alerts before due dates

- Show how bills impact cash flow

For guidance on avoiding late fees and understanding billing rights, the Consumer Financial Protection Bureau is a reliable source.

5) Debt tracking that connects payments to progress

Debt payoff motivation comes from seeing the trend, not just the balance.

Look for:

- Clear debt summaries (by type and interest rate)

- Payment history visibility

- The ability to track payoff progress over time

If you are focused on payoff, the “best personal finance program” is often the one that makes progress obvious and automatic.

6) Investment and net worth tracking (without extra spreadsheets)

Even if you are not an active trader, tracking net worth is one of the best ways to measure financial direction.

Look for:

- Investment account support (brokerage, IRA, 401(k))

- Net worth calculation (assets minus liabilities)

- Historical trend charts

You do not need complex portfolio analytics for this to be valuable. You need consistency and clarity.

7) Reporting you can actually use

Pretty graphs do not always lead to better decisions. Useful reports answer questions like:

- Where did my spending change this month?

- What are my true recurring expenses?

- How much did I save after bills?

If a program offers “insights,” verify they are based on real patterns you can validate, not generic tips.

8) Alerts that are customizable (and not noisy)

Alerts are powerful when they are specific and limited.

Look for alerts such as:

- Large or unusual transactions

- Bills coming due

- Category overspending

- Low balance thresholds

Avoid programs that send constant notifications with no easy customization. Alert fatigue is real.

9) Security and privacy posture you can verify

Personal finance tools sit near your most sensitive data. Evaluate security like you would for any financial relationship.

At a minimum, look for:

- Multi-factor authentication support

- Clear explanations of data handling and sharing

- A transparent privacy policy and account deletion process

For broader consumer guidance on identity theft and account protection, the FTC’s identity theft resources are a good reference point.

10) Data portability (export) and long-term maintainability

In 2026, apps come and go. Your history should not be trapped.

Check whether you can:

- Export transactions and reports

- Keep historical records even if you change banks

- Maintain categories and rules over time

This matters more than people think, especially if you ever switch tools, work with a tax professional, or want to audit spending changes year over year.

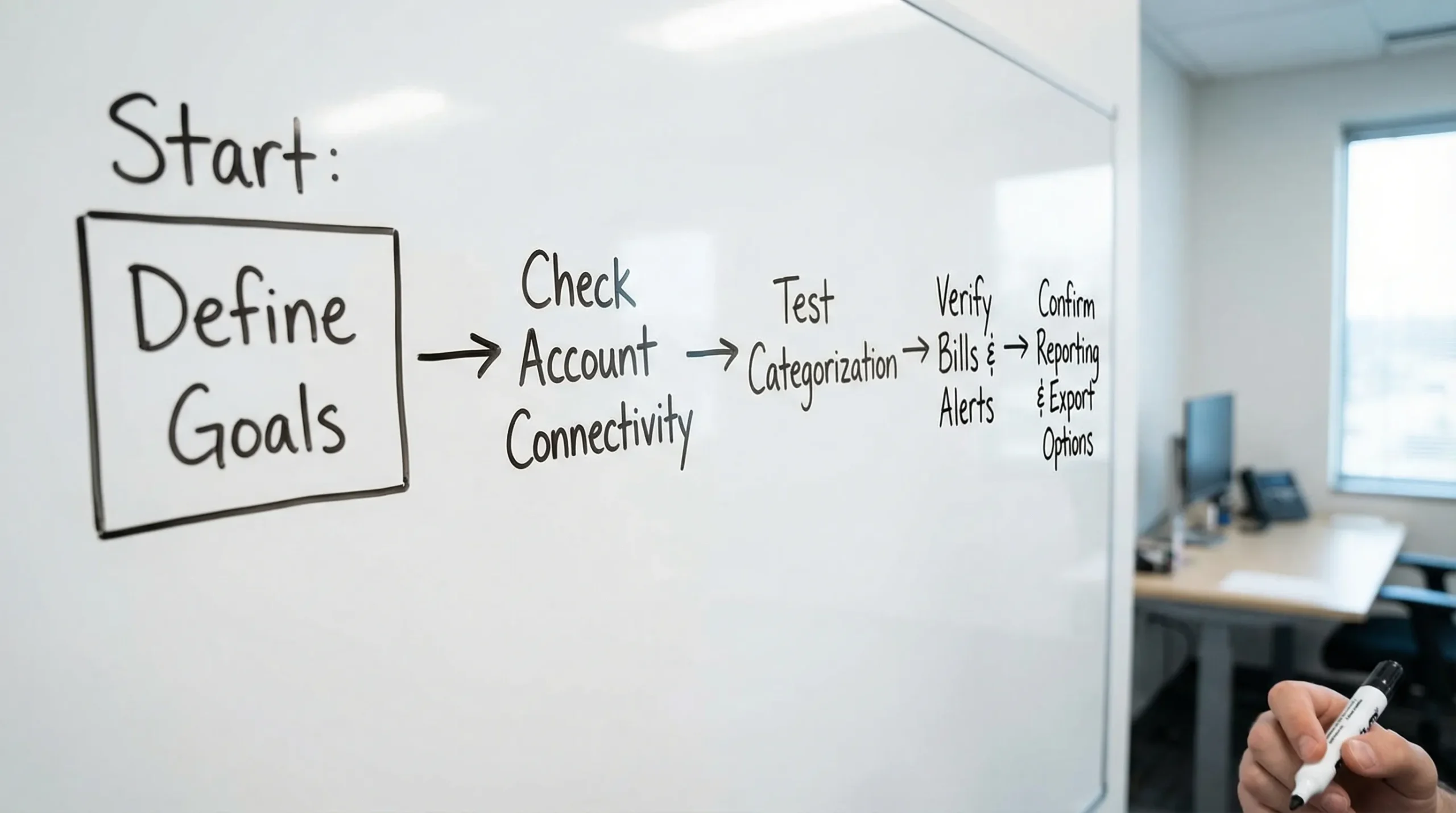

A practical “tryout” test you can do in under an hour

You do not need a month-long trial to know if a program fits. Use this quick test instead.

Do a 15-minute setup test

Connect your primary accounts (checking and your main credit card). Then verify:

- Does the import look complete?

- Are pending transactions handled in a way you like?

- Can you spot your last paycheck and your last rent or mortgage payment?

Do a 15-minute accuracy test

Pick 10 recent transactions and try:

- Changing categories

- Creating one rule for a repeating merchant

- Splitting one mixed purchase

If this feels clunky, it will not get better when you have 1,000 transactions.

Do a 15-minute decision test

Answer these three questions using the tool:

- How much did I spend on food and dining in the last 30 days?

- What bills are coming up in the next two weeks?

- Am I trending up or down versus last month?

If you cannot answer quickly, the program may be more “data storage” than “decision support.”

Do a 10-minute habit test

Ask yourself honestly:

- Would I open this weekly?

- Are the insights understandable without tinkering?

- Does it reduce anxiety or create more?

The best personal finance program is the one that helps you take action repeatedly.

What to prioritize based on your life stage

Different households should weigh features differently.

| Situation | What to prioritize | What is optional |

|---|---|---|

| First serious budget | Easy categorization, simple category budgets, strong alerts | Deep investment analytics |

| Busy family juggling bills | Bill reminders, cash-flow view, shared visibility, reliable syncing | Advanced debt modeling |

| Paying down high-interest debt | Debt tracking, payment visibility, overspending alerts | Portfolio tracking |

| Growing investments and net worth | Investment tracking, net worth trends, solid reporting | Granular envelope workflows |

| Variable income (gig, commissions) | Income tracking, cash-flow planning, flexible budgeting | Rigid monthly-only budgets |

Use this table to avoid overbuying features you will not use.

Common traps to avoid when picking a finance program

Choosing based on “best app” lists alone

Many rankings reward popularity, not fit. Your bank connections, bill patterns, and decision style matter more than a generic score.

Over-optimizing for automation and ignoring review time

Even the most automated program requires a weekly review. A sustainable system is typically:

- 5 minutes a day (optional)

- 20 to 30 minutes once a week (recommended)

If the program cannot support a simple weekly check-in, you will drift.

Ignoring the cost of switching later

Switching costs are not just financial. They include lost history, broken budgets, and time spent rebuilding rules.

Before committing, confirm export options and how the tool handles historical data.

Where MoneyPatrol fits (if you want an all-in-one program)

If your goal for 2026 is to manage your finances in one place, MoneyPatrol positions itself as a free personal finance and budgeting app designed to cover the core areas most households need:

- Expense tracking and budgeting tools

- Bill and debt tracking

- Income management

- Investment tracking and net worth visibility

- Credit score monitoring

- A personal finance dashboard with customizable alerts, reminders, reconciliation, and detailed reports

Because MoneyPatrol also supports connectivity to thousands of financial institutions, it is built for people who want a consolidated view rather than juggling multiple tools.

You can explore the platform at MoneyPatrol and evaluate it using the tryout test above. If it helps you answer “Where is my money going?” and “What do I need to do next?” faster than your current system, it is doing its job.

A simple checklist to make the final decision

Before you commit, make sure your top choice meets these requirements.

| Must-have (most people) | Nice-to-have (depends on goals) |

|---|---|

| Reliable account syncing for your main institutions | Investment performance analytics beyond balances |

| Fast category edits, splits, and rules | Advanced scenario planning and forecasting |

| Clear budget or cash-flow workflow you will follow | Shared household workflows and permissions |

| Bill reminders and due-date visibility | Receipt capture and storage |

| Customizable alerts without noise | Credit score monitoring inside the same tool |

| Reports that answer real questions quickly | Deeper reconciliation and audit tools |

| Export options for transactions and reports | Integrations with other services |

If you check every “must-have” and most of your “nice-to-haves,” you have found your best personal finance program for 2026.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances