Most people don’t fail to track money because they “don’t care.” They fail because the system is too detailed, too time-consuming, or too disconnected from real decisions.

If you want to track income and expenses in a way that actually sticks, you need a lightweight routine that:

- Captures spending with minimal friction

- Keeps categories simple enough to maintain

- Builds a review habit (so the data becomes useful)

- Creates a monthly “close” so you trust your numbers

Below is a practical system you can start this week, whether you use a spreadsheet, a notes app, or a personal finance app.

Why most tracking systems collapse after 2 to 3 weeks

Expense tracking usually breaks for one of three reasons:

1) It demands perfection. If your system only “works” when every transaction is categorized daily, you will eventually quit.

2) It’s too granular. Do you really need to separate “coffee,” “snacks,” “takeout,” and “restaurants” to make better decisions? Sometimes, but most people don’t.

3) There’s no feedback loop. If you track but never review, you’re just collecting receipts in a different format.

A system that sticks optimizes for consistency, not detail.

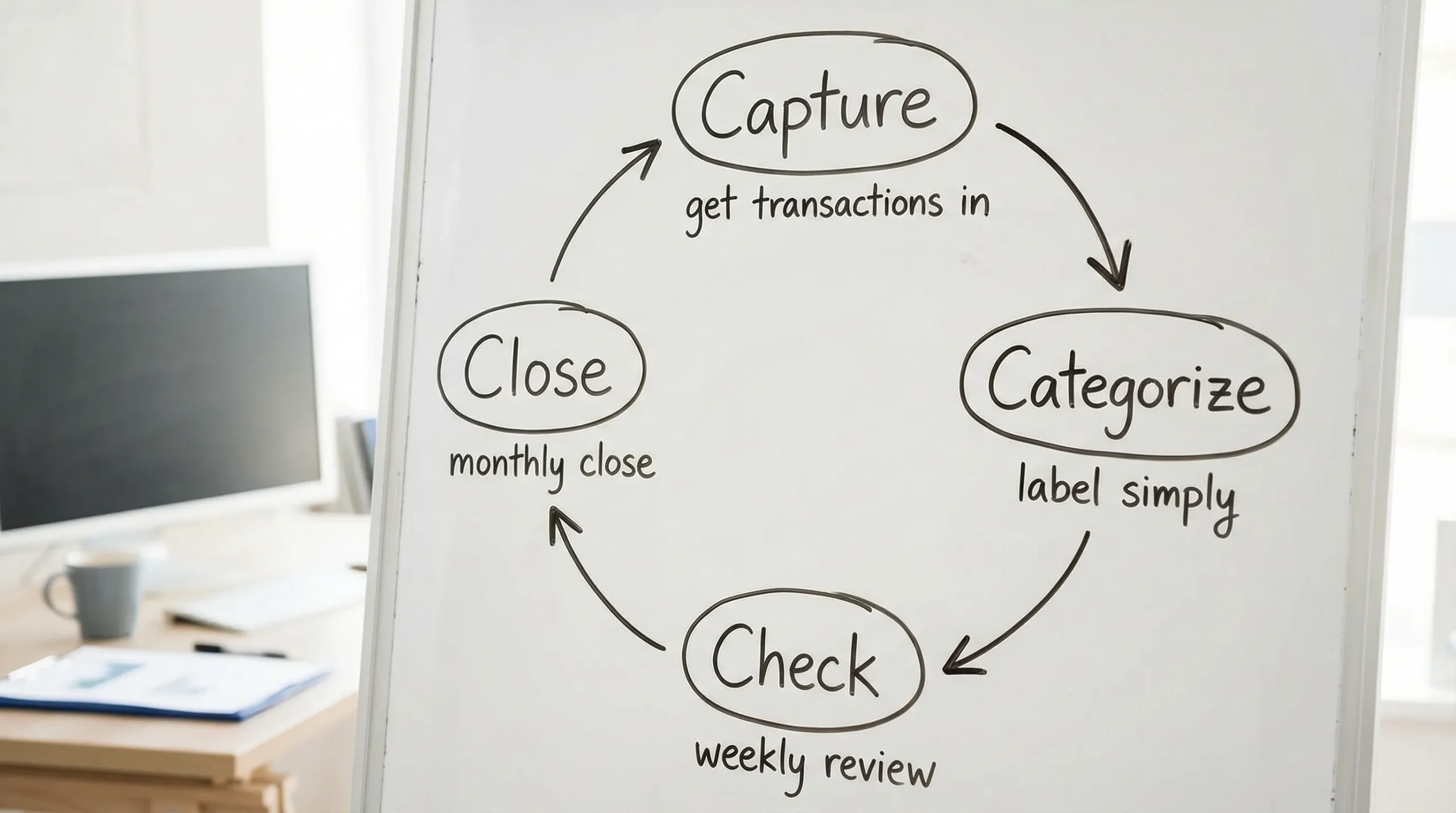

The 4C method: Capture, Categorize, Check, Close

Think of your tracking workflow as four small loops:

- Capture: get transactions into one place

- Categorize: label them with a simple taxonomy

- Check: do a quick weekly review to stay honest

- Close: do a monthly reconciliation and reset

You don’t need to do all four daily. You only need the right frequency for each.

1) Set up your “money map” in 15 minutes

Before you track anything, define the scope. The biggest hidden reason people can’t track income and expenses is that money is spread across too many places.

Write down (or add to your tracker) these three lists:

Accounts you use to spend: checking accounts, credit cards, cash.

Accounts you save or invest in: savings, brokerage, retirement.

Income sources: paychecks, self-employment, benefits, support payments, interest, side gigs.

Two important rules:

Rule A: Don’t confuse transfers with expenses. Moving $200 from checking to savings is not spending, it’s a transfer (your net worth did not change).

Rule B: Decide what “cash” means for you. If you often spend cash, you need a simple capture habit (more on that below). If you almost never use cash, don’t overbuild for it.

2) Choose a cadence you can keep (daily is optional)

The goal is to reduce “memory work.” The longer you wait, the more you forget what a transaction was.

A sustainable cadence for most households:

- 2 minutes, 3 times per week: categorize any uncategorized items

- 10 minutes, once per week: review totals and catch surprises

- 25 minutes, once per month: reconcile and plan next month

Here’s what that looks like in practice.

| Frequency | Time | What you do | What you get |

|---|---|---|---|

| 3x per week | 2 minutes | Categorize new transactions, mark anything unclear | A clean dataset without daily stress |

| Weekly | 10 minutes | Check spending vs plan, review upcoming bills, scan for duplicates/fraud | Fewer “where did my money go?” moments |

| Monthly | 25 minutes | Reconcile balances, confirm income totals, review trends, adjust budgets | Trustworthy numbers and better decisions |

If you can only do one thing, do the weekly check. That is where tracking becomes behavior change.

3) Build categories that are easy to maintain (and still useful)

A category system should answer the questions you actually care about:

- “How much did I spend on essentials vs lifestyle?”

- “Am I covering bills and still saving?”

- “What is my true monthly cost of living?”

A good guideline is 10 to 15 categories total. If you have 35, you’ve built a bookkeeping system, not a personal system.

Start with four groups.

| Category group | What it includes | Examples |

|---|---|---|

| Fixed essentials | Predictable, necessary bills | Rent/mortgage, utilities, insurance, internet, minimum debt payments |

| Variable essentials | Necessary, but fluctuates | Groceries, gas/transportation, household items, medical |

| Lifestyle | Optional and easy to overspend | Dining, entertainment, shopping, subscriptions, travel |

| Goals | The whole point | Emergency fund, retirement, debt payoff above minimum, sinking funds |

Two practical tips that prevent category burnout:

Keep “catch-all” categories. Having one “Miscellaneous” line is better than abandoning tracking because you can’t decide between three micro-categories.

Separate “shopping” from “needs.” Many people hide lifestyle overspending inside a dozen “reasonable” categories. A single “Shopping” bucket makes patterns obvious.

4) Standardize the tricky transactions (so you don’t re-decide every time)

The fastest way to make tracking stick is to remove repeated decisions.

Pick rules for these common situations:

Income deposits: Decide how you will label paychecks, reimbursements, tips, and side-gig payments.

Credit cards: Decide whether you track spending when the purchase happens (best) or when you pay the card (not recommended). Card payments should be treated as a transfer from checking to credit card balance, not a new expense.

Reimbursements: If you pay $120 for work travel and later get $120 back, decide whether you:

- Mark the original spending in a “Reimbursable” category, then categorize the reimbursement back into that category, or

- Mark reimbursement as income and accept that your expense report will look inflated

Consistency matters more than the “perfect” accounting choice.

Refunds: Decide whether refunds reduce the original category (recommended) so your category totals reflect reality.

5) Make bills and due dates part of your tracking system

Many people track expenses but still get hit with late fees, because tracking tells you what happened, not what’s coming.

Add a simple bill routine:

- Keep a list of recurring bills and due dates

- Set reminders a few days before the due date

- Review the next 14 days of bills during your weekly check

If you use a finance app that supports bill tracking and customizable alerts, take advantage of it. Alerts are not just “nice to have,” they reduce the mental load that causes people to quit.

For general guidance on building a spending plan and bill-pay routine, the Consumer Financial Protection Bureau (CFPB) has solid, practical resources.

6) Do a monthly “close” so you actually trust your numbers

A monthly close is the difference between “I tracked” and “I know what’s true.” This is where you catch missing items, fix mis-categorizations, and make next month easier.

Use a simple close checklist.

| Monthly close task | What you’re checking | Why it matters |

|---|---|---|

| Reconcile balances | Does your tracker match bank and card balances? | Builds trust and finds missing transactions |

| Confirm income totals | Did all income sources land as expected? | Prevents planning on money that never arrived |

| Review top categories | What are the top 3 spending buckets? | Shows what’s driving your month |

| Identify “one-offs” | Any unusual expenses that should not repeat? | Helps you plan a realistic next month |

| Adjust next month | Change budgets based on reality | Makes the system self-correcting |

If you have variable income, base next month’s plan on a conservative number (like your lowest typical month), then allocate extra income to goals when it arrives.

Handling the most common friction points

“I forget what a charge was”

Fix: create a rule that any unclear transaction gets temporarily labeled “Needs review”. During your weekly check, you look it up once. This is far better than leaving it uncategorized for months.

“Cash spending ruins my tracking”

Fix: track cash with a single category called Cash spending or Wallet. When you withdraw $80, categorize it once. Don’t try to split it into five categories after the fact unless you’re willing to track cash purchases in real time.

“Shared expenses are confusing”

Fix: pick one of these approaches and stick to it:

- Track only your portion (requires quick math, but cleaner reports)

- Track the full amount and track repayments as income (simpler, but reports can look inflated)

“I’m tracking, but I’m not improving”

Fix: during the weekly check, choose one adjustment for the next 7 days (not 10). Examples: pause one subscription, cap dining out, or move $25 to a goal bucket.

The weekly review is where behavior changes because it happens while the month is still in progress.

Spreadsheet vs app: what matters if you want the habit to last

Spreadsheets work if you enjoy manual control and your finances are simple.

Apps work best when you want automation, fewer missed transactions, and an easier time reviewing multiple accounts.

When choosing a tool, prioritize these capabilities:

- One place to see all accounts (so tracking is not scattered)

- Reliable expense categorization (with easy edits)

- Budgeting and reporting (so reviews are fast)

- Bill, debt, and income tracking (so you see what’s coming, not just what happened)

- Alerts and reminders (so you don’t rely on memory)

MoneyPatrol is built around this “single dashboard” approach: it helps you track expenses, manage income, monitor accounts, set alerts, and review detailed reports, with connectivity to thousands of financial institutions. If you want to reduce manual work and keep your tracking consistent, you can start with the free app and build your routine around the weekly check and monthly close.

You can explore the platform here: MoneyPatrol.

A simple start plan you can do this week

If you’re starting from scratch, don’t set up everything at once. Do the smallest version that creates momentum.

Day 1: Add your accounts (or list them in one place) and define your 10 to 15 categories.

Day 2: Categorize the last 7 days of transactions.

Day 7: Do your first 10-minute weekly check and pick one small adjustment for next week.

End of month: Do your first monthly close and adjust categories only if needed.

Once you’ve done one full month, tracking stops feeling like a chore and starts feeling like having a dashboard for your life.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances