Most people don’t fail at budgeting because they “don’t know where their money goes.” They fail because they check too late.

A spending tracker is most powerful when you use it like a weekly instrument panel, not a monthly autopsy. If you look at the right numbers every week, you can catch small leaks before they become overdrafts, late fees, or credit card surprises.

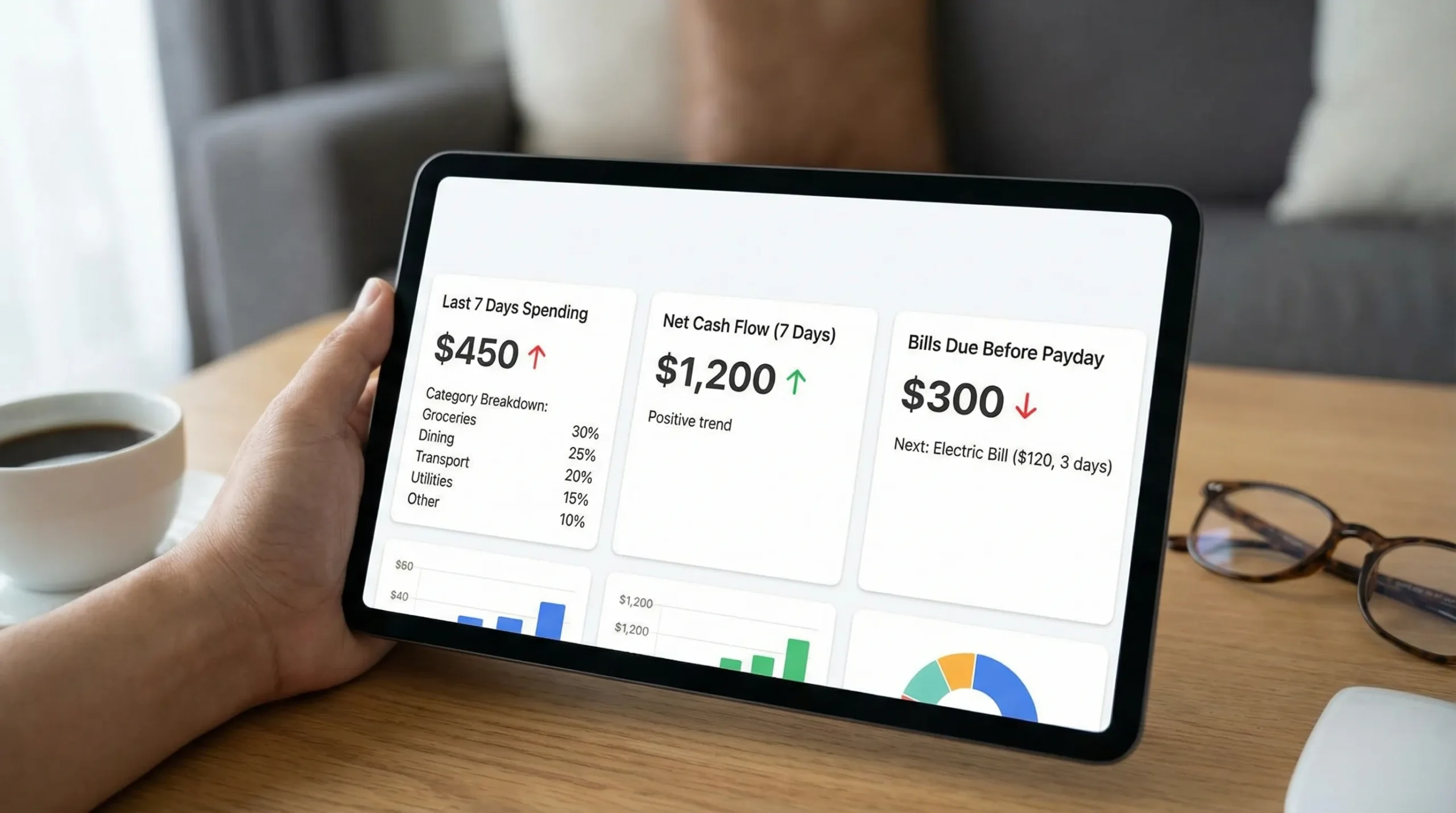

Below are the 3 numbers to check weekly (plus exactly what to do when one looks off).

Why a weekly check beats “end of month” budgeting

Monthly budgets are useful, but they can hide problems for weeks. A weekly review gives you faster feedback loops:

- You spot overspending while there is still time to course-correct.

- You can time bill payments around paydays and avoid low-balance stress.

- You reduce the chance of missing subscriptions, variable bills, or autopays.

The CFPB’s budgeting guidance also emphasizes tracking and adjusting, not just setting a plan once and hoping it works.

The 3 numbers to check weekly in your spending tracker

1) Last 7 days spending (and the gap vs your weekly target)

What it is: The total of your outflows in the last 7 days, ideally split into two views:

- Total spending last 7 days

- Variable spending last 7 days (groceries, dining, shopping, rideshare, entertainment)

Why it matters: Weekly spending is the earliest signal that your month is drifting off plan. Most budgets fail in variable categories, not fixed bills.

What “good” looks like:

- Your last 7 days spending is roughly at or below 1/4 of your monthly plan (if your income and bills are relatively steady).

- Your variable spending stays within a weekly cap that feels realistic.

What to do if it’s high:

- Pause optional spending for 3 to 7 days (restaurants, delivery, impulse buys).

- Make one concrete swap: one no-spend evening, one pantry meal, one free weekend activity.

- Check category mislabels (for example, a large annual insurance payment incorrectly categorized as “shopping” can distort your view).

MoneyPatrol’s expense tracking and categorization can help you see the total quickly, then drill into what actually moved.

2) Net cash flow for the week (inflows minus outflows)

What it is:

Net cash flow (7 days) = Money in (7 days) − Money out (7 days)

Include paychecks and any other income that posted, and compare it to everything that left your accounts (spending, bills, transfers, debt payments).

Why it matters: A weekly spend total tells you “how much left.” Net cash flow tells you “are you moving forward or borrowing from the future?”

Even if your monthly cash flow is positive, a negative week can create timing problems that lead to overdrafts or credit card float.

What “good” looks like:

- On weeks with paydays, net cash flow is typically positive.

- On non-pay weeks, net cash flow may be negative, but it is negative in a planned way that your buffer can handle.

What to do if it’s negative unexpectedly:

- Identify the driver: one-time bill, overspending category, duplicate subscription, or a transfer you forgot.

- If it’s a timing issue, schedule bill payments right after payday when possible.

- If it’s a structural issue, lower your variable spending cap or renegotiate one fixed bill.

A strong spending tracker makes this easier because you are not guessing. You are reconciling what happened across accounts.

3) Bills and minimum payments due before your next payday (and your “safe-to-spend” number)

What it is: Two numbers that go together:

- Total due before next payday (bills + minimum debt payments)

- Safe-to-spend = Current cash balance − Total due before next payday

Your “current cash balance” can be your checking account balance, or checking plus cash accounts if you routinely pay bills from multiple places.

Why it matters: This is the anti-surprise metric. People often overspend not because they lack income, but because they forget what is already promised to bills.

What “good” looks like:

- Your safe-to-spend stays above zero.

- Ideally, it stays above a small cushion you choose (for example, one week of groceries).

What to do if safe-to-spend is low:

- Delay nonessential purchases until after payday.

- If needed, move money from a “holding” savings account to checking (and note it so you can rebuild it).

- If the issue repeats, lower fixed costs or change due dates (many providers allow you to adjust billing dates).

MoneyPatrol’s bill and debt tracking, plus alerts and reminders, can support this weekly glance so you are not relying on memory.

A 10-minute weekly money routine (that uses only these 3 numbers)

Pick a consistent time, like Sunday evening or the day after payday. Then run this short checklist:

- Check last 7 days spending: If it is high, choose one category to tighten this week.

- Check net cash flow (7 days): If negative unexpectedly, identify the single biggest driver.

- Check due-before-payday total and safe-to-spend: If tight, delay optional buys and confirm bill dates.

The point is not perfection. The point is a fast feedback loop.

Quick reference table: the 3 weekly numbers and what to do

| Weekly number | What it tells you | Common red flag | Fast fix for this week |

|---|---|---|---|

| Last 7 days spending | Whether your month is drifting early | Variable categories spike | Freeze optional spending for 3 to 7 days and cap one category |

| Net cash flow (7 days) | Whether you are moving forward or falling behind | Negative on a week you expected positive | Find the largest transaction driver, adjust timing or reduce one expense |

| Due before payday + safe-to-spend | Whether upcoming obligations will squeeze you | Safe-to-spend near $0 | Delay optional purchases, adjust bill timing, protect a small cushion |

Common mistakes that make weekly tracking misleading

Confusing transfers with spending

Moving money from checking to savings is not “spending,” but it is still an outflow that affects cash flow timing. Treat transfers intentionally so your weekly view stays clear.

Ignoring annual or irregular expenses

Car insurance paid semiannually, annual subscriptions, holidays, and back-to-school spending can blow up a “normal” week. If you can, set aside a small monthly amount so the week it hits is not a crisis.

Letting categories go unreviewed

Even the best spending tracker needs occasional cleanup. If transactions are miscategorized, you may cut the wrong thing.

MoneyPatrol’s detailed reports and account reconciliation tools can help you keep the data accurate enough to act on.

Frequently Asked Questions

What is a spending tracker, and how is it different from a budget? A spending tracker records and categorizes what you spend. A budget is the plan. Tracking weekly helps you compare reality to the plan early enough to adjust.

Why check weekly instead of daily? Daily tracking can feel heavy and easy to quit. Weekly is frequent enough to prevent surprises, but light enough to maintain.

What if my income is irregular? Weekly checks become even more important. Focus on “due before next payday” and safe-to-spend, and use a conservative weekly cap for variable spending.

Should I track credit card spending or just bank account spending? Track both. Credit cards can hide overspending because cash does not leave checking immediately. A good spending tracker should reflect the transactions regardless of payment method.

How long does a weekly money check-in take? If your accounts are organized and transactions are categorized, usually 10 minutes. The goal is quick decisions, not detailed analysis.

What is the single most important number if I only pick one? Safe-to-spend (cash minus bills due before payday). It prevents the most painful outcomes, like overdrafts, missed payments, and last-minute scrambling.

Try these 3 weekly numbers inside MoneyPatrol

If you want a simple weekly rhythm without spreadsheets, MoneyPatrol combines expense tracking, budgeting, bill and debt tracking, alerts, and financial reporting in one place.

Start by connecting your accounts, then make your weekly review a habit: check last 7 days spending, weekly net cash flow, and bills due before payday. Those three numbers cover most real-world money stress points before they escalate.

Explore MoneyPatrol here: https://moneypatrol.com

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances