For any individual, their spouse is a significant part of their life, too, as it has a direct psychological and physiological correlation. After all, partners make an individual feel loved, desired, and comfortable. High-value net-worth is the key to fulfilling all those desires of living a duty-free life with a spouse. It allows an individual to make decisions out of pure choice and not adjustment. Human beings are herd animals; we cannot be alone. We all have someone or something. Relationships, be they of any kind, are crucial for evading insanity. Having someone to spend our time with is a thought nurtured by all.

However, it is not just fun and games. It is also a big responsibility that requires commitment and dedication, especially during challenging times like these, where many financial concerns and solutions are few.

- Such instances could seriously impact one’s life in several aspects, simultaneously or parallelly.

- Financial and Economic issues have a way of creeping in and destroying your emotional, physical, and mental health along with robbing you of intimacy with your partner.

- Thus, learning how to make marriages, families, and finances go together is crucial.

It is crucial to have a life with assets that quickly compensate liabilities or externalities. Outcomes are determined with a materialistic and subjective approach for most of our lives. Thus, money and finance become an inseparable part of ourselves.

Table of Content

What is Hight-Value Net-worth?

- Try to Converse and Understand Your Lifestyle Choices and Patterns together!

- Do not Let the Salary Differences Arise between You

- Set Realistic Financial Goals and Expectations together!

- Mutual Assessment on Financial Decisions

- Do not Let your Needs and Desires Run a Separate Show

- Monitor the Money Flow

- Refrain from Keeping Financial Secrets

What is High-Value Net-worth?

Economist John M. Keynes said, “In the long run, we all are dead.” The question here is with whom do we want to be in the long run? What kind of life do we want to spend in the long run? We wish for an accessible, comfortable, rich, wealthy, and decent life. We have heard of many stories where financial and economic problems have left couples and their families in a tight spot. Many families, be it in our relations and neighborhood, can also see where families are entirely devastated due to such problems.

It is unwise to hope for the economic and financial problems to go away on their own or never to occur. They will take place because of several socio-economic and political reasons. Hence, a properly monitored confrontation could help a lot in overcoming these concerns and understanding them so that their occurrence could be halted or minimalized.

The only way to confront the economic and financial concerns is, working together on several aspects of lives and not just money and finances. The problems of money and finance may start on their own. Still, soon they are anchored by several other factors, such as utility bills, housing expenses, medical expenses, marginalized living standards, and many more. It doesn’t take much for a minor financial concern to start turmoil in our lives. Fights between couples can easily break out on an item of unnecessary expenditure, unpaid bills, cash crunches, etc. We can spot these out in our own families and neighborhood at ease.

- A hale and hearty

- difference or disagreement among married couples are acceptable.

- However, money is the crucial cause of conflict among married couples, resulting in separation and divorce.

Even though times can be stressful, most marital problems can be solved with honest and transparent communication. Dishonesty and secrecy in such situations work on adding fuel to the fire.

Let’s see through 9 essential tips to minimize financial conflicts and be a high net-worth couple.

1. Try to Talk and Understand Your Lifestyle Choices and Patterns together!

Today we live in an era of diversity. Our perceptions of living are greatly influenced by our upbringing. Every house in our neighborhood or area is different, even after being referred to as one together. Differences are very easy to find; all we have to do is look for them.

For having a healthy and positive relationship, it is essential to acknowledge these differences and work on them or just accept them. The most common cause for conflict emergence in households is money and its usage.

The most common use of money is done on lifestyle. Everyone has some desired income and outlay trends for their desired level of lifestyle. However, several studies have found that. Many times, the outlay trends of one partner upsets the other. There could be several reasons behind such upsets.

- One of the main reasons is disapproval of such expenses and thinking of them as unnecessary.

- It is essential to understand, just as the physical habits, financial habits of individuals also differ.

- Thus, it is essential to have clear conversations on such things. It is wise to have them before the expenses occur.

- Always remember that everyone has different philosophies and attitudes towards money and finances.

Sharing your financial history helps in shaping your approaches and opinions towards money. Sharing your thoughts, feelings, good or bad, your doubts and fears, are crucial to building a robust financial set-in case of an undesired emergency. Try to understand your partner’s habits to know about each other’s actions and reactions in money-related circumstances.

You can also split financial errands like paying regular and emergency bills, balancing the checking account and keeping an eye on the overall finances and related decisions to stay transparent and connected.

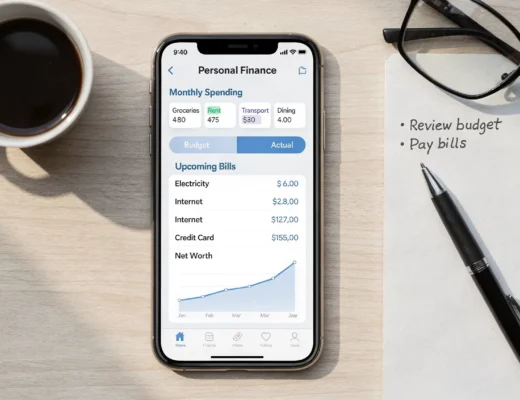

MoneyPatrol can be of your assistance in setting up those budgets, bill reminders, checking clash-flow. And generating reports to assess your financial state to help you make conscious financial choices. You can also track your financial and economic activity and look at the trends and patterns.

2. Do not Let the Salary Differences arise Between You two

You and your partner are people with different thoughts, visions, and abilities. Your salaries will also be directly dependent on these factors as well. Just accept that both of you may earn a different salary, and that’s okay.

- Relationships are supposed to have equal partnerships.

- However, the terms and conditions of having them and equal partnerships must be discussed in detail as they differ from household to household.

Divide the chores and expenses so that suffering should be at least. For doing that, try to make a proper assessment of your income and outlay trends. Try to work as a team even if you manage the ‘expenses’ alone

- If you feel burdened by some expenses, share them with your spouse, the favor shouldn’t be returned at a rate of interest but in kind.

Always be aware that you are not disrespecting them in any way. Financial disrespects never prove to be a good idea and are one of the leading causes of resentment.

- Don’t hide your expenses from each other, as the action of hiding suggests a lack of trust.

- As Khalil Gibran said, “Money is like love; it kills slowly and painfully the one who holds it and enlivens the other who turns it on his fellow man.”

If both of you earn a different salary or just earn a paycheck, do not try to dictate each other’s outlays. However, this does not mean you should not state your opinions and suggestions. The share of financial contribution is a personal choice, which needs to be made as per the situation.

- In case if you or your spouse contributes less in the financial matter, that doesn’t mean you bring less to the table. Remember, couples with high net-worth or financially empowered couples bring much more than money to the table.

3. Set Realistic Financial Goals and Plans together!

It is usually said, “If you fail to plan, you plan to fail.” this saying could be most efficiently utilized when it comes to financial concerns. We all hope for a long comfortable, and prosperous life. Our roadmap has a lot of milestones included in it. Financial planning is such a critical tool that guides, letting us know, what we need, how much we need, when we need it, and what is it(money) needed. You must discuss and create short-term and long-term financial goals and plans as a couple. You Should include both of your individual requirements and desires as a couple.- It should be a guideline on handling minor and significant financial decisions such as retirement, travel plans, number of children to have, education, property buying, relocation, and many more.

Many couples never discuss such things in detail and rely more on indirect non-vocal decisions. When they do it unexpectedly, it becomes a problematic situation for both. You should create a plan to achieve these financial goals and plans together once you have determined your relationship’s mutual terms and conditions.

Many high-value net-worth couples work together to achieve financial goals and plans. They do not just bring money to the table. Instead, they get whatever they can from their end, trying to optimally utilize their assets.

- As Seneca said, “It is not the man who has too little, but the man who craves more, that is poor.”

To set up practical and achievable financial goals, having complete information about your finances on the go is crucial. With MoneyPatrol, you get to organize your finances and connect all your financial accounts. Also, you can monitor money transactions to get a better look at your inflow and outflows. Overall, assisting you in making better financial decisions and achieving your financial goals.

4. Mutual Assessment and Consent on Financial Decisions

On financial fronts, joint decision-making is about equal partnership and trust and shows that you and your spouse are on the same page.

- One of the most significant consequences of a joint financial decision is that you and your spouse are aware of your financial state. Awareness is knowing all the assets and liabilities created during financial planning execution.

- It also shows your ability to work together to make the most appropriate decision for your family.

- Mutual Assessment and consent also strengthen the feeling of ownership in the relation and financial matters, making both of you more responsible and reasonable.

- Also, it helps you spend more time with each other. Doing activities together also strengthens the bond between you two.

- In case of an untimely situation or if you or your partner is unavailable to take the financial decision. Any one of you can make a sound financial decision in another’s absence or during an untimely situation. Both of you know your financial condition, assets, and liabilities, which helps you make the optimal choice.

As Aristotle said, “Money is a guarantee that we may have what we want in the future. Though we need nothing at the moment, it ensures the possibility of satisfying a new desire when it arises.”

For most of our lives, we use subjective scales of measurement, measuring rod of money is one of them used most frequently. Money cannot buy everything, but it gives you the authority to fulfill your respective demands.

6. Do not Let Alone Needs and Desires Run the Show

We, humans, have lots of needs and wants. We try to fulfill these needs and desires for most of our lives, be they materialistic or non-materialistic. These needs and desires influence our purpose or goals in life. Many times, our purpose, vision in life is just what our needs or desire dictate. For example, being rich, buying a new house, having a comfortable life, and many more.

- As Mario Cuomo said, “The closed circle of materialism is clear to us now – aspiration becomes wants, wants becomes needs, and self-gratification becomes a bottomless pit.”

A blind eye while fulfilling these needs and desires could prove very hazardous to our finances, as their fulfillment pursuits materialistic satisfaction or consumption. Even if it craves a non-materialistic satisfaction, its cost is in the materialistic format of money. Also, it is not necessary to fulfill all the needs and desires in life.

- Paul Rand said, “Design a way of life, a point of view. It involves the whole complex of visual communications: talent, creative ability, manual skills, and technical knowledge. Aesthetics and economics, technology and psychology, are intrinsically related to the process.”

Crystal-clear financial planning will help you practically assess your needs and desires accordingly. It has to be remembered that needs and desires often could be misjudged by one another very quickly.

Particularly while making a purchase, we all have something we want to buy. After buying it, we had second thoughts or even realized we may not need it. It is a classic example of misjudging needs and desires.

6. Monitor the Money Flow

We all can make a lot of money in our lives, but it won’t be used if we cannot utilize it properly. Usually, the problem is not with money-making but with spending. Very often, we hear couples complain about their partner’s expenditure habits. There are too many reports of teams fighting over finances in our families and our surroundings. Thus, it proves crucial to keep a tab on your financial inlays and outlays.

- As Ralph Waldo Emerson said, “Money often costs too much.”.

Monitoring the Money Flow also helps understand the financial trends for your expenses and revenue generated.

- It is also often seen in high-value net worth couples that they monitor the money flow closely to get a better idea about their assets and liabilities.

- This also helps them form an optimal budget for housing chores and every other aspect of life.

In many instances monitoring money, flow could be chaotic. So, it is necessary to monitor it to not stand as a problem between you and your spouse.

- Understand and assess your present and future financial situation, individual and collective spending habits, and keep a tab on where you are going.

- Compromising is key in such situations.

- You must not deny your spouse those small but delightful pleasures like a short trip once in a year, that Xbox he’s been eyeing for months let them have those but cut spending elsewhere.

- You must collaborate as a couple and make realistic, achievable, and comfortable plans for both.

MoneyPatrol, provides such features, assisting users in sharing their financial profile containing revenues and expenses. This proves very helpful for monitoring finances together.

- Other features, such as trackers, assist users in tracking their inlays and outlay from an annual basis to daily.

- Know your credit usage, balance, payments, and many more.

- Weekly, monthly, and yearly account activity summaries.

- Tracking trends and patterns in your financial performance and many more.

7. Refrain from Keeping Secretes from Each Other

Honest communication about your financial needs and aspirations is essential. Hiding information about large college debts, personal credit cards, and bank accounts comes under financial infidelity.- It can create feelings of betrayal and mistrust.

- If you want to conquer money issues, you must communicate with your partner and overcome difficult situations together.

- As Eleanor Roosevelt said, “He who loses money, loses much; He who loses a friend, loses much more; He who losses faith, loses all.”

Make sure you have a set time for reviewing your finances so that you can understand the situation clearly and make improvements where required.

- No spouse must get a free pass, even if assigned to handle the financial chores.

- To remain on track and achieve your individual and collective goals, you must continuously discuss each other.

Money management becomes a complicated task for couples if it is not handled with maturity. Life is not just about meeting basic requirements or making average money for living hand to mouth. It is about being together in whatever you do.

Always try to self-evaluate the state of personal finances. It is advisable even by many wealthiest people to contact financial advisors. You can also get personalized financial advice from MoneyPatrol to achieve your financial goals and expectations.

In Conclusion

Several people think that money can solve all their problems. Still, in reality, it can also create more problems if it is not appropriately handled. A prosperous background can be the reason for a higher probability of financial disputes.

Therefore, couples need to understand, discuss, and manage money and bring comfort and peace along with ample wealth into a relationship. Couples can decrease their financial conflicts, improvise their decision-making skills with the tips mentioned above.

- As Henry Ford said, “If money is your hope for independence, you will never have it. The only real security that a man will have in this world is a reserve of knowledge, experience, and ability.”

- If the problem persists, you can always take a professional’s help to sail through your wealth management journey. A qualified professional is a neutral third party who can bring unbiased opinions into the equation, solve your problems and answer your queries.

- You can make informed choices and better decisions when your judgment is not clouded with emotions.

- Relationships require honesty, trust, transparency, and respect; if you have those, the state of your relationship will definitely flourish, just like your wealth.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances