Do you know your Net Worth? Do you track your Net Worth? Do you have a positive or a negative Net Worth?

- Net Worth is an essential indicator of how you have been doing financially.

- A positive and improving Net Worth indicates that you have been doing a good job managing your finances.

At the same time, a negative Net Worth could signify that you need to seriously focus on driving your finances better.

What is Net worth?

Net Worth is a measure of the value of your assets minus liabilities. Assets include your cash holdings, investments, house, and vehicles. At the same time, disadvantages include loans and debts such as student loans, credit card loans, mortgage loans, and car loans.

If the value of your assets is greater than the value of your liabilities, then you have a positive net worth. If the value of your purchases is lower than the value of your weaknesses, then you have a negative net worth. Suppose you are married or have a partner. In that case, you can combine your assets and liabilities to determine the combined net value of the household.

A positive net worth is a sign that you are doing an excellent job with your finances. Ideally, your net worth should continually increase over time—however, external economic factors such as a downturn in the stock market.

Or in, the housing market may lead to a decline in the value of some of your assets, due to which your net worth may also decline. In the long run, though, the markets will likely rebound, leading to an increase in the value of your assets.

Net worth is harmful when you have more liabilities than you have assets. Now, if you have just graduated from college, most likely you have a student loan due to which your debts are higher than your assets. And, over the years, as you pay off your student loans and start building assets, your net worth will go from negative to positive.

However, suppose you are not a graduating student and are someone who has been working for a few years and still have a negative net worth. In that case, you seriously need to do a better job with your finances and implement ways to increase your net worth.

Net worth can be increased by either increasing the value of your assets or decreasing the value of your liabilities. The value of investments goes up if you increase your savings or appreciate some of your help.

Your Net Worth also increases when you decrease your liabilities by paying off your outstanding debts.

Suppose you continue to increase your net worth. In that case, you may eventually become a high-net worth individual, also called an HNWI. These individuals are people with more than $1Million in Net Worth.

High net worth can be determined in several ways. Still, generally speaking, it refers to investable assets of $1 million or more. In some cases, the Net Worth of these individuals is calculated by excluding the value of their house.

Being a High Net Worth Individual opens an opportunity to work with top wealth advisors. These dedicated wealth advisors work with clients to create a personalised financial plan that considers the client’s circumstances and financial goals.

The wealth advisors also provide 1-on-1 coaching and advice on investment strategies, debt management, tax planning, and retirement savings.

An experienced wealth management firm can provide several essential services, including creating a Trust and Estate Planning. This type of planning is necessary for individuals and families who want to ensure their assets are protected. And their loved ones are taken care of in the event of their death.

Note that if you have a spouse or a partner, you both will have to work together as a team to increase your combined Net Worth. Now, let’s talk about ways you can increase your Net Worth.

1. Get a High Paying Job

The first step in this journey is to get a job that pays well because when you have a higher salary, you can save more and have more money to invest. You should evaluate if your current company is paying you well. If it is not, you should consider moving to another company that may produce better.

- Or maybe, you can renegotiate your salary or ask for a promotion.

If you are in a field that does not pay well, you should consider switching to an area that pays well. This may require upgrading your skills. And, with the availability of many programs on platforms such as Coursera and Udemy, you don’t necessarily have to go back to school for another degree.

2. Focus on Savings

Having a steady income and then focusing on saving as much of your income as possible will help in increasing the value of your cash holdings. One way to save money is to cut out unnecessary expenses.

- Do you need that cable TV package?

- Could you get by with a cheaper cell phone plan?

- Do you need to eat out often?

If you can find ways to cut your expenses, you’ll be able to save money each month. Saving as much money as possible will give you more financial flexibility and freedom.

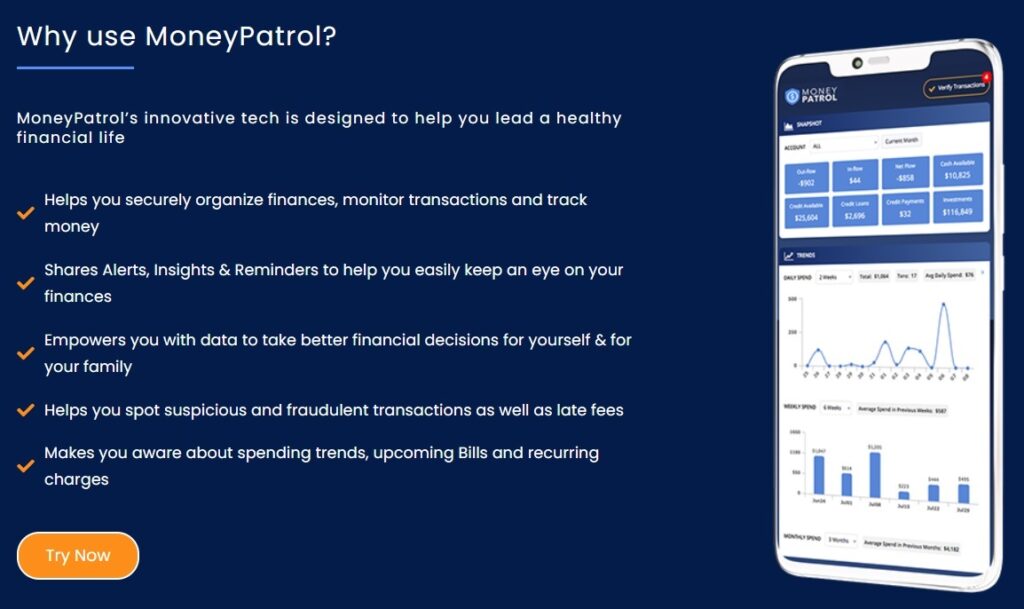

Another way to save money is to make sure you’re not paying too much for the things you need. It means being a savvy shopper and looking for deals. You should track all your expenses diligently and identify areas where you can cut your spending. Use an app such as MoneyPatrol to help with tracking your expenses. You don’t have to be stingy or highly frugal, but you need to have a proper plan to save as much money as possible.

3. Pay Off Your Debt

Paying off your outstanding debt requires a lot of patience and hard work. For example, many people have 15- or 30-year mortgages. Paying such loans will take many years. However, the good part about mortgage loans is that the interest rates are much lower than the interest rates on other loans, such as Credit Card loans. First, you should prioritise paying off high-interest loans, such as Credit Cards.

- Use MoneyPatrol to figure out how much debt you have, and identify your monthly payments. And create budgets to ensure that you’re putting enough money towards your debt payments each month.

Once you have a plan in place, stick to it and don’t give up. If you’re feeling overwhelmed by your debt, don’t panic. You can get out of debt if you’re willing to put in the work by staying focused and disciplined.

4. Invest your Money

Suppose you genuinely want to see a massive increase in your net worth. Long-term investments such as buying and holding stock, or investing in mutual and index funds, are the key.

Keep frequently investing when you invest in the stock market or joint or index funds. You will reap the rewards of increasing ROI over time due to compounding returns and growth. These investments will sometimes see a dip in returns during the bear market downturns.

However, historically, these markets have always rebounded and have rewarded investors by increasing the value of their investments. Even buying a house is also a form of investment. However, the value of a home may not grow at the same rate as the increase in value that you would see in your stock investments.

But, if you are paying rent, then it would make sense that you buy a house and make mortgage payments instead of paying the rent, as this will build equity in your home over time.

5. Max Out Your Retirement Contributions

One of the best things to increase your Net Worth is to max out your retirement contributions, such as 401K plans. You’ll be putting away as much money as possible for your later years by doing this. Talk to your HR department or financial advisor if you’re unsure how much you can contribute. And in many companies, the company itself will also contribute some amount via employer contributions to your 401K plans. This is free money that you are receiving from your employer.

The critical point about 401K investments is that the contribution amount will be auto deducted from your paycheck, and it is a tax-deferred investment.

You are not charged any taxes in your salary for this investment.

You may have to pay early withdrawal penalties; however, our recommendation is that you never touch your 401K investments until before the age of 60 years. When you start your withdrawals at that time, the taxes you pay will be much lower.

Summary

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances