Each of us is working, learning, and living through a global pandemic. It’s a stressful, confusing, and challenging time to be alive right now.

- The shopping process can give that thrill of the hunt and the guilty pleasure of self-pampering.

- At some point, all of us have used shopping to deal with stress and feel better.

Compulsive purchasers, unlike some other habits, cannot quit cold turkey.

- Going cold turkey is impossible, especially during the holidays when gift-giving feels obligated.

- Treatment instead focuses on dealing with the root impulses that lead to compulsive spending.

- CBT can be especially beneficial because it seeks to identify and repair harmful beliefs while also treating these thoughts cause.

While acknowledging you have a problem with someone else may be the first step toward healing, you must first identify the problem to yourself.

- It’s an issue if you’re afraid your purchases will raise red flags among your friends or family members, to the point where you’re hiding them or lying about your expenditures.

People who love and appreciate you should not pass judgment on a bad habit you’ve developed, but they should be aware that you’re having trouble so they can assist you.

- Considering shopping is an inherent aspect of life, it might be challenging to detect shopping addictions.

- However, if you’re regularly suffering one or more of these symptoms, it’s time to see a counselor or therapist.

Signs You’re a Shopaholic:

- You frequently purchase items regardless of your financial situation.

- You go shopping in response to your feelings.

- If you do not buy anything you want, you will feel irritated or deprived.

- You’re often thinking about or daydreaming about shopping.

- You feel ashamed of your purchases and want to hide them.

It’s normal to splurge on something you really want or need now and then.

- Without having a shopping addiction, the average shopper can succumb to impulse purchases.

Some people addicted to shopping may resort to theft to pay for or obtain the products they can’t leave behind.

- It becomes an issue when you do this so frequently that you miss crucial bills or are unable to pay for food and other essentials due to your splurges.

This disregard for budgets could lead to credit card debt or, worse, some compulsive shoppers.

Is It True That Spending Is Addictive? Why do we do it?

People who love and appreciate you should not pass judgment on a bad habit you’ve developed, but they should be aware that you’re having trouble so they can assist you.- Well, it’s not just us; most people turn to shop as a coping mechanism associated with a “new and better” mentality.

- Buying something equates to happiness and gives a sense of self-worth.

- Thereby becoming a way to express one’s emotions and self soothes them.

- Advertising plays on the mentality, and it can feel like a promise for the future.

- Every advertisement associates brands and goods with a luxurious life, societal acceptance, great prestige, and that feeling of being confident and assertive.

- Pleasurable behaviors, including sex, buying, and eating, stimulate dopamine release in the brain’s reward centers.

- As a result, you can get “high” without using any drugs.

- To be an addict, you wouldn’t have to use drugs or alcohol.

- It takes more spending ever to induce dopamine surges over time, just like it does with drugs.

- As a result, compulsive spenders wind up pursuing a dopamine high, much like a heroin addict might follow the next big hit.

- If you find yourself unable to do these things since you keep returning to the lovely sneakers you saw from the window or the deal that was too good to pass up, it may suggest a more significant issue.

- It could indicate an addiction if shopping absorbs all of your thoughts.

What are the Impacts of Stress Shopping?

Shopping makes us feel better when stressed, but it is a vicious cycle. When people feel bad about themselves, they shop and feel better.

- When that “shoppers high” wears off, they either feel bad about themselves, or something mildly wrong happens in their life.

- Then they start up again.

Shopping in itself isn’t bad but ruins everything when it starts coming in between a person’s life, and he feels utterly powerless in that situation.

- Since there’s this need to shop, people tend to do it even when facing financial instability.

The real test is when you visit a brick-and-mortar storefront and walk away without buying anything. If there is any problem in doing so, that says this shopping isn’t necessary, it’s just emotionally driven.

- Another indication that can be difficult to detect is purchasing because you’re upset.

- When you receive a new job or celebrate an accomplishment, it’s natural to give yourself a treat.

However, if you start buying because you’re depressed or make yourself sound better, you may have a problem.

- Some folks enjoy going shopping.

- It doesn’t imply you’re addicted to shopping if it makes you happy.

- People who rely on retail purchases to shift their moods, on the other hand, should step back and try to deconstruct their feelings.

Although compulsive spending can be detrimental to your financial future, many compulsive spenders have the funds to make seemingly limitless purchases.

- Others limit their spending to low-cost things, allowing them to keep making purchases while going into debt.

- You don’t have to be bankrupt to become addicted to buying.

Other ways that compulsive spending can destroy lives include:

- Thoughts of guilt and humiliation are cultivated.

- Relationships are being harmed. When you’re caught lying about your spending, for example, you can have relationship issues.

- Taking away time that could have been spent on more valuable activities.

- Have significantly more belongings than you have room for.

- Hoarding. Compulsive spenders can often become hoarders, living in a state of disarray surrounded by unnecessary goods.

What are the Causes of Compulsive Spending?

Like many other addictions, compulsive spending is a means of coping with stress, suffering, trauma, and different negative feelings.- People who indulge in compulsive spending do so in response to negative feelings.

- They may feel shame or disappointed after making a purchase, resulting to further unpleasant emotions and spending.

- Anyone can develop a spending addiction.

- A history of mental illness or past addictions is two risk factors.

- Having a solid connection to consumer culture.

The following are some indications of compulsive spending:

- Spending a large chunk of your income on non-essential goods.

- Having a significant quantity of consumer debt.

- Despite making resolutions to cut back on spending, you continue to do so.

- Keeping purchases hidden from family and friends.

- You may experience a sense of disappointment or shame after completing a purchase since you were more pleased about making the buy than about having the item.

- You’re not going to use everything you buy.

- You are purchasing a tremendous amount of items that you do not require.

- You’re having relationship issues as a result of your expenditures.

- You’re embarrassed about your spending.

- While shopping, you may feel anxious or aroused.

- Feel like your next major purchase will make a significant difference in your life.

- People struggling with compulsive shopping may be thinking about the “next buy” in the same way that drug addicts worry about the “next high.”

- They’re not out shopping to meet a bodily need; they’re out shopping to scratch a psychological itch.

- It is not always sufficient to change one’s behavior, as it is with most addictions and behavioral illnesses.

- Those suffering from addiction frequently require professional help to treat underlying mental health issues.

How Stress Shopping Hurts Your Money?

In some extreme cases, stress shopping has proved to improve the mood of many people.

- However, it causes adverse effects and becomes too much to handle when it goes beyond the budget.

Just because we can afford to buy something doesn’t mean we should buy it.

- In some cases, people buy things on credit and cannot make the due date.

- Thus, what is initially used to reduce stress starts adding to it.

Here’s why stress shopping might be hurting you and your wallet:

Compulsive Buying

Buying something does reduce stress, but going on and on without any limit, can prove harmful. It’s worst if it turns into a trauma.

Buying Despite Huge Debts

If people don’t set limits or know where to stop, they may fall into considerable debts in the future.

Shopping without assigning or sticking to a budget can prove fatal to one’s pocket.

Buying Unwanted Products

People end up buying unwanted and unnecessary products. They might seem valuable and attractive initially but might not be of any actual use in the future.

Risking Financial Security

At some point, most of us have seen ourselves driving that luxury car of our dreams; but what good is it if you can’t fill the tank! It’s not worth all that trouble. Unnecessary luxury items are not worth risking your financial security.

Jeopardizing Long-term Goals

Living in the present is acceptable. But not considering the future for satisfying short-term desires can cost dearly to our family and us.

- That dream of buying your own house, sending your kid to a good college, or saving up for the care of your elderly parents can all go for a toss if you’re not careful.

7 Tips to Reduce Stress Shopping

Spending money on ourselves makes us feel good. It even reduces anxiety and stress and boosts your mood.

- With the advent of technology, it’s now easier than ever to buy anything from the comfort of your home and have it shipped to your doorstep tomorrow.

- Shopping isn’t the problem; it can act as a soul soother when done in moderation.

- The trouble starts when it prevents us from paying essential bills on time, ruining our budgets, lying about purchases, and feeling a considerable amount of shame for doing so.

Here are some ways to help reduce stress shopping:

1. Know the Triggers:

The first key to curb stress buying is knowing what drives you to spend.

- What are the things or moods that compel you to do unplanned shopping?

- You can always find ways to avoid those temptations if you know this.

If you cannot alter or eliminate the source of your stress, you may need to adjust something else.

- For example, if you had a bad day at work, you might need to take an alternative route home to avoid passing by your favorite retail store.

- Some folks despise going shopping.

- Others use “retail therapy” to ease boredom, forget unpleasant news, or celebrate good news.

- And they don’t imagine the pleasure they derive from shopping.

Aside from acquiring something new, shopping modifies brain chemistry by momentarily increasing dopamine, the brain chemical that regulates the reward and pleasure regions.

In plain words, buying is pleasurable! Shopping to relieve stress or boredom, on the other hand, can have drawbacks, such as excessive credit card bills and spending the money that should be saved for an emergency or retirement.

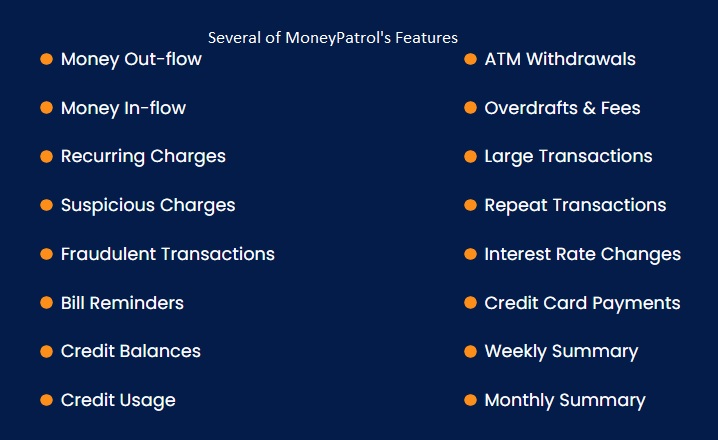

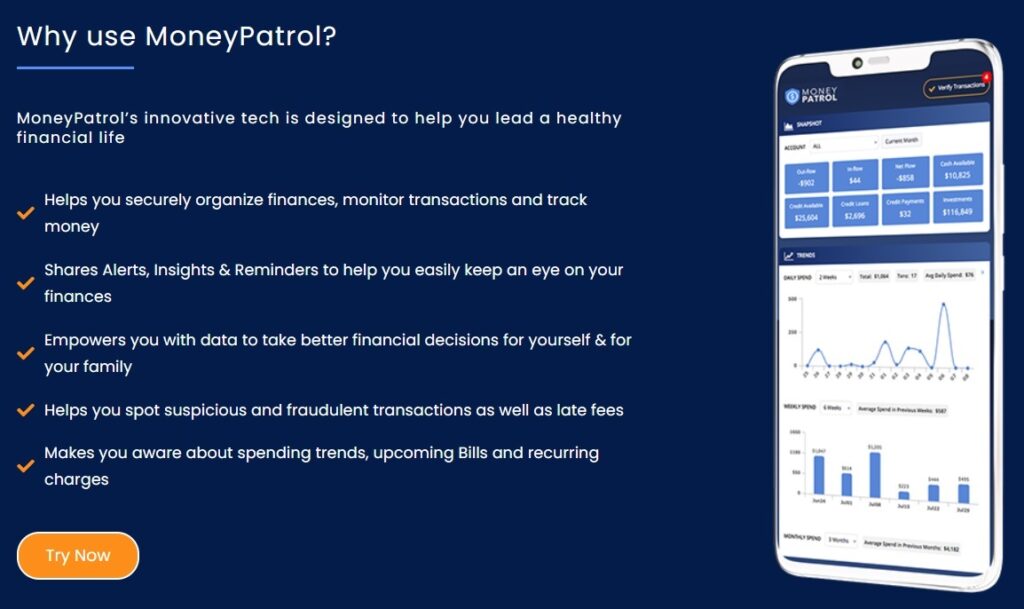

2. Keep Track of Your Purchases:

Track your daily spending. You will become better at identifying your habit and its emotional connection.

- Hold on to all your receipts for doing the audit later on.

- Take help from budgeting and tracking apps to track your behavior.

- You will notice certain months, weeks, or days where you’re spending on things you don’t need.

Many here prefer to be in the darkness about our financial situation. We are paid, spend our money, and we hope we don’t spend more than we could ever afford.

However, if you are an impulsive spender, you may find yourself paying more of it than you regularly earn if you use this strategy.

- Check your accounts at least once a week, if not once a month.

- Keep track of how much you’ve spent and how much you have to remain to pay.

- It can help you make financial planning a regular part of your life and help you think more sensibly about how you spend your money.

3. Remove Online shopping Apps from Your Phone:

Remove all the shopping and coupon apps. Unsubscribe to retailer emails that send you offers and encourage you to spend. Fight that urge, take it as a challenge, and don’t give in to temptation.

- If you’re like most people, you probably get dozens of emails from stores each week advertising various products, discounts, and sales.

- If you get one of these emails when you’re worried, you may make an impulse buy.

- Unsubscribing from these mailing lists can help decrease temptation exposure.

- If you’re anxious, stressed, or sad when shopping, take a break and do something different.

- Take a walk, listen to music, or make a phone call to a buddy.

Taking care of yourself in non-monetary ways will discourage you from making those self-soothing impulse purchases.

4. Stick to a Budget:

Budgeting helps in reducing overspending.

- It will force you to save a fixed amount every month while letting you spend on things you need.

- Use the envelope method, where you assign some amount to savings and some to shopping.

- Going beyond that limit is a complete no.

Having a budget is by far the most effective tactic to keep one “s finances under control.

- A budget might help you restrict the amount of money you spend on certain products if you find yourself stressed shopping frequently.

- Of all, a budget is only a starting point. You must still maintain self-control and refrain from diverting from your budget.

The zero-based budget comes in very handy in this situation. You’ll be less prone to spend more money impulsively if you give every penny of your income a clear purpose.

5. Get Support from Friends:

Take help from your best friends or your friend circle.

- Sometimes just talking to someone makes you feel better, and you’re not tempted to spend to taking your mind off of things.

- The best is to meet someone who can make you stick to your financial goals whenever temptations strike.

Do not attempt to do the task on your own.

- Finding Support and holding yourself accountable might go a long way toward protecting you from overspending.

- Marter advocates establishing a monthly check-in with an accountability partner.

It might be a spouse, partner, acquaintance, or someone else who is likewise trying to improve their financial situation.

- Have monthly check-ins to be completely transparent about how you’re doing and receive feedback and encouragement.

- A financial counselor or advisor can also assist you in keeping a healthy financial lifestyle and managing impulse purchases.

- You don’t need money to look around, which feels equally great.

Make sure you leave your credit cards at home so you won’t buy anything at the store.

6. Treat Yourself with Small Buying Pleasures:

Create a small shopping budget that allows you to buy something at the end of the month.

- If your financial goals are on track, there’s absolutely nothing wrong with it.

Deprivation isn’t the answer to it anyway. Moderate, small purchases can do wonders.

7. Follow the 48-hour Rule:

It’s a straightforward way of dealing with emotional spending temptations.

- Consider if you need the product or is it just a filler.

- You can write the name and price of that thing in your diary and give yourself 48 hours to think about it.

Most of the time, this will work, and it will help you be more clear about your buying decisions.

Final Words

Always remember your mistakes do not define you. You’re only human, and at some point, all of us make mistakes.- It’s normal to feel shame or guilt after giving in to stress buying.

- But it may help make better decisions next time.

- Make conscious choices that are right for today and the days ahead.

- That way, you can enjoy shopping without regretting it later on.

- It can be repeated indefinitely.

- You can relieve a lot of tension and anxiety in your life by breaking the habit of stress spending.

- You’ll be happy and have fewer worries.

- There’s nothing wrong with asking for assistance.

- You’ll be a lot happy at the end of the day, and your financial condition will almost certainly improve.

- Shopping was not the only way to encourage your brain to make more.

Other techniques to raise your levels and make you feel good include:

- Get moderate activity regularly.

- Play your favorite tunes.

- Use your hands to create something.

- Meditate

- Make to-do lists and cross items off as you finish them.

- A savings challenge, rather than simply saying “I’d like to save some money,” provides you clear short- and long-term goals to work toward and helps you alter your perspective from spending to saving.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances