How to reduce Subscription Charges? It is a question that has circulated through most of our thoughts. However, still, no clear solution could be obtained through it. People frequently underestimate how much they pay in subscriptions and membership fees.

- A little cost may not seem like much, but it can mount up quickly, especially if you’re spending many firms each month for services you don’t use.

- When fees are automatically invoiced to your credit or debit card, it’s easy to forget about them.

From gym memberships to music streaming, many adults spend a considerable amount on subscriptions.

- And some of that could be wasted if you don’t check when, where. And how you spend it each month or year.

- Most people take gym membership and TV streaming services that they don’t even use daily.

- Popular subscription services include credit reports, delivery plans, magazines, hobby memberships, newspaper subscriptions, and post-pandemic we seem to be spending more on them than ever before.

Yet, we don’t get the best value from those services.

You might have begun with the best intentions, but in reality, you didn’t go to the gym, and you’re still listening to your favorite old albums rather than the latest tunes.

- It’s relatively easy to sign up for a subscription in the hopes that you’ll use it someday.

- There might be a few seasonal subscriptions too.

- If you’re spending the summer, spring, and weekends out, you’re won’t be able to take advantage of any home-based paid services.

Work out the cost compared to the usage to get a clear idea about the subscription and its actual worth.

- So let us say you’re only using your TV streaming service for a handful of programs per week.

- In that case, it will be cheaper to wait until you can binge watch it in one go through a DVD or a pay-as-you-go service.

- Make a note when your services will auto-renew in your calendar, specifically if the subscription is annual.

This way, you will get an alert to prompt you to reassess if you want to keep subscribing or not.

- It seems like an easy deal, but some subscriptions have a notice period, often about 30 days.

- In that case, you will have to cancel three or four working days before the renewal date to get the cancellation done.

- Always check for penalties or cancellation fees, and while we are at it, it’s best to ask if you can get a refund on the services you won’t be using until the contract ends.

If you start missing the service, you can always start the subscription again.

Most Common Forms of Money Wasteage on Subscription Charges

The cable can be costly. As a result, many consumers have shifted to streaming services, far less expensive. Millions of people have several subscriptions to streaming services.

Although the total cost may be less than cable, this does not necessarily imply that money is well spent.

- You could be wasting money if you have one or more streaming subscriptions that you don’t utilize regularly.

- You might be able to save money while still watching your favorite TV series and movies if you make certain sacrifices.

Food delivery services, beauty subscription services, and organizations that provide monthly pet supply deliveries have all gained popularity.

- Those companies may give basic and important stuff, but paying for those deliveries is pointless if you don’t use the items you receive.

One area where people commonly waste money is gym subscriptions.

- Signing up for a gym membership to work out regularly is normal, but people stop visiting after a few weeks or months.

- It frequently occurs at the start of a new year.

- If you’re paying for a gym membership that you’re not using, either start working out to receive the value for your money or cancel your subscription.

It’s simple to cut the cord with so many streaming options to pick from.

- However, may you pay more money than you realize by subscribing to various services?

- Disney will begin delivering its films and original programming on the impending Disney+ service in November, while Apple is set to introduce Apple TV+ this autumn as if there weren’t already enough options to keep you entertained.

GOBankingRates polled 1,000 Americans to determine what subscription services they’re paying for, such as entertainment, food, and beauty subscriptions, and how frequently they use them.

- Take a look at how Americans stream, and find out how you can save money by canceling membership services you don’t use.

Why Are Subscription Charges So Popular?

SaaS, or Software as a Service, is famous in IT.

- It’s the concept that Software isn’t purchased once and installed but instead is subscribed to and updated regularly.

- What is Office 365 from Microsoft? SaaS.

- What is Google Drive? SaaS. What’s the name of your kid’s coding app? Again, it’s SaaS.

Content as a Service (CaaS) is another option. What is Netflix? Hulu? Spotify? What is Apple News+? CaaS is for everyone.

- Then there’s HaaS, which stands for “hardware as a service.”

- Subscriptions are now available for your connected door lock, thermostat, security camera, and possibly even your car or toothbrush.

Put everything in one basket and name it “Everything as a Service,” or, if you don’t mind, “EaaS.”

According to a survey conducted by GOBankingRates, roughly half of all Americans pay for some form of entertainment subscription.

- Netflix is the most popular streaming service among respondents, followed by Amazon Prime Video and Hulu.

- With just over 1% of respondents reporting they subscribed to Sling TV, an online TV provider that’s an alternative to cable, it was the least popular.

According to a survey conducted by GOBankingRates, many Americans do not use their entertainment subscriptions daily.

- Approximately 9% of those polled stated they utilize the services every month.

- Furthermore, more than 4% of respondents indicated they never use the entertainment services they pay for. However, if you pay for a service that isn’t used, you aren’t saving money.

Respondents had an average of 1.65 entertainment subscriptions among those who pay for streaming services but don’t utilize them.

These folks waste an average of $347.81 per year on entertainment subscriptions they don’t use, based on the costs of those services.

- People between the ages of 25 and 34 were the most likely to be spending money on entertainment subscription services, with over 7% of those in this age bracket claiming they never use their memberships.

- Adults 65 and older, on the other hand, were the least likely to be squandering money, with only 2% of those in this age bracket agreeing.

According to a Deloitte Global report, faster broadband connections and smartphones have spurred the expansion of entertainment streaming services.

- And the number of services available to households is only expected to increase.

These entertainment streaming services are frequently viewed as a less expensive alternative to cable television, which an increasing number of Americans are abandoning.

- According to Nielsen, 16 million households have cut the cord in the last eight years, representing a 48 percent raise.

4 Point Guide to Save Money on Subscription Charges

Online subscriptions are simple to obtain and equally simple to overlook. According to a Chase poll conducted in April 2021, about two-thirds of consumers have forgotten at least one recurring payment in the previous year.

- Automatic payments for monthly utility bills, for example, are handy and can help you avoid late fines.

- On the other hand, others have the potential to become significant financial leaks.

- For example, a monthly subscription to Ancestry.com costs $24.99, and a monthly subscription to Morningstar, a financial information site, costs $29.95.

Keep your subscriptions if you’re a frequent user.

- If you’re not actively studying your family history or changing your investments regularly, cancel your memberships before they auto-renew and save the money.

- On an individual or month-by-month basis, subscription service expenses could appear minimal.

However, such fees can quickly pile up over a year — especially if you subscribe to many services — and put a significant dent in your budget. As a result, it’s critical to check the services you’re paying for to ensure you’re receiving your money’s worth.

Here are a few pointers on how to figure out how much your membership service costs:

- To figure out how much you’re spending overall for these services, make a list of the services you’re paying for and their specific costs.

- Don’t forget about Amazon Prime, which charges an annual price rather than a monthly one.

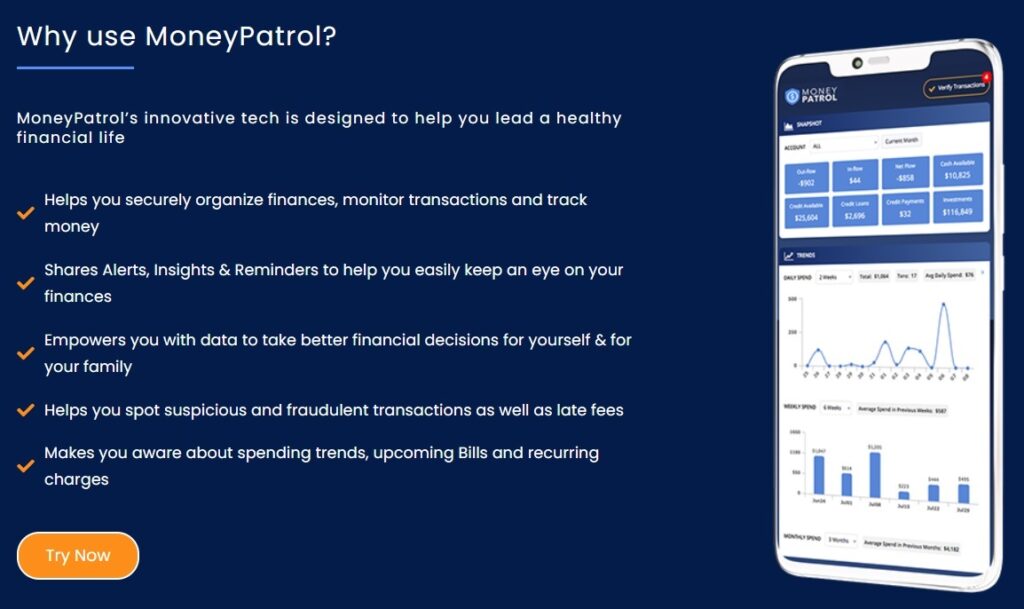

- Analyze your accounts with a mobile app like Trim to look for reoccurring subscription expenses.

If you don’t want to give up any of your services, look for ways to save money. Enter the name of the service and the terms “coupon” or “promo code” into a search engine, for example, to find promotional bargains, according to Woroch. Negotiate with your service providers to see if you can get a better deal. Inform them that you are dissatisfied with their service and consider moving to a rival.

1. Do an audit:

Log in to your bank accounts and credit card and make a list of all your yearly and monthly subscriptions, along with their charges. Then make a simple list and tally up the totals.

2. Combine family plans:

Sit with your partner, do the same, and cross-check the lists. You might spot some duplicates in your household if you’re lucky, like Amazon prime and apple music subscriptions. Instead of two subscriptions, you will pay collectively for one family plan.

3. Cancel Unnecessary Subscriptions:

Mark all those subscriptions you don’t find any value in anymore. Also, mark the ones that began as free trials and then converted into a recurring monthly expense.

- Then hit the unsubscribe button and goodbye.

- It is easier said than done. It’s very often that the “Cancel my subscription” button is hidden in the website or an app menu.

Sometimes you may even have to call their customer care and silently question what you have done to deserve that 30 minutes of ear-melting music.

It’s better to send it an email or try the company’s customer chat service if you’re still having difficulty.

4. Disable Auto-Renew:

Lookout to disable any auto-renew function whenever you sign up for any new services.

- Set up a reminder on your calendar just before the trial period ends if there’s a free trial, so you can easily cancel before you get charged the following month again.

It is better to go through this cumbersome routine every year to ensure that you don’t keep paying companies for the rest of your days.

- Make a list of your monthly and annual subscription and membership charges from your recent bank and credit card bills.

- Then consider how often you utilized each service and whether the reasonable cost.

Despite the advantages of saving money, most people have a passing interest in doing so.

- If this is the case, you should consider terminating your plan.

- If you want to make regular saving a habit, keep reading to learn how to overcome the first hurdle: obtaining the additional cash.

You could be paying for the service that you signed up for years ago and then forgot about, or that you never signed up for in the first place.

- Many people subscribe to websites and mobile apps, only to use them seldom or never at all, and then forget about them.

- Occasionally, a child uses a parent’s phone to sign up for a subscription without permission.

Final thoughts

We have seen massive growth in options for subscription-based services in the past year.- Whether it’s online video streaming, app-based streaming music services, or even standard monthly fees like gym memberships, each flourished during the last year.

- Despite the pandemic, things are getting back to normal, and most consumers are beginning to wonder if it’s the right time to cancel subscription services as the costs are adding up.

- You might also be able to find out other ways to save on your subscription.

- But don’t do it in the heat of the moment.

- Even if you’re reserving this time, you’re still not using the subscription, and it’ll still be money wasted that you could have used for something better.

- There are many extensive subscription services out there to help bring entertainment, efficiency, ease, and joy to your daily life.

- They can start extorting more money from your bank account than they are worth.

- It is why it is essential to pay close attention to your recurring yearly or monthly fees and bills.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances