Insufficient funds and their costs are inconvenient, but they are a part of life in the financial world. NSF fines are still lawful, despite increased criticism and challenges. Clients can prevent them by keeping track of their bank balances, keeping a cash reserve in their accounts, and enrolling in overdraft protection, which comes with its own set of costs. An overdraft is a type of credit that you can get on your checking account.

Many banks also provide overdraft credit lines. It is a unique product that you can register for if you have a financial emergency. An overdraft line of credit needs you to fill out an application form, which is evaluated based on your credit score and profile.

By properly budgeting, you can prevent NSF fees: Even if you’re about to have a cash injection, never write a check or pay a bill for more than your current balance. It’s also a good idea to retain a cushion—contingency amounts in your checking accounts—to avoid overdrawing.

- Furthermore, it would be best if you kept a close eye on your account balance, keeping an eye out for debit card purchases and scheduled transactions, which are easy to overlook and hence major causes of overdrafts.

- If you have more than one bank account, such as a checking and a savings account, you can link them so that money moves from one to the other automatically to cover withdrawals.

1. What are Insufficient Funds?

Insufficient funds, often known as non-sufficient funds, are a bank account condition (NSF). If a transaction withdraws funds from a bank account while the account balance is inadequate to cover the withdrawal, the report will be marked as insufficient funds. A note will appear on the account holder’s bank statement or receipt.

Check purchases, withdrawing money, automatic electric payments, and other transactions can result in this status.

- For instance, A writes a $5,000 check to B but only has $4,500 in his checking account. When B attempts to transfer the check, the bank where A keeps his account would probably refuse to transfer the funds and send A a notice of insufficient funds.

It’s also known as a bounced check or a faulty check. A can ask the bank to process the transaction with inadequate money, which is characterized as an overdraft and usually comes with a cost.

- Insufficient finances can result in not only increased fees but also legal issues. Issuing many faulty checks or checks in high amounts with the intent to defraud may result in criminal penalties. In some jurisdictions, insufficient funds are accompanied by a criminal accusation of fraud.

To deal with inadequate money checks, numerous jurisdictions in the United States administer harmful check reparation programs (BCRPs). The scheme allows beneficiaries of such cheques to collect funds from their district’s local attorneys.

Check writers can escape criminal prosecution by making the payments in exchange, and local agencies will follow up with them to collect the monies. The charges are usually waived if the check fraud issuers can make their payments within six days.

2. What is an Overdraft?

It allows you to take money out of your bank account or pay bills even if there is no money in it.

As long as you don’t go over your overdraft limit or even have payments refused, a scheduled overdraft will likely harm your credit score. Your credit score may improve if you utilize your overdraft responsibly and pay it off regularly.

It’s because an overdraft would display as debt on your credit record. It means creditors will be able to see if you have had an overdraft, how much of it you’re spending, and what your limit is. Keeping the same current account for several years will help your credit history develop, improving your credit score.

If creditors can see that you remain within your agreed-upon limit and clear your overdraft regularly, it demonstrates that you are a trustworthy borrower. It means that if you seek another type of credit, including a credit card or a mortgage, you are much more likely to qualify.

Because overdrafts do not need monthly repayments and must be paid in whole or in part in lump sums, everyday interest is levied on the outstanding balance until the petitioner bears the balance in full.

The amount you owe grows as you continue to borrow money. You will be charged daily interest or an overdraft fee until you settle the entire amount borrowed. However, you do not have to pay it back in full right away. As long as the lender allows it, you can pay the lender back in installments whenever it is convenient for you.

As you repay the loan, the amount owed to you lowers, so the interest rate drops. Once you’ve reimbursed your bank in full by putting the funds in your account, you’re authorized to borrow again up to your lender’s credit limit.

Fees stack up: Your bank will charge you a fee if you don’t have sufficient funds in your account. The bank will charge the firm that deposits your bad cheque, passing the charges on to you.

Your merchant will also charge you a fee as there might be some penalties for failed electronic payments. If your cheque bounces several times in a row, those penalties build up a stack.

Damage of Reputation: It’s a fact that banks don’t like customers who overdraw their accounts, even if they generate huge revenue. If your account gets overdrawn too often, you might end up in the bank database that tracks consumers with a history of writing bad cheques. That gives your bank all the rights to close your account or ban you from getting one in the future.

Legal and credit troubles: If you start overdrawing your account more often without overdraft protection, you may eventually blow your credit scores. You might even get involved in legal problems if it seems like you’re intentionally incurring more than you are capable of paying back. Your chances of getting credit, a credit card, or even a debit card in the future would be frail.

How to Limit or avoid overdraft Fees?

Banks offer various overdraft protection programs to cover your payments if and when you’re low on funds. Some tips to avoid high overdraft fees

Overdraft protection: Your bank will make payments for you instead of rejecting them, even when you don’t have money for them. There would be charges for it, though, around $35 extra each time. Also, you would still be required to pay back those funds as soon as possible.

Overdraft protection is optional. If you want it on your checking account, it’s not usually a good idea to authorize the bank for processing every transaction, whether you can afford it or not. Also, they’ll charge you a fee every time you overdraw.

If you don’t take over protection: Whenever you make a payment that you cannot afford, your debit card will get rejected at the cash register. Although you can choose a different means of payment like another card, pay cash, or do without!

4. What are the Advantages and Disadvantages of Overdraft?

- An overdraft is more flexible than a loan because you only take what you want then at the moment, which might also make it less expensive.

- It’s simple to put together.

- There is no penalty for paying off an overdraft sooner than intended in most cases.

- You’ll typically have to pay an agreed charge if you need to prolong your overdraft.

- If you go over your overdraft threshold without authorization, your bank may charge you.

- The bank has the power to demand the return of your overdraft at any moment. However, this is rare unless you are experiencing financial hardship.

- Overdrafts can be secured against the assets of a company.

- An overdraft, unlike a loan, can only be obtained from the bank with which you have a current account. You’ll need to transfer your company bank account to receive an overdraft somewhere else.

- Because the interest rate is almost constantly fluctuating, it’s tough to determine your borrowing costs precisely.

- Banks may reduce unused overdrafts on short notice, but this is unlikely unless you are in financial distress.

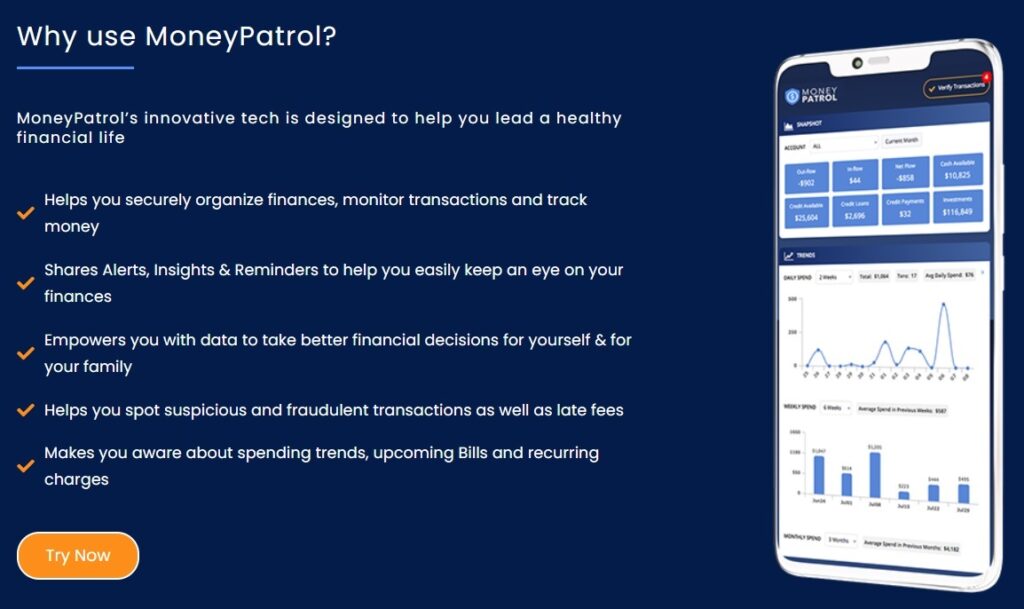

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances