Credit card fraud is a type of identity theft in which crooks impersonate you and take control of your finances using your personal information. Identity thieves can use credentials such as your name, date of birth, address, and Social Security number, in addition to credit card information, to apply for bogus tax refunds, unemployment benefits, take out loans in your name, take over bank accounts, and Social Security checks, thereby taking advantage of benefits you’ve earned.

About one in 5 persons is a victim of credit card fraud. Sometimes, the victims of credit card fraud get refunded for their loss, and other times; they are not. Therefore, it is important everyone is informed on rules surrounding credit card fraud, so they don’t end up on the wrong side of the law in the event of falling victim to credit card fraud.

The most important first step when an account is compromised is to contact the credit card provider and notify them of the situation to become a beneficiary of fraud returns in case it occurs.

Table of Content:

- What is The Fair Billing Act?

- What is the Consumer’s Right’s to Dispute to a Billing Error?

- How to Settle Credit Dispute with Creditors?

- When the Creditor is Non-Compliant to the FCBA Guidelines?

- What is the Meaning of Zero-Liability Policy Against Credit Card Fraud?

- Some of the Methods of Credit Card Fraud Prevention in Banking and Non-Banking Systems

- Conclusion

1. What is The Fair Billing Act?

The Fair Credit Billing Act protects consumers from unfair billing practices, and it applies to “open-end” credit accounts such as credit cards and charge accounts. The law is also intended to provide consumers with a means of disputing billing inaccuracies.

The Fair Credit Billing Act was intended to protect consumers against unfair billing practices such as unauthorized charges, charges for goods and services that were not accepted or provided, and other disputed costs.

Among the most significant consumer safeguards are:

Under federal law, your maximum liability for illegal credit card use is $50.

The act states that if you report a loss before your credit cards are used, the card issuer cannot hold you liable for any unauthorized payments.

Recurring charge accounts and open-end credit accounts, such as credit cards, are covered by the statute.

To dispute a charge, send your name, address, account number, and a summary of the billing error to the “billing inquiries” address provided by the creditor.

Billing mistakes under the FCBA include the following:

- Charges that were not incurred by the customer.

- The amount charged is incorrect.

- Fees for products or services that the consumer did not obtain/received.

- Fees or charges for things that aren’t delivered on time.

- Damaged-in-transit charges.

- Payments and credits to an account are not properly reflected.

- Wrongfully-addressed or mailed statements.

- Charges that the customer would need to be clarified or for which he or she would like evidence.

The FCBA has a number of other rules.

The FCBA has other requirements in addition to developing a method for dealing with billing problems, including the following:

- For open-end credit accounts with a grace period before applying finance charges, billing statements must be provided at least fourteen days before the bill is due.

- If banks report late payments to credit bureaus, they must also disclose disputed charges.

- Merchants may not be prohibited by credit card issuers from giving deals to customers who pay with cash or check.

- Banks are generally prohibited from using funds from checking or savings accounts to settle an overdue credit account with the same institution.

2. What is the Consumer’s Right’s to Dispute to a Billing Error?

In terms of protection under the legislation, consumers must follow the required rules set forth by the Fair Credit Billing Act when disputing a billing error.

The following are some of the consumer rights protected under the FCBA:

- Consumers have 60 days from the date of receipt of the bill to contact the creditor to dispute a billing error. The disputed sum must be greater than $50 in order for FCBA to evaluate it.

- Calculation errors, unauthorised transactions, or a bill with an inaccurate amount or date can all cause billing issues.

- The consumer must submit their grievance in writing to the authorized billing inquiry address, not the address for receiving payments.

- Consumers can use a model complaint letter given by the FCBA. The working title, mailing address, and details concerning the disputed billing error are among the consumer’s personal information contained in the complaint letter.

- The card issuer should send an acknowledgment receipt within 30 days of receiving the complaint letter.

- The issuer must complete the investigation within two billing cycles, according to the statute (not exceeding 90 days).

- The issuer is unable to collect payment on the challenged billing amount or report it to a credit bureau as a defaulted obligation during this investigation period.

- The consumer, on the other hand, is still obligated to pay for products shipped by the issuer on subsequent billing.

3. How to Settle Credit Dispute with Creditors?

- Within 60 days of receiving the invoice with the error, you must send your dispute letter to the creditor.

- Within 30 days of receiving your disagreement, creditors must address your complaint.

- In two billing cycles, creditors must finish their investigation.

- At this period, they are prohibited from collecting payment, charging interest, or reporting to credit bureaus.

- You must react within 10 days of obtaining the explanation if you disagree with the investigation’s findings.

- Consumers can use a model complaint letter given by the FCBA. The working title, mailing address, and details concerning the questioned billing error are among the consumer’s personal information contained in the complaint letter.

- The card issuer should send an explanation statement within 30 days of receiving the complaint letter.

- The issuer must complete the probe within 2 billing cycles, according to the statute, however, it must not exceed 90 days.

- The issuer is unable to collect payment on the challenged invoice sum or transmit it to a credit bureau as a delinquent obligation during this investigation period.

- The consumer, on the other hand, is still obligated to pay for products shipped by the issuer on subsequent billing.

- The FCBA provides a sample complaint letter for consumers to utilize. The consumer’s personal information in the complaint letter includes his or her working title, postal address, and facts about the disputed billing issue.

- Within 30 days after receiving the complaint letter, the credit card provider should send an account statement.

- According to the statute, the issuer must finish the investigation within 2 billing cycles, but not more than 90 days.

- During the investigation time, the issuers are unable to collect a settlement on the disputed invoice sum or report it to a credit bureau as a late obligation.

- On the other hand, the consumer is still responsible for paying for things sent by the issuer on future invoices.

4. When the Creditor is Non-Compliant to the FCBA Guidelines?

- The creditor cannot retrieve the disputed invoice amount if the creditor fails to satisfy any of the deadlines provided by the Fair Credit Invoicing Act, irrespective of whether the billing was correct or incorrect.

- The creditor is also barred from retrieving the disputed amount if the FCBA settlement procedures are not followed.

- When the creditor acknowledges receipt of the consumer’s complaint letter after the time limit has passed, here is an example of such a scenario.

- Even if the billing is correct, they will not be able to collect the disputed amount.

- When a consumer’s rights under the FCBA legislation are violated, he or she has the option of pursuing legal action against the creditor.

5. What is the Meaning of Zero Liability Policy Against Credit Card Fraud?

A zero-liability policy is a clause in credit card agreements that states that the cardholder will not be held liable for any unauthorized transactions done using the card.- Almost all prominent insurers provide zero-liability insurance.

- This means that cardholders are not obligated to pay for all fraudulent activity and are not subject to legal action.

- As a result, even if there is a fee for using the zero-liability policy, it is worth it because the cardholder is not obligated to pay for those transactions in any way.

- They can breathe a sense of relief because they are no longer responsible for making payments.

- Credit card issuers’ revenues will suffer as a result of this. Credit card businesses provide zero-liability policies to their customers in order to recruit customers.

- Debit cards, on the other hand, are governed by a separate federal rule.

- If unauthorized withdrawals are made with the card, the cardholder may be held liable for account losses.

- Unless the cardholder notifies the loss or theft of the card quickly will the damage be limited to $50. Two days or fewer is considered “prompt.”

- In the worst-case situation, a cardholder who fails to notify a loss within a reasonable amount of time may be held liable for the account’s full balance.

- Because users could otherwise refuse to use credit cards, issuers offer zero-liability policies. Users do not want to be exposed to fraud’s possibly huge charges.

- The policies’ terms are spelled out in the cardholder accord.

6. Some of the Methods of Credit Card Fraud Prevention in Banking and Non-Banking Systems

While none of the methods and technologies discussed here can completely eliminate fraud, each technique adds to the ability to identify it. As will be covered later, best practice implementations frequently employ several, if not all, of the fraud prevention strategies discussed here.- Manual Review

- Address Verification System:

- Card Verification:

- Payer Authentification:

Conclusion

In 2018, unlawful financial fraud losses via payment cards and remote banking totaled £844.8 million in the United Kingdom. Banks and credit card companies saved £1.66 billion in 2018 from unauthorized individuals or fraudsters.

WHEN AN INDIVIDUAL IS HELD LIABLE?

According to existing legislation by most credit card companies; the customer is responsible for the cost of fraud when:

- They have acted fraudulently, for instance, they contributed to, were involved in, or benefited from the loss, they won’t get a refund.

- They have proven to be careless: by, for example, writing down the pin number. In this situation, the onus is on the card provider to prove negligence.

- They failed to inform the bank of a stolen card or a third-party knowledge of their PIN.

- When they don’t use the card providers’ 3D Secure system (e.g. Verified by Mastercard, Visa Secure Code).

- If an additional cardholder is held responsible for any of the reasons above.

Despite the right of credit card owners to receive compensation in cases of credit card fraud, when they are found culpable by intentionally compromising their security. The ‘good news for credit card holders is that the burden of proof lies with the credit card issuing company.

WHEN YOU ARE NOT LIABLE?

According to existing legislation, the customers are not responsible for fraud when:

- Their card was lost or stolen and when they realized, told the bank before the fraud was carried out.

- A third party knew the users’ pin, and they realized and informed the bank before the fraud took place.

- Card details are stolen without the cardholder’s knowledge: If it’s an instance of the card, not present fraud where the details are taken online.

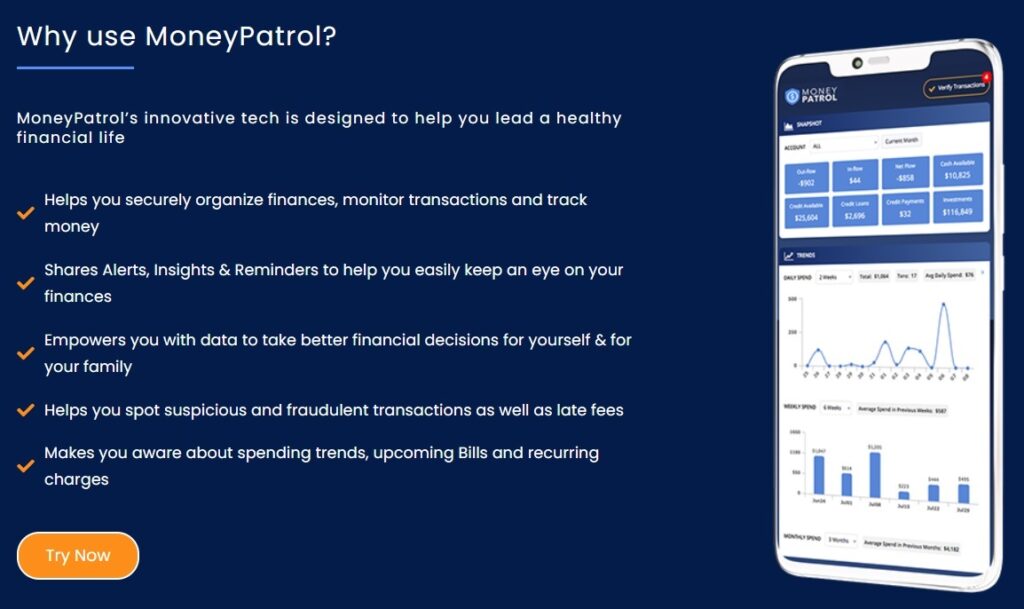

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances