Credit Card! We all have heard of it, seen it, and know-how its usage is. A credit card is a financial tool through which we can purchase the desired goods and services in the present and pay afterward. It is actually straightforward, yet it is complicated even to make any individual hit rock bottom. Before beginning into the other details of credit cards, let’s first see the significance of credit cards in America itself.

- The value of gross credit available on American credit cards is around 3 trillion U.S. dollars. That’s the same around Apple’s valuation.

- It also has to be noted that there are about 1,103 million credit cards in America.

- Hence, the importance of credit cards as a tool of exchange is growing in the U.S. and around the global market.

Even after being so general in usage, many Americans and others worldwide face economic and financial troubles due to improper credit card usage. For example, an article states that, in 2019, nearly 70% of Americans admitted that they couldn’t pay the credit card debt.

- Roman Emperor Marcus Aurelius has said, “Everything we hear is an opinion, not a fact. Everything we see is a perception, not the truth.”

On regular occasions, we hear several credit card stories. And how these stories derail people off the track. For instance, the value of credit card debt in the U.S is around 770bn $. Because of this, people either try to keep a tight grip on their credit card activities or try to take it easy. But very often, the trouble is just around the corner.

- One more disadvantage that most people face due to such stories is that People restrict themselves from gaining the optimal utility from the credit card. This is a significant loss because it provides a credit that can increase our income elasticity and increase our purchasing power.

If we look at inflation. We will see that the average daily expenditure of any individual has been successively rising per head. The average consumer demand continuously increases as we consume more goods and services than any past moment in the previous year or time. Thus the availability of credit cards and their optimal utilization prove crucial for increasing the demand elasticity of any individual.

- For example, you are out in the shop too but something, but your income balance is zero.

- Thus, though you desire to purchase particular goods and services, you cannot buy them as there is no money.

- In such instances, credit cards can be utilized to purchase those desired goods and services, thus expanding your demand elasticity for the short run.

As Cicero said, “Frugality includes all other virtues.”

1. What is a Credit Card? And Its Resemblance?

Traditionally a Credit Card is,

- A thin rectangular piece of plastic or metal issued by a bank or other financial institution.

- To make borrowed payments and pay later.

- The payment made later is as per the terms and conditions agreed by the parties involved in the transaction and exchange of monetary and other goods and services.

Some of the most Important chronological activities of credit cards in the U.S. can be traced back to;

- 1914 – Western Union’s Metal Money – A precursor to Credit Cards.

- 1958 – American Express’s First Charge Card in U.S. and Canada.

- 1960’s – Forrest Perry (IBM Engineer) invents the magnetic strip for credit cards and other identification badges.

- 1974 – President Gerald Ford signs the Equal Credit Opportunity Act.

- 1985 – First Discover Credit Card purchase in Atlanta, Georgia, USA.

- 2009 – The Credit Card Act enacted.

Credit Card usage in America?

If we look at the figures, the average number of credit cards in the U.S. is 3. It shows how heavily Americans use credit money to fulfill their demand for utility and other goods and services. The study further also states that the average balance on the credit card is around $ 5,500.

- However, there is also a decrease in the balance on credit cards in 2021 relative to 2019, which had around $ 5,800, and 2018, $ 6,100.

- There can be several reasons behind this decrease, pandemic, economic shifts, etc.

There are several modes of payment that Americans purchase daily and other goods and services. However, there has been a consistency in using credit for these purchases in recent decades. For example, the study further states the average non-mortgage debt in 2021 is around $ 25,000.

- If we look at the previous years, 2020 (during the pandemic) and 2019(a bit before the pandemic; the non-mortgage debt stood the same.

- This shows how Americans used money from other resources to pay off their debts or maintain at previous levels, even during times of shutdown and increasing unemployment.

2. What Are the Benefits of Using Credit Cards?

More and more people are choosing credit as a mode of payment, and the number of credit card users will increase in the near future. As more and more people are shifting towards general-purpose cards. For example, in a study by the Consumer Financial Protection Bureau (CFPB), nearly 79 million Americans have credit cards for general use. However, there has been a decrease in Private label card holding in recent years.

There are also various extra added benefits of using a credit card. They are:

- Sign-up Bonus and Cash Back Points

- Purchasing Power and Global Acceptance

- Credit Balance Transfer and Credit Score Benefits

- Rewards on Purchase and Grace Period

- Security, Moderation, and Tractability

Let’s have some briefing about those mentioned above most common Benefits of Using a Credit Card.

Sign-Up Bonus and Cash Back Points

Sign-up bonuses and Cashback points are used by financial service provider institutions specifically to lure the consumers to themselves. However, that does not mean that the consumer cannot get anything in return. Data shows that nearly 12.8 users use credit cards mainly to utilize the rewards on Credit Cards. Whereas, Cashback is the most favored reward by users.

These bonuses and rewards are valuable perks. Though many institutions offer or grant these perks, the consumer can use them free of cost in the short run or within a defined time frame.

Cashbacks are the most favored reward by the consumer. The cash reward offered is generally a percentage of your total purchase. Over time, these rewards and cashback points add up to give a significant bonus that can be redeemed at the selected retail outlets.

Purchasing Power and Global Acceptance

The most significant advantage of credit cards is that users can make purchases that they might not otherwise be able to afford. In our earlier articles, we have discussed the concept of demand elasticity and its different forms.

Credit Cards temporarily increase the purchasing power of consumers by adding surplus funds to their income. Thus, optimal utilization of credit cards can lead to much ease in paying off those increasing prices of goods and services. Particularly for essentials, daily use, and other utility goods and services.

Nowadays, credit cards can purchase most of our needs and desires. They could be used on international vacations, making reservations, hoteling, renting various goods and services, and many more. All of this could be done because, unlike paper money, credit can make hassle transactions and exchanges at a very long distance.

Credit Balance Transfer and Credit Score Benefits

A balance transfer is a facility given by a credit card issuer where the subscribers can move the debt of one credit card to another.

A balance transfer can also help you consolidate your debts and make your life easier. The balance transfer allows you to avail of an introductory offer on a new credit card. Also, switching to a lower interest credit card can help you save money in the long run. You are not required to pay interest on the outstanding balance for the specified period. However, you still have to pay back what you owe.

Credit cards are an essential tool to repair and maintain your credit score. The Final transaction conducted using your credit card is a crucial factor that impacts your credit score.

Rewards on Purchase and Grace Period

The money spends on credit cards works similarly to loans. Credit Card levy zero interest on purchase for 30 days. The money on credit is borrowed in cash advances which means you do not need to pay funds immediately, unlike debit cards.

The grace period offered works in your favor. If you repay the bills within the grace period, you save the finance charges and positively impact your credit score.

Many credit cards offer rewards programs that accrue points, discounts, or other benefits like frequent flyer miles.

Security, Moderation, and Tractability

There is always a chance you might get pick-pocketed with less than a 1% chance of getting hold of a pick-pocketer. You immediately call the hotline and block the card with a credit card.

Also, in cases of prompt reporting of a lost or stolen card. You are protected against any unauthorized usage. Cashless purchases are possible with credit cards; thus, credit cards make saving hard-earned money easier.

1. What is a Credit Score?

A credit score evaluates your potential of settling debt on time. A credit index is determined using details from your credit report.

Credit scores are used by businesses to analyze whether or not to lend you a mortgage, credit card, vehicle loan, or other credit product. They’re also used to calculate how much interest you’ll pay on a loan or credit card, as well as your credit limit.

Keep in mind that there is no such thing as a “perfect” credit score. It’s crucial to understand that you don’t have just “one” credit score and that you, as well as lenders, have access to a variety of credit ratings. Any credit score is based on the information used to compute it, and it may differ depending on the information used.

Any credit score is determined by the information used to construct it, which can vary based on the scoring model, the provenance of your credit history, the kind of loan product, and even the day it was computed.

A higher credit score makes it easier to qualify for a loan and may lead to a lower interest rate. The majority of credit ratings fall between 300 and 850.

The FICO scores can range from 300 to 850 on a scale of 1 to 10. In general, scores in the band of 670 to 739 indicate a “strong” credit history, and so most lenders would look fondly on this rating. Borrowers in the 580 to 669 band, on either hand, may have difficulty finding reasonable and suitable financing.

Bankers and Creditors utilize a borrower’s FICO score to calculate his/her’s creditworthiness, but they often weigh other factors such as income, employment period, and the borrower’s credit and payment history.

To provide a high FICO score, one should have a range of credit accounts and a solid payment and credit history. Borrowers should also exhibit constraints along with moderation by holding credit card balances within respective credit card ceilings. FICO ratings are dropped by maxing out credit cards, paying untimely, and enrolling for new credit in the heat of the moment.

Considering the significance of a strong FICO score in effective decision making for the optimal allocation utilization of the credit. It may also be worth it to invest in a reliable credit monitoring service to preserve respective interests.

FICO scores are used in over 90% of credit appraisal and risk assessment in the U. S.

Regardless of the fact that borrowers can defend negative items on their credit reports, having a low Credit score is a turnoff for many lenders and institutions.

Many lenders, primarily in the housing market, have strict credit score minimums for approval. A veto results if this threshold is exceeded. As a consequence, there is a strong argument to be made that borrowers should emphasize FICO above other credit reporting agencies when starting to build or strengthen respective credit scores.

4. What Affects the FICO Score?

i. Payment History – This information contributes to approximately 35% of a FICO Score:

- Payment records for a variety of accounts:

Credit cards

Retail accounts

Installment loans - Items related to bankruptcies and collections

- Information on missed payments, insolvencies, and collection items

- The number of accounts without any overdue payments or that have been paid as scheduled.

ii. The Amounts Owed to You – This factor contributes to approximately 30% of a FICO Score:

- The Evaluation of estimated Cost amount owing among all accounts

- Amounts due on different kinds of accounts

- Sums owed on certain types of accounts

- Amounts owed on specific types of accounts

- Number of accounts with a balance

- How much of the overall line of credit is used on rotating credit accounts.

- How much on installment loans is still owed, comparison to the initial loan amounts.

Among the most crucial pieces reviewed in this classification is credit utilization, it analyzes the money you owe to the total credit you have authorized. While bankers and creditors decide how much credit to issue, you retain control over how much you use.

You do not really have to be a high-risk borrower with a low FICO Score if you have credit accounts with amounts due. A strong record of making regular payments on credit accounts may convey to lenders that you really can responsibly manage additional credit.

iv. Credit History Duration – This factor accounts for approximately 15% of a FICO Score:

- When all other things are equal, a higher credit history will elevate a FICO Score. According to what their credit report states about their payment history and balances owed, even those who haven’t had credit for long can get a good FICO Score.

- The number of credit accounts maintained; The oldest account, the newest account, and the mean lifespan of all accounts can all be considered when computing a FICO Score.

- The time duration of specific credit accounts.

- When was the last time you utilized a particular account?

v. New Credit – This information accounts for approximately 10% of a FICO® Score:

- As per the FICO’s research, opening multiple credit accounts in a short span of time substantially increases the risk, — particularly for people without a strong credit history. A FICO Score in this category takes into account the following factors:

- The sum of new accounts opened.

- When was the last time you opened a new account?

- How many new credit demands have been made, as reflected by consumer reporting agency queries.

- The period of time since lenders asked about respective credit applications.

- Whether there is a strong current credit history? As well as any payment history concerns.

FICO Scores, on the whole, adjust for this shopping behavior by doing the following:

- After 30 days, FICO Scores normally treat inquiries of the same type (i.e., car, mortgage, or student loan) that fall inside a typical shopping period as one inquiry for calculating your score.

vi. Credit Varieties in Use – This factor contributes to approximately 10% of a FICO® Score:

- Credit cards, retail accounts, installment loans, finance business accounts, and mortgage loans are all incorporated into FICO scores.

- It is not necessary to have each one of them, and creating a credit account you do not intend to use is not wise.

A FICO Score considers the following factors in this category:

- What types of credit accounts do you have on your credit report? Is there any credit experience with both revolving and installment accounts, or has it been restricted to simply one type?

- How many of each type of account are there?

5. How to Improve Credit Score?

i. Checking Credit Report on a Regular Basis

It does not matter where you turn the credit check in be it in one of your banks or any consumer credit bureaus; you need to keep an eye on your credit. In case you discover any inaccuracy or mistake, always seek help from a professional to file for a dispute. When the dispute is approved by a credit bureau, the error will always be corrected within 30 days which will help increase your credit score.

ii. Register for Free Credit Monitoring

It is important that you always keep a close eye on your credit. Registering for credit monitoring will help alert you on some of the important changes in your credit which will, in turn, enable you to check for any suspicious activity. Any fraudulent activity can easily weigh down your good credit score. Make it a habit of disputing any inaccurate credit details.

iii. Get to Know the Amount of Money You Owe

Collect all your bills and create a suitable plan that will enable you to pay them off. There are two methods you can use when it comes to paying off your bills:

- Snowball Method: Focuses on paying off lowest balances first.

- Avalanche Method: Focuses on paying balances with high-interest rates first.

When you have several credit cards that you have to track, it is advisable that you consolidate the credit card debt into one balance transfer card. With this, it will be easier for you to manage all your monthly payments.

The strategies above will help you in paying off credit card debt faster, reduce credit utilization and increase your credit score. Always go with a plan that works best for you.

iv. Set Auto Pay to Ensure You Never Forget Making Credit Card Payments

Setting up auto-pay will help you make consistent payments. Although it might not lead to a fast increase in credit score, it is capable of protecting your scores from dropping which can easily happen whenever you miss making payment in time.

vi. Consider Making Payments Twice a Month

Instead of waiting to make single huge payments at the end of every month, consider splitting the payments after every two weeks. With this, you will be in a position of sneaking in a few extra payments something that will enable you to make some savings on interest charges. The extra payments will help in paying down your balance quickly which will in turn help lower your credit utilization ratio and account balances.

v. Negotiate Low-Interest Rate

Low-interest rate will help in paying off your balance quickly since you can apply most of your payment to the principal balance than the interest. Low balances will mean a low ratio in credit utilization.

vi. Request for an Increase in Credit Limit

A higher credit limit is another method you can use to help in reducing the credit utilization ratio which will help increase your credit score. However, you need to note that there are credit issuers who will conduct intense credit checks whenever you make a request for a credit limit increase. This can easily make your credit dip further.

vii. Always Mix It Up

Credit mix refers to the different account types included in your credit report. Although it might not be in a position of breaking or making your credit scores, most lenders are happy seeing a mixture of installment loans like student loans, auto loans or mortgages, and revolving credit accounts.

The more you decide you diversify the finances you borrow the better. It is never a great idea to remove a loan you do not require for the sake of adding extra color to the credit mix.

viii. Become Authorized User

Do you have a friend or relative with a high credit limit and a long record of great credit card use? Make a request to see if they can add you as one of the authorized users. You do not have to use the card of the account holder or even have their account number. It is an effective method when you have a thin credit line as it will always have a huge impact.

ix. Consider Using a Secured Credit Card

Using a secured credit card will help improve your credit or build your credit from scratch. However, this card type is always backed by a cash deposit. You will always make an upfront payment and the deposit amount will always be the same as the credit limit.

x. Ensure You Keep the Credit Cards Open

When in a rush to improve your credit profile, ensure you are aware that closing the credit cards will make the job more difficult for you. When you chose a credit card, it means you will lose the card’s credit limit whenever there is a calculation of your overall credit utilization which can easily lead to a lower score. Ensure the credit card is always open and use it on a frequent basis to prevent the issuer from closing it.

6. Conclusion

It could be easily seen that the cost of living and inflation has held hands together in recent times. A significant rise could be observed in them accordingly. Thus, it could be observed that many people fail to keep up with the rising expenditures very often. Also, several recent events and the pandemic has derailed a lot of people from there

A recent study shows that more than 90% of Americans feel stressed while handling their finances. The main reason is the increasing costs and the lack of abundant disposable income. Nearly 65% of the subjects involved expressed an inability to overcome their financial barriers. Whereas 40% admitted to not having a safe financial future. While 40% reported being highly optimistic about their economic and financial future.

- In the study, most people showed discomfort on the financial fronts, not just because of the increasing cost of living and inflation.

- But also due to the failure of disposable income to increase with the costs.

- For an average individual, the costs are successively increasing in the present, relative to any past moment. Thus, If these costs are not compensated with the equivalent disposable income, the satisfaction deteriorates. And the consumer/individual falls back to lower consumption levels, which are usually malnourished.

If we look at expenditure patterns for the needed and desired goods and services for any average being. A significant increase could be seen in the present expenditure level compared to past expenditure levels.

- The problem does not reside here alone. The rate of increment in the disposable income in the hands of the consumer is not as same as the increase in inflation and general prices of goods and services.

- There needs to be a successive increase in disposable income.

Consumers want to consume more and better from their previous levels of consumption. Suppose the rise in disposable income is not proportional to the changes in inflation and other factors. In that case, this hinders the individual’s effective decision-making ability.

Key Factors to keep in mind:

i. Free Price Protection: For certain Credit Cards, if the transaction goes wrong, if the selling company goes bust, or if the purchase is faulty or goes missing, you can claim the cost back from your credit card provider. You’ll also be able to claim a refund if your credit card is used fraudulently, as long as you weren’t negligent with it.

Also, if the price of the article you bought went down after the return period then you can approach your credit card company and they will refund you the difference in the price of the article.

ii. Extended Warranty: An extended warranty is a credit card feature offered by Visa, MasterCard, Discover, and American Express that will match and exceed the length of a manufacturer’s warranty on eligible purchases.

For e.g. If a product has a warranty of 5 years and the manufacturer is providing a warranty of 3 years then with the credit card you will have a total warranty of up to 4 years.

iii. Extended Return Period: Most places only allow you to return things up to 30 days but with a credit card you can return things up to 60 days or even 90 days

However, it is not always easy to increase the income levels as per the inflation and other factors. Thus, we mostly face problems while budgeting and financing due to the inelastic nature of the demand for the needed and desired goods and services. Where the income falls short for making consumption or purchase.

- In such cases, Credit Card/s could be used to expand our disposable income levels in the form of credit injections.

- However, it has to be kept in mind that credit borrowing could only be used optimally during the short run and has the potential to become a solid asset.

But, in the long run, it can become a liability. Thus, balanced, moderate, and proportionate credit cards can provide good returns successively.

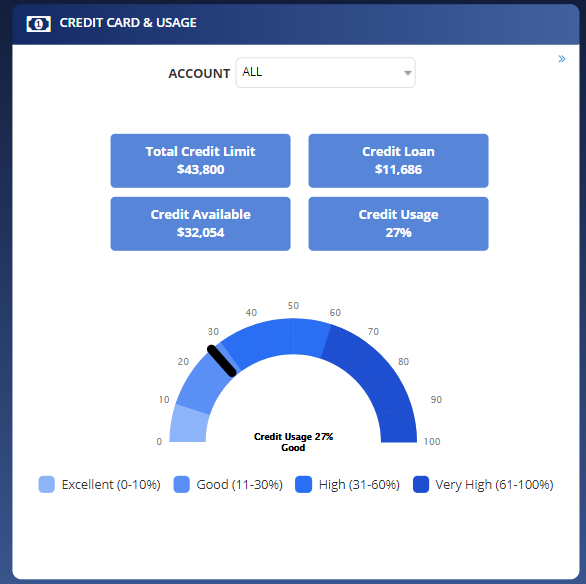

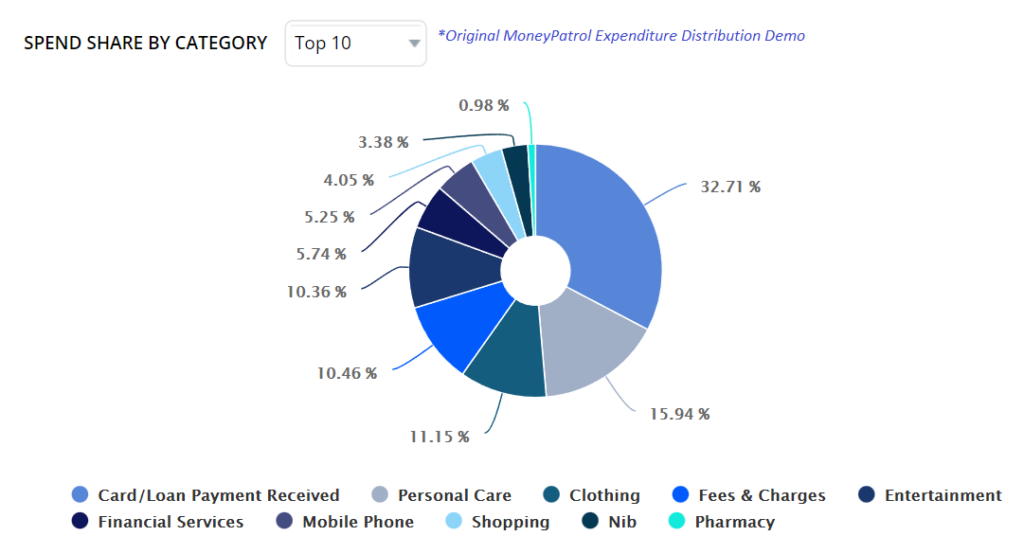

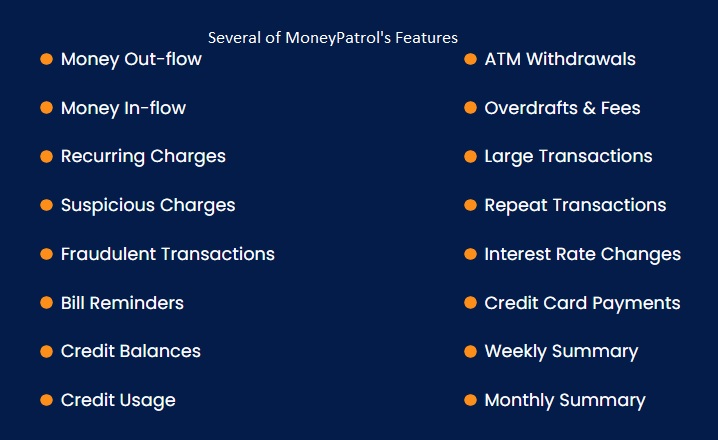

- It is a personal finance management and monitoring platform with all of your finances in one place.

- The provocative infographics and several of MoneyPatrol’s features to differentiate your finances into various other sections make it easier to be conscious about your finances.

- With MoneyPatrol, you get a better chance at managing your finances and economic ventures optimally to have that desired standard of living, the better standard of living!

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances