We all want to make money. And we all want to make it easy. A degree and a job are no longer sufficient in the modern world to provide financial security. People need to learn how to manage their money and invest in several income streams now that the cost of living has dramatically increased.

Although we could start a passive income through affiliate marketing or get a part-time job like driving for Uber, wouldn’t it be good to earn some quick money from the comfort of our homes?

- Do you recall when we used to be cautioned against debt because it never stopped charging us, never slept, never took a day off, and never celebrated a holiday?

- The opposite is also true, though.

No matter if they are seeking a new career or simply some additional money, many people share the desire to make money from home. What previously looked like a far-off fantasy has become a reality for many individuals.

You’ve come to the perfect spot if you’re seeking ways to supplement your income or have more time to spend with your family at home without giving up your job or way of life.

Table of Content:

- Promote on Instagram

- Get on YouTube

- Earn Money Off Your Reviews

- Rent Your Gadgets by the Hour

- Start Investments

- Test Beauty Products

- The Study Credit Card Offers

- Make the most of Credit Card Rewards

- Invest in real estate

- Buy Stocks that Pay Dividends

- Create an Online Course

- Sell Stock Content

- Look into Content-based Ideas

- Remote Work Ideas

- Practice the Sacred Art of Budget Planning

- Conclusion

1. Promote on Instagram

If you have a sizable Instagram following, you can use your influence to generate income in various ways. Instagram first appears to be more relevant to a particular group of people, such as photographers, graphic designers, chefs, and anyone who can fully capitalize on image-sharing.

However, it’s incredibly good at marketing affiliate items and other companies compatible with your profile. Once you begin promoting on Instagram, keep an eye on your Instagram numbers and continue to develop and try new things. Just concentrate on growing a sizable following to attract the interest of businesses searching for social media influencers.

2. Get on YouTube

You know those irritating YouTube adverts you must endure before the video starts playing?

Making money on YouTube wouldn’t be as simple without those advertisements. There are several methods you could go about doing this. You might put your skills on display for the world to see and get found by a major record company like a sure Justin Bieber, or you could upload engaging videos on a subject you know a lot about and make money off of your YouTube account.

Some of the most popular YouTube channels may be created without a staff, expensive equipment, or elaborate editing. With only one person and their phone camera, many YouTubers produce videos with millions of views with minor editing.

3. Earn Money Off Your Reviews

Reviews are crucial to a brand’s success in a world that is becoming increasingly digital. Businesses frequently seek customer input in return for money to improve. Some companies will pay you to sample their goods or services or review previous purchases in exchange for credits.

Start by stating the motivation for your decision to build a budget. Are you attempting to cut costs, get out of debt, or stop spending so much money? Perhaps you’re putting money up for a wedding or a child. Or it might be anything that you need or want.

Points to remember:

- There are several methods to budget, just as there are various justifications for doing so.

- Some individuals manually check-in and keep track of spending each day. Others choose an app because they want to do as little labor as possible.

- Learn about several budgeting strategies, such as the 50/30/20 budget or the cash-based envelope system, and give one a try that suits your way of living.

Focus on the necessities first, such as food, shelter, and transportation expenditures, after understanding the difference between needs and wants. It would help if you were still focused on your financial objectives, such as debt repayment or retirement savings. However, that does not imply that other costs are not significant.

4. Rent Your Gadgets by the Hour

According to estimates, more than 57 million tonnes of electronic garbage will be generated in 2021. It may be mitigated by earning money from home while simultaneously saving the environment by leasing out the technology you don’t use.

Users eager to rent out various things may be found on websites like Flexshopper, Rent-A-Center, and Aarons. Complete your profile, list your items for rent, and receive an extra monthly income

5. Build your Investments

Investing may help you see your money increase yearly, depending on your risk tolerance. Why not get a profit from it if you have room in your budget? There are several possibilities available.

6. Test Beauty Products

Yes, free cosmetics are exactly what they say. You can be compensated with cash or additional products. By testing and reviewing items for companies like L’Oreal, you effectively get to live the life of a beauty influencer.

7. The Study Credit Card Offers

Choose one that offers benefits that you’d genuinely use. Get a card that provides miles, for instance, if you frequently fly, particularly with a specific airline. Choose a store that offers cash back on certain purchases if you frequent several.

These cards often have hefty interest rates, so only apply for one if you can pay it off ultimately each month. The interest rate and the yearly charge are the only two items you should be mindful of.

8. Make the most of Credit Card Rewards

Plan a vacation for all your pals and ask them to pay you back if you have a rewards card that you are paying off—having supper for a birthday celebration?

Put the entire cost on your card and ask everyone to Venmo you immediately. By doing so, you may increase your benefits without having to spend additional money.

9. Invest in real estate

When you invest in real estate, you can profit as the property’s value rises, but you won’t see that money until you sell the property. Invest in real estate that will generate rental income if you want the cash flow immediately.

10. Buy Stocks that Pay Dividends

You will get dividend payments from a successful firm if you are a shareholder, often once every three months. But success is essential here, so do your homework before investing in stocks.

11. Create an Online Course

Writing ebooks, articles, and videos is a few early tasks in building an online course. However, once these course materials are operational, your system will automatically transmit the required resources to subscribers.

12. Sell Stock Content

Publishers of books, periodicals, and websites all utilize stock photos or graphics as illustrations and pay the artists a licensing fee in exchange. Videos, music, and sound effects can also be considered stock material.

13. Look into Content-based Ideas

You may earn money online in a variety of ways using content-based strategies. Potential possibilities include blogging, freelance writing, joining a content firm, editing, proofreading, and publishing ebooks.

A lot of individuals have discovered that YouTube may generate revenue. You may earn money by selling advertisements or signing up for affiliate programs for some content ideas, including blogging or creating an online newspaper or magazine.

14. Remote Work Ideas

If you wish to work from home and earn money online, several organizations allow full-time employees to do so. Those may make websites, logos, and other visual branding materials with graphic design and web design expertise for individuals and companies.

You may work as a virtual assistant or a remote call center representative as a side hustle or part-time employee.

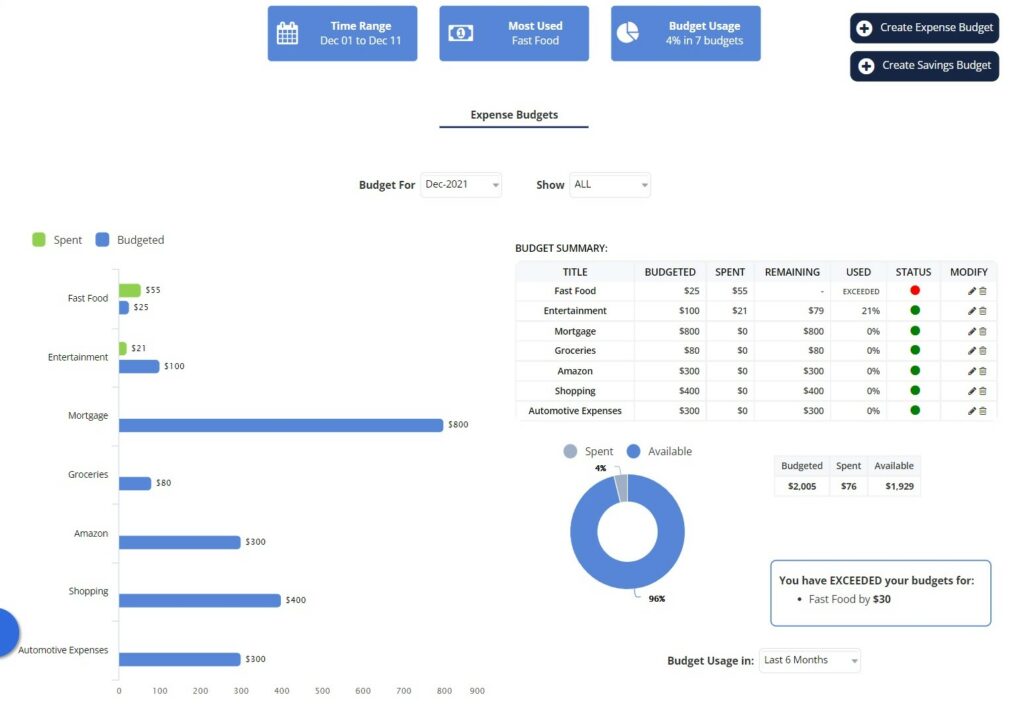

15. Try The MoneyPatrol Way

By choosing MoneyPatrol, you won’t receive any monthly allowance or income. But with MoneyPatrol, you will get financial and monitor stability in daily life. You can save a lot of money on ongoing expenses by taking hold of your budgeting and finance.

Thus, if you need extra income but cannot get any at the moment, then the best thing for you would be to start budgeting so that you would be able to prioritize your resources in the most needed fields of life and balance the average living with a bit ease and comfort.

Start by outlining the reasons why you choose to create a budget. Are you trying to save money, pay off debt, or reduce spending? Maybe you’re saving money for a child or a wedding. Or it might be whatever you require or desire.

Points to remember:

- There are several methods to budget, just as there are various justifications for doing so.

- Some individuals manually check in and keep track of spending each day. Others choose an app because they want to do as little labor as possible.

- Learn about several budgeting strategies, such as the 50/30/20 budget or the cash-based envelope system, and give one try that suits your way of living.

After recognizing the difference between needs and wants, place the primary emphasis on the essentials, such as spending money on food, housing, and transportation. Keeping your attention on your financial goals, such as debt reduction or retirement savings, might be beneficial. That does not, however, mean that other expenses are not essential.

- Create a budget.

- Keep a spending log.

- Plan for upcoming bills.

- Set and monitor your financial goals.

Put money aside each month for other expenses and make regular contributions to an emergency fund. You may handle an urgent auto repair or another problem in this way without accruing credit card or loan debt.

- Technology may make budgeting less laborious and help you avoid setbacks.

- So why not let it handle a portion of the work?

- Consider automating transfers so you may save money or pay bills regularly without thinking about it.

- You can also use budget apps to track your expenditures easily.

The basis of every financial strategy is a budget. If you want to manage your finances, whether you make six figures a year or barely get by, you need to know where your money is going.

Contrary to common misconception, budgeting doesn’t just include cutting back on your spending and taking away all the fun from life. Knowing how much money you have, where it goes, and how to utilize it wisely are the real keys.

16. Conclusion

The internet has made it simpler than ever to generate money, from making money in coffee shops to starting a business from scratch. There are numerous more options, such as sharing knowledge, beginning an internet business, and creating content.

You may create a lot of lucrative internet enterprises on your own or as part of an organization.

- Solve a challenge.

- Compile and arrange consumer reviews.

- Be ready to go off course.

- Make ordering from you simple.

- Make sure your product is user-friendly.

- Recognize the assets in your company.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances