Budgeting might be challenging, but with the appropriate software, you should be able to keep track of your spending patterns, identify strategies to increase your savings, or budget successfully with a partner.

We looked for the finest budgeting apps and ensured that our top choices were simple to use. We also thought about how various people could value different things while trying to stay within a budget.

- You generally don’t want to spend much money on creating a budget if you are concerned about keeping track of your spending.

- Because of this, price played a significant role in establishing our list.

Our goal is to assist intelligent individuals in making the most significant financial decisions possible. We recognize that the term “best” is sometimes arbitrary. Therefore, in addition to outlining the financial product’s undeniable advantages, we also list its drawbacks.

1. MoneyPatrol, the Easiest Way to Excel at Budgeting

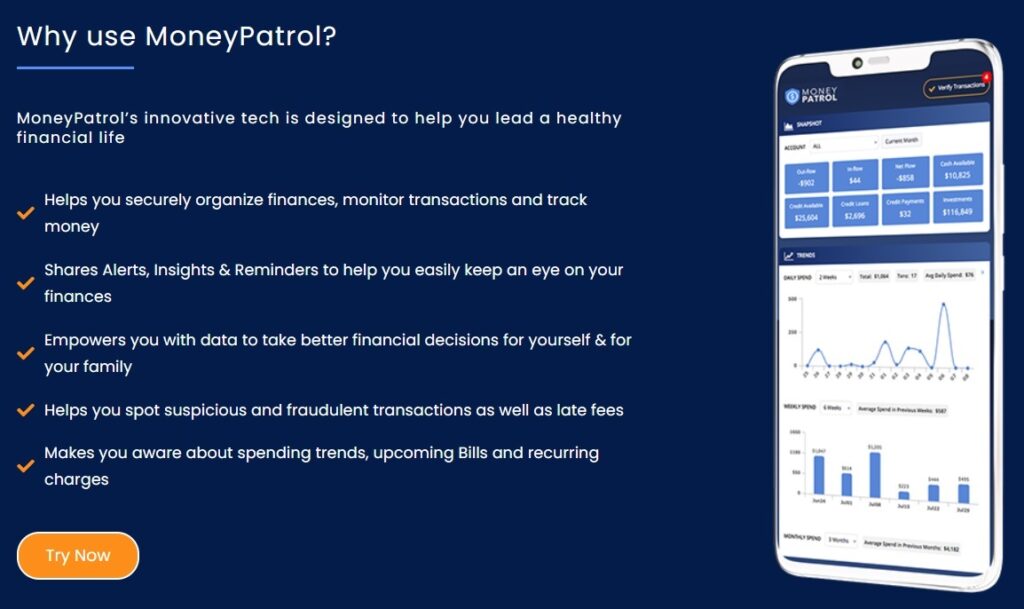

We offer one of the most excellent solutions accessible, so your hunt for the best budgeting software to manage your spending in 2022 is over. The most incredible budgeting tool connects to your bank accounts and is simple. It allows you to customize your budgeting approach and, most significantly, is reasonably priced.

By monitoring your spending, notifying you of transactions, and recording your expenses, the intelligent free budgeting tool MoneyPatrol helps you manage your money. On a single dashboard, you may view information about all of your financial accounts. According to reports, the application made a $5K profit.

- Categoric Organization and Assessment of Personal Finance.

- Monitoring Transactions – Calendar-wise (weekly, monthly, and annually).

- Monitoring Investments.

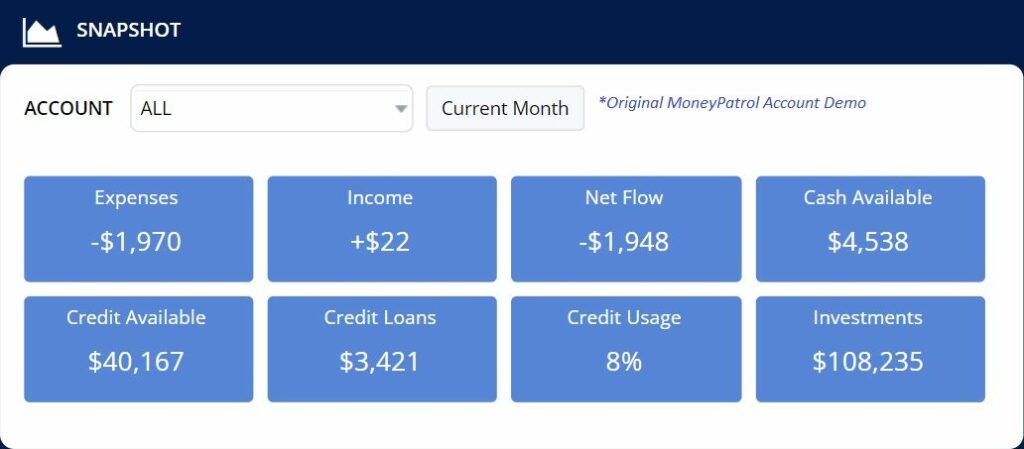

- Monitoring and Assessing the Cash flow (Inward and Outward).

- Monitoring Loans and Credit Card Activity.

- Reminders and Alerts.

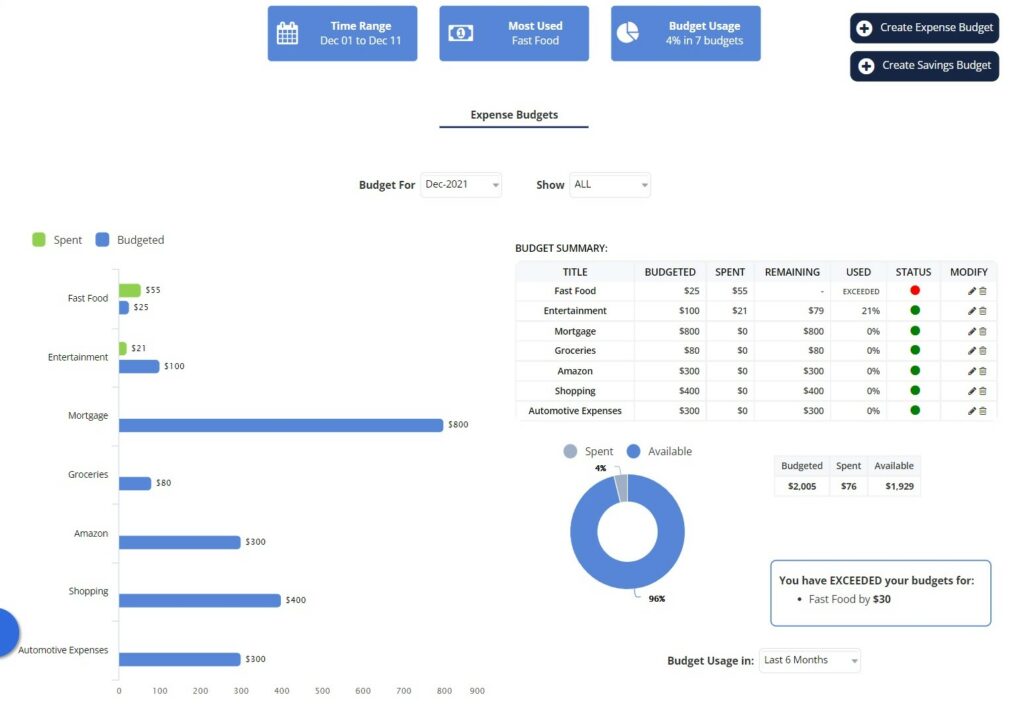

- Budgetary Assessment.

- Daily Format, providing users daily updates on the business activity going on through users’ registered accounts. With a focus on delivering calmness amid the budget.

- Monthly Format provides users with their financial trail in a month which is helpful for the users to prepare a monthly budget with complete knowledge about their requirements.

- Annual Format provides users with a walkthrough of their expenditure and earnings, proving crucial for them to set and achieve long-run targets.

The Money Patrol Balance Sheet area provides comprehensive information on the net worth, current account balance, savings account balance, investment account balance, asset budgeting, credit loan balance, mortgage balance, and other obligations.

- As a result, the user is wholly supported in being informed and making decisions aware of the expense of living to live a better life.

Money Patrol assists customers in setting up budgets so they may manage their money effectively to pay for living costs and live healthier lifestyles. An NEC survey indicates that about 32.4% of participants agree or strongly agree, 39.9% are neutral, and 27.7% disagree or strongly disagree that emotions and mental health impact people’s ability to make money decisions. According to NEC’s survey, about 28.7% of respondents concurred, 36.5% stayed neutral, and 43.8% disagreed that handling personal money might cause stress.

2. Is MoneyPatrol Worth it?

Even though choosing a budgeting program may seem insignificant, it is critical since the right program may significantly impact how you manage your finances. You must determine your financial goals before selecting one of the top budgeting apps since doing so will help you concentrate your app search. The following qualities should be considered when choosing a budgeting tool.

- By providing you with a visual depiction of your finances, budgeting software may help you remain on course.

- Your income and spending are tracked using a budgeting tool. It enables you to identify where your money is going and potential areas for spending reductions.

- You may also create a budget and monitor your progress to determine if you’re on track.

Finding a budgeting tool that works for you is crucial because several are available.

- Connecting your financial accounts and keeping track of all financial transactions

- Setting your financial goals

- Designing a budget

- Tracking expenses

- Getting notifications of upcoming bill payments

- Credit score tracking and more

- Loan Crisis

- Customer service

But MoneyPatrol’s budgeting software is its most crucial feature. You no longer need to keep your spending monitoring and budget separate. MoneyPatrol manages your spending for you based on the amount you specify. A single interface is used to handle your finances. You may decide to modify your course in the future if you discover that you are lacking in some areas.

Even though there are several budgeting applications, the perfect one for you will ultimately rely on your unique needs and preferences. Read reviews as you contrast several applications to see what other users say about the usability and efficiency of the app.

If you want to manage your finances better or are trying to save money for a specific purpose, MoneyPatrol is the ideal choice. It is an excellent tool for keeping track of your spending and making a budget. It is a perfect tool for managing finances as well.

It’s important to remember that some of the best budgeting applications could provide more features than others, but they might also be trickier.

- Employ multi-factor authentication when any other device tries to connect to your user account.

- Information from your financial institutions is sent using 256-bit military-grade data encryption.

- Does not save the login information for its clients’ banks and brokerages on its server.

- Never requests sensitive information from customers, such as name, address, or Social Security number (SSN); Uses security scanning techniques to ensure the secure transfer of sensitive data.

- Private data and information are confidential, and sharing your important information with third parties is never encouraged.

- No one else has access to your account or the ability to withdraw money from it.

Try out the top budgeting software right away! Download the app and make an account to begin going. Once logged in, you may link your financial statements, such as those for your bank accounts, credit cards, and investments. You may view your balance, transactions, and spending patterns for each account over time. The app offers several built-in features to assist you in getting started if you’re unsure where to begin.

3. What's the Mint Way?

Using Mint, you may sync bank accounts, money management accounts, retirement and investment accounts, credit cards, and other financial accounts. You may easily make on-time payments using Mint by keeping track of every monthly spending and receiving reminders.

You may combine all your financial accounts in one location online with the free budgeting application Mint to obtain a complete view of your financial condition. Users of the application may also set and track financial goals and keep tabs on their spending and savings.

- The simplicity of usage.

- Flexible budgeting tools enable experimentation with various scenarios.

- Emails or texts notifications and summaries of the financial situation.

- TurboTax and tax-related tools are integrated.

- Equifax provides a free credit score.

- Email and SMS alerts for low balances, bill reminders, and abnormal account activity.

- Data security at the bank level for account aggregation.

- Financial reports that are easily consumable and customizable.

- On-the-spot creation of expenditure and revenue categories.

- Transaction downloads from virtually all U.S. banking institutions are done automatically.

Users of the Mint budgeting software may see a detailed picture of their financial situation and overall debt within the app, thanks to connections with their bank accounts.

It’s helpful since it may help you become more financially literate while teaching you how to save money more wisely.

Anyone may use Mint for free. The app does not have a premium version that can be purchased separately. After creating a free account, you may use the app’s features and advantages.

- The app has advertisements and offers for other financial goods because Mint earns its money through strategic alliances with other businesses.

- The product offers may be a little bothersome for specific users, and there is no paid way to get rid of them.

Security is a top priority for Mint and Intuit, the business that owns it. Mint uses cutting-edge security methods to protect user information, including robust encryption, multi-factor authentication, and other security procedures. Users may further protect their Mint accounts by setting up a four-digit security code on their mobile devices.

You must download the app and create an account to access the app’s features. Then you may make a total monthly budget, group costs into different categories, keep track of your spending and check your credit score.

With Mint, you can set up bill reminders and receive alerts when you exceed your predetermined spending limit, incur late fees, or when a bill is about to become due. Goal-setting features are also included in this budget program, so you may create financial objectives and monitor your progress.

4. What will Mint do to Your Finances?

Mint is a great personal finance program that has received several Editors’ Choice awards because of its ease of use, functionality, and insightful financial features. Among many other things, it enables you to connect to your online financial accounts, check your credit score, and determine your net worth rather accurately. Even better, Mint is cost-free, made possible by the regular display of targeted advertisements for credit cards and other financial goods.

When you sign up for an account with Mint, it walks you through its features before asking you for the usernames and passwords for your banking, credit card, and other financial accounts. Since it needs this information for everything, the site is worthless if you do not consent to these connections.

- Categorization.

- Budgeting.

- Setting Financial Goals.

- Tracking Bills.

- Reports and Trends.

- Investments.

- Late fees.

- Low balance.

- Bill reminders.

- Over budget within a category.

- Rate changes.

- Unusual account activity.

How much data you give Mint permission to track is totally up to you. Connect to as many accounts as possible if you want a complete view of your money and the best advice from the service. It applies to possessions like your house and car. Mint provides connections to external websites to determine their worth.

- Not only is Mint free, but it’s also simple to set up and use.

- You not only receive overviews of all of your accounts, but you can also track spending and make budgets.

- The software primarily accomplishes its goals, albeit occasionally, you might need to rejoin a financial account, which might be a hassle.

It’s hard to find a free budgeting program that offers more excellent value than Mint. Whether an expert budgeter or a complete beginner, it’s a great tool even though it isn’t perfect.

- The parent business of Mint, Intuit, uses advanced security and technological safeguards to protect its users’ private information.

- Multi-factor authentication, as well as software and hardware encryption, are our security measures.

Mint is the best free choice for you if you’re new to budgeting applications or sick of paying for the one you already use.

All the functions of conventional budgeting software are available to users, along with credit monitoring, personalized notifications, and coaching tools to help them along the way.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances