Financial stress has always been an active cause of Mishappening for years. Many individuals believe they will never be able to come back financially when they lose money in the stock market, take too long to start saving, lose their jobs, or get divorced.

Additionally, many believe they will never be able to lead the same lifestyle they had before to the setback. And some of them risk unneeded money to get well.

- Psychologists have talked extensively about the defenses humans employ to exclude unpleasant or harmful elements from the reality they see.

- A bad investment is an example of something that everyone would wish to go back and undo.

I implore individuals to adopt a fresh perspective on their circumstances. We can use practical methods to assist you in compensating for financial loss.

Losing a significant sum of money may be traumatizing for an individual, mainly if it affects crucial life milestones like retirement, paying for a child’s school, or buying a home. Many believe there is no way to recover from the financial loss and respond in ways that worsen the situation.

Understanding the Financial Stress

Nobody worries about money more than you do. Many individuals worldwide and from many walks of life cope with financial stress and uncertainty during this difficult time.

Whether your problems are brought on by a job loss, growing debt, unplanned expenses, or a combination of reasons, financial worry is one of the most pervasive stresses in modern life.

- Financial issues may affect your emotional and physical health, relationships, and quality of life.

- It can exacerbate discomfort and mood swings, leaving you angry, ashamed, or terrified, cause friction and arguments with those who matter most to you,

- and even increase your risk of experiencing sadness and worry.

- If you feel defeated by money issues, your sleep, self-esteem, and activity level may deteriorate.

An American Psychological Association (APA) survey indicated that 72% of Americans experience financial stress occasionally, even before the worldwide coronavirus outbreak and its economic repercussions. Due to the recent economic challenges, many of us are experiencing financial difficulties and troubles.

To cope with your problems, you can use harmful coping strategies like binge drinking, misusing drugs, or gambling. In the worst cases, financial stress can lead to suicidal ideas or deeds. But no matter how dismal your circumstance appears, assistance is accessible.

1. Refrain from Acting Impulsively

When faced with difficulties, it’s only normal to desire to act rashly to resolve the situation as soon as possible. It is natural to occasionally give in to your feelings and make rash decisions, whether it is to spend all of your funds, sell all of your potential investments, or mortgage your remaining assets.

I can’t help you recover the money you’ve lost. Still, I can help you develop a plan utilizing the resources you already have to prevent expenses like taxes, debt, inflation, and “lifestyle creep” from cutting into your ability to accumulate wealth. When you finally retire, your assets will behave like you had not experienced a loss. Each dollar you lose has a 100% negative rate of return.

Diversifying your portfolio should always be the first step in the investment process to guarantee a balanced portfolio and prevent severe losses.

- If you took too many chances, placed your confidence in the wrong people, or just got bad luck, you may be more cautious and diversify your portfolio in the future.

- Perhaps if it takes years, it’s reassuring to consider the possibility that you may recover part or even all of it back.

Recognize that acting in the heat of the moment is not an intelligent decision. You may improve the quality of your long-term decisions by simply taking the time to calm down, allowing thoughts and turbulent emotions to settle in your brain.

2. Make a Financial Inventory

You would think that avoiding calls from creditors, not reading bills, or not viewing bank and credit card reports would make you feel better if you’re facing financial difficulties. However, denying the reality of your situation will only make things worse in the long run. Providing a breakdown of your income, debt, and expenditure for at least one month is the first step in developing a strategy to handle your financial concerns.

Depending on where you reside, various organizations provide free counseling on resolving financial issues, including managing debt, developing and adhering to a budget, obtaining employment, corresponding with creditors, or requesting benefits or financial aid.

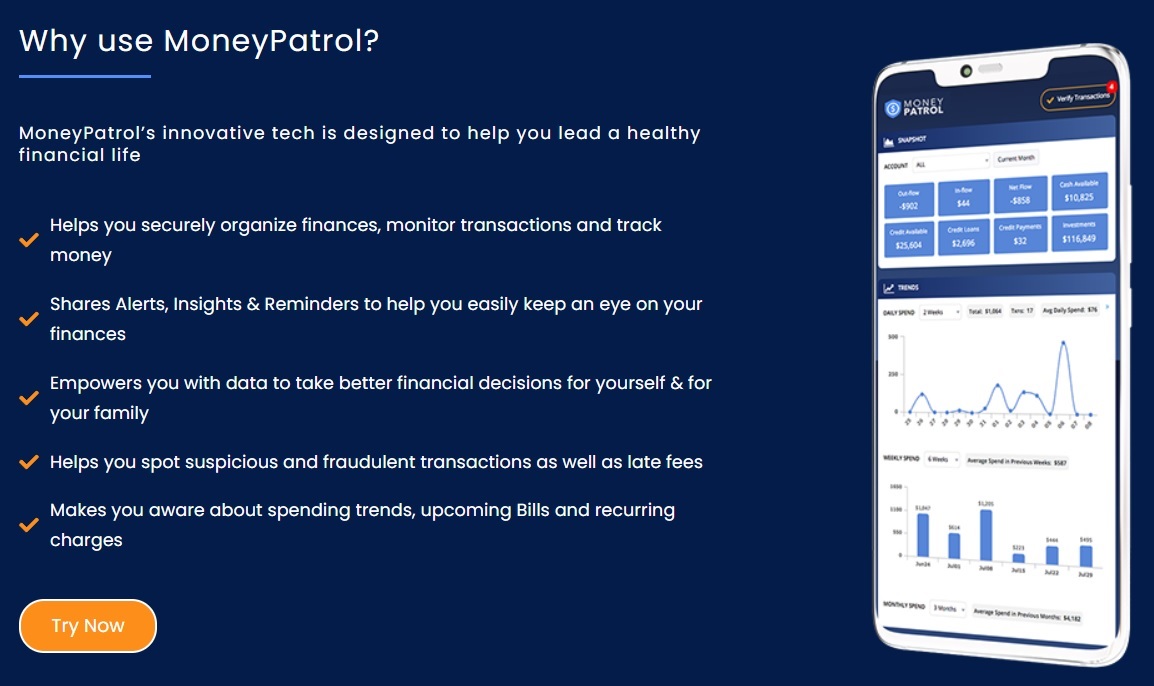

You can work backward by gathering receipts and reviewing bank and credit card statements, or you can use various websites and smartphone apps to keep track of your finances.

- Of course, some financial problems are more straightforward to resolve than others, but by assessing your finances, you’ll have a better picture of where you are.

- Tracking your money in great detail can also help you begin to restore a much-needed sense of control over your circumstances, no matter how complex or unpleasant the process may appear.

Whether you have a friend or loved one you can talk to for emotional support, it is always a good idea to receive counsel from a professional. Reaching out is not a show of weakness and does not imply that you are a terrible parent, spouse, or provider.

It simply means you are sensible enough to understand the stress your financial position is giving you and that it needs to be addressed.

3. . Choose your Asset Allocation Wisely

Asset allocation is a topic that financial advisers frequently discuss. This investing approach aims to strike a balance between risk and return by altering the amount of each asset in a portfolio following the investor’s risk appetite, goals, and time horizon.

I think it’s equally crucial to pay attention to asset placement – putting your money in assets with various tax treatment options. Tax-efficient investment becomes increasingly significant as your income and tax band increase.

The term “eighth wonder of the world” is occasionally used to describe compound interest. But in a taxed setting, it is untrue.

- You must pay taxes on all contributions you make to a tax-advantaged (tax-exempt) account, such as an Individual Retirement Account (IRA), a Roth 401(k), or a Roth 403(b), up front.

- However, the money will come income-tax-free and will be distributed tax-free in the future.

In contrast, if you put the money in a taxable account, like a conventional brokerage account, you will have to pay taxes at various points when you receive interest or dividends or when you sell an investment that appreciates and realize capital gains. Investors typically pay the taxes from a different account than their investment account.

Finally, you will receive a tax deduction if you place that money in a tax-deferred account, such as a standard 401(k), 403(b), or an IRA. You won’t have to pay taxes on the money until you remove it.

To discuss the tax implications of your investing choices, always visit your financial advisor. Your net worth could change significantly over time due to one wrong decision.

4. Increase Sources of Income

You now understand the efforts or financial inputs required to fill the gap created by your financial loss since you have a rebuilding plan or vision in place. It’s essential to maximize your current income, though. Even if you cannot cut one monthly expense by $500, you might be able to locate five that can each be cut by $100. Understand that small thing add up.

- Finding other sources of income is one approach to complement your current income.

- The internet has made it possible for many people to make money at home.

- Why not hunt for writing jobs if you have superb writing skills?

- Or, if people rave about your sweets, why not make money out of this pastime?

An efficient tool for analyzing and managing your expenditures is a budget. It could help you save costs and avoid going overboard on existing expenses. You may look for ways to divert part of your monthly income toward the things that are putting a burden on your budget after you have a thorough understanding of where it is going.

- Divide your expenditures into requirements and desires, and then seek methods to cut back on your want list.

- Analyze your spending habits to find opportunities to reduce little everyday costs.

- Consider changing your budget to emphasize objectives that would lessen your overall financial stress, such as paying off a high-interest credit card.

Consider expanding your sources of income if you believe your current income is insufficient. The majority of successful individuals have numerous sources of income and encourage diversifying them to lower risk at all levels.

Building an emergency fund, especially one large enough to cover three to six months’ costs, might seem intimidating. Don’t worry about the exact amount; what matters is that you consistently save money.

Financial worry may be significantly reduced by having money set up for emergencies like auto repairs, job loss, or illness.

5. Control your General Stress Level

The solution to financial issues typically consists of gradual, little efforts that pay off over time. Your economical problems are unlikely to vanish overnight, given the state of the economy. However, it doesn’t mean you can’t start doing something right immediately to reduce your stress and discover the strength and tranquility to cope with obstacles more effectively in the long run.

- On most days, aim for 30 minutes, perhaps divided into several 10-minute segments if that’s more convenient.

- Exercise may increase your self-esteem, lift your spirits, and give you more energy.

- You might feel more rested and energized with even a little regular exercise.

Your self-esteem can be raised while tension, rage, and anxiety can be reduced by volunteering. Although having financial difficulties might make you feel unsuccessful, there are other, more fulfilling methods to boost your sense of value.

Concentrating all your attention on the problems when financial worries and uncertainties torment you is simple. You don’t have to ignore reality and act as though nothing is wrong; instead, you can pause to savor a special connection or the magnificence of a sunset.

Utilize a relaxing method. Give your brain a break from the continual concern by spending time each day to unwind. You may reduce stress and regain some balance in your life by practicing relaxation techniques like breathing exercises, meditation, or breathing exercises.

If your outgoings surpass your income after you’ve evaluated your financial condition, cut out discretionary and impulsive spending, take stock of your options, improve your income, reduce your expenditure, or do both. Making a strategy and carrying it out is necessary for realizing any of those objectives.

Conclusion

Just as there are ups and downs in life, so are their times of profit and loss in the business world. The only option is to approach the circumstances with clarity and calmness, as one cannot reject the reality of the situation.

A financial loss is a reduction in finances or a loss of money. In this case, a failure due to a failed debt was caused by non-payment, no remittance, and default. A capital loss—the difference between the asset’s acquisition and selling price—is recognized when a purchase is sold.

There are several various types of money issues that can lead to worry about money, and there are also numerous different types of potential remedies. The strategy to deal with your particular problem can be to stick to a stricter budget and reduce the interest rate on your credit card debt.

Limit your internet spending, apply for government assistance, file for bankruptcy, or find new employment or another source of income.

Methods for Dealing with Financial Losses:

Recognize or accept that you have experienced this loss.

- A powerful and protective technique is denial.

- Until you are prepared to cope with the pain, it helps to numb you against it.

- However, there are instances when you must actively leave denial and move toward acceptance.

Stop yourself from ruminating. It’s simple to become trapped attempting to “solve” the issue by repeatedly discussing it.

- However, your attention becomes relatively narrow at that point, and The Problem takes over your entire existence.

- Release it. Expand your view and discover other aspects of your existence.

Everything has a lesson to teach us.

- Perhaps you did make some poor financial choices.

- Take note of your errors.

- Maybe you had a value system that was too materialistic.

- Discover the benefits of living.

- Perhaps until now, your kids didn’t truly understand the importance of sticking together as a family until now.

A pearl is eventually created by the sand that annoys the oyster.

Your current financial loss could be what you need to learn to take advantage of the new chances coming your way.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances