Money Saving Challenges are a trend that often comes and goes by. I have a fierce rivalry with myself. I enjoy challenging myself to try new things or to get better at something. I adore these enjoyable money-saving challenges because of this. Something about having to save money doesn’t seem like fun. Some people might find saving money to be “ugh” inducing. If this describes you, a creative money challenge that will indeed encourage you to save money is what you need.

However, as you watch your nest egg grow, modifying how you save money could inspire you to form healthier habits. Making saving a game, even a quick one, might motivate your money-saving initiatives.

Everybody wants more money accessible for their needs, but how do you make that happen? It conjures up ideas of forgoing enjoyable activities or eating the same dish repeatedly to save a few dollars.

What are the Money Saving Challenges?

When you attempt to save as much money as possible or a certain amount, you are engaging in a money-saving challenge. Since the objective is to remove as little as possible, fundamental math, namely subtraction, is used, making it easy to understand. Sounds easy, huh?

- Consumers place a substantial premium on conserving money due to rising inflation and petrol costs.

- Although saving money at the moment can be challenging, finding innovative methods to make cuts might be helpful, such as making a money-saving task more fun.

It might be enjoyable to complete a task, to show oneself that you CAN accomplish these things. This does not mean you must do things alone; performing them with your partner or children may be just as enjoyable.

You are not alone if you feel this way. Nearly 50% of Americans think that the most considerable risk to their financial stability is the ongoing rise in living expenses. A challenge to save money can be precisely what you need.

The U.S. Bureau of Labor Statistics reports a recent rise in food costs. You can see why individuals would be interested in saving money when you contrast the increase in the cost of living with the actual pay index.

Money-saving challenges, which can be found on Pinterest and personal finance blogs, inspire spenders to start saving by finding innovative ways to cut costs. “Not knowing where to locate money to save is not the main issue preventing people from beginning to save money. Instead, it’s how they view money. It consists of thinking, “I’ll never be able to save money or earn enough to have an impact.

Having additional cash can help you reach your financial objectives while reducing stress. You may quickly build up your savings account by immediately starting a money-saving challenge and forming a new, profitable habit. You may even create a savings club account just for your difficulties.

1. The No Spend Challenge

Because it’s so simple—don’t spend anything—taking on a no-spend challenge is my favorite money-saving task. Ha! While some of the difficulties below have fewer restrictions, you must save arbitrary denominations that you must later withdraw and set away.

Put $1,000 away in just 30 days. It could seem more doable if you consider it to be $33.33 each day.

Taking on this challenge is advisable if you have a lot of extra money to spare but struggle to rein in your spending on unnecessary items.

Does setting aside $1 every day seem too simple to you? Consider increasing the savings. Try setting aside $20 every week for a year. You’ll finish with $1,040; those $20s add up quickly!

A No Spend Month is also a fantastic way to help declutter your cupboard and freezer! The frozen tilapia fillets and the artichoke hearts in the can have been there forever! I discuss how this monthly no-spend challenge helps with grocery budgeting, and if you can get rid of any old products that are simply taking up space, that’s a double win!

2. The 'No Eating Out for a Month' Challenge

The Bureau of Labor Statistics’ most current data shows that the typical family spent $2,375 on eating out in 2020, much less than the $3,526 per capita Americans spent the year before due to the epidemic.

Using that reasoning and arithmetic ($2,375 divided by 12), your household may save around $200 if you don’t eat out every month.

You pack your lunch five times a week for 30 days as part of this savings challenge. Additionally, this adds significantly to your savings and helps avoid food waste.

You can also choose to avoid harmful foods and utilize components you enjoy.

You cannot spend money on things like eating out, shopping, coffee, or other non-essentials. Everything else must wait till later unless it is a bill or essential cost.

Granted, you might not be able to make significant cuts given how expensive everything is these days, even food. But considering that cooking at home is typically less costly than eating out or ordering takeout, and given that you could have a cupboard full of goods you’re not using, cutting out restaurants and delivery for a month should result in lower expenditure.

Once you begin going, you’ll be astounded by how many unnecessary purchases may find their way into your everyday spending routine. Finally, keep track of this monthly money challenge in a spending diary for best success.

3. The 'Roll the Dice' Money Challenge

Roll a six-sided dice once every day. This is a game in every word, but you should set your own rules and abide by them. In the worst situation, you save $6 daily, which equates to slightly over $2,000 per year. However, in this case, the “worst” case scenario is fantastic for your savings account.

Instead of an R-rated home, would you prefer a G-rated one? Consider implementing a “swear jar,” as some families do. You might charge $1 or even $5 for each curse word, allowing family members to deposit $1 or $5 into a savings account.

Since hardly everyone has large amounts of cash on hand these days, depending on how frequently you wish to play, you can roll one or two dice, or even every day or every week, and the result will determine how much money you save.

For instance, you need to save $1 that day if you roll a “1”. Depending on how you feel, either phew or darn. If you move a “6,” you must set away $6 in some manner, such as a jar or your savings account.

Now, you might determine that rolling a “1” equals setting aside $10 if you want to up the stakes. If you roll a six, you must set aside $60 that day or that week.

3. Monthly Savings Challenge

One dollar a day is a touch too simple (maybe excellent for a tween), but with this one, you start with $1 on the first of the month, increase it by $1 on the second to save $2 that day, and then save $3 on the third. You have therefore saved $10 after four days. You will have held close to $500 by the end of a month (30 days).

The monthly savings challenge gives you much freedom to choose your own savings objectives. Figure out how much you want to save each month from getting started.

The challenge from Part-Time Money is here. It will walk you through a month of financial habits that fundamentally alter how you save and spend money.

Here’s a fresh spin on the month’s theme to keep things exciting for an entire year. Decide on a financial category to eliminate each month. By the end of the year, this “fasting” strategy can help you save hundreds or even thousands. You can start with the same monthly amount and gradually reduce or increase it. You’ll soon meet your financial objectives.

The most extraordinary thing about a monthly savings challenge is that you get to set the amount and may use any methods you choose to save the money, such as working more hours or selling things you have lying around the house.

5. 52-week Money Challenge

Let’s imagine you have a high financial objective, like having enough money for a fantastic trip, a wholly loaded emergency fund, or a new back patio redo. This 52-week savings challenge plan is solely for the devoted, whatever you need money for!

The idea for this creative challenge appears to have come from SavingAdvice.com.

- Those who can persevere for an entire year will be well rewarded.

- You must save money in 5-cent increments to complete this challenge.

- Most bank accounts won’t let you move 5 cents from one account to another, so you’ll probably have to deal with a cash savings difficulty.

- On the first day, though, you only need to place a cent in a jar or other receptacle, and you are done.

The goal is to avoid spending money to save some. Additionally, it could be enjoyable. If you find yourself unexpectedly unable to purchase a tool you need, you may be compelled to devise inventive workarounds. Alternatively, you may decide to look farther into your closet rather than invest in new clothing.

Either set aside the same amount each week or vary it to make it harder. And for one, a usual savings target is either $1,000, $5,000, or $10,000, though you may choose anything.

Concluding Statement

When friends make New Year’s resolutions, we frequently hear about monthly money challenges, but you can take on a financial challenge at ANY TIME of the year.

- This may be an excellent moment to persuade yourself that you’re finally breaking a pattern of behavior, and you’ll save money by not buying coffee or smoking.

- However, if you succeed in quitting your habit at the end of the month, you might want to treat yourself to something enjoyable with the money you’ve saved by taking on this challenge.

A struggle to save money is enjoyable! It may serve as a source of accountability and inspiration to start saving. It might be much more enjoyable and inspiring if you do it with a friend! Occasionally, taking on a challenge is a delightful way to start living within your means and saving money. Find out how much money you may save by choosing a handful of these tasks!

Banking: Top 6 Frequently asked Questions You Should Know

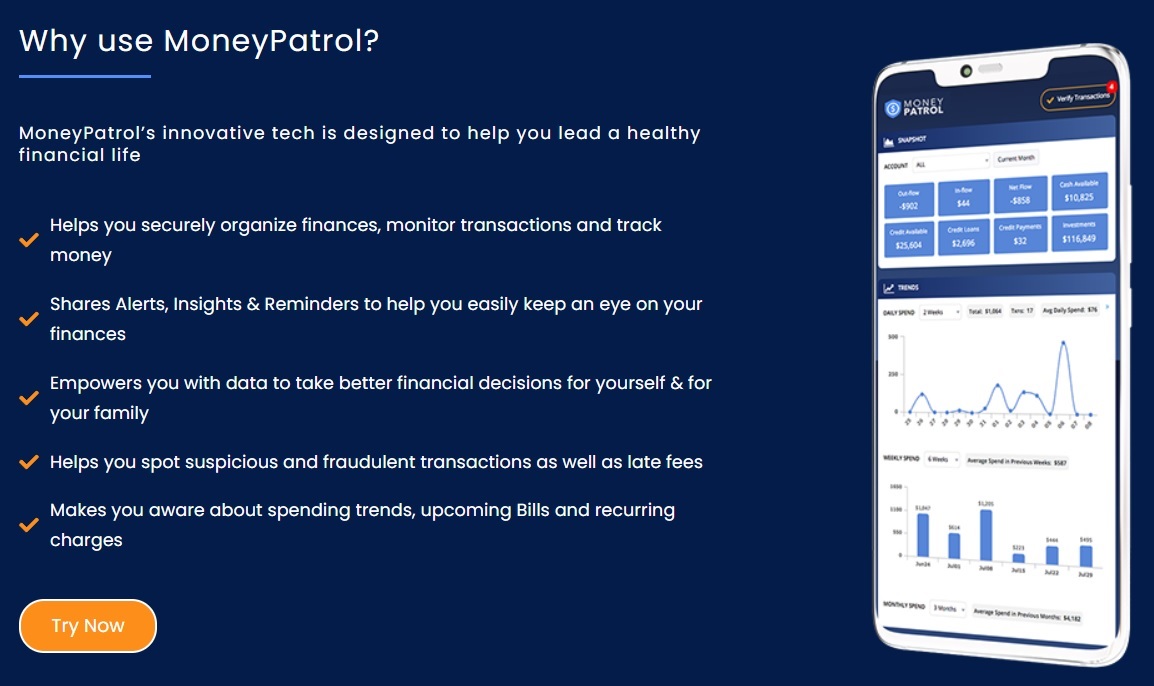

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances