Investment and Budget are usually considered to be different by many. But it is not actually. If you have a lot of spare cash, investing is a terrific way to spend it. But what happens if you don’t? Many of us put off saving and financing because we believe we do not have enough money or since retirement is too far away to consider. Others are burdened by significant debt. If the latter is true for you, you should consider paying off your debt or making a substantial dent.

- If you have never invested before, budgeting for it may appear to be a challenging undertaking.

- How much of your income you devote to investment is determined by your income, as well as your current living status and future aspirations.

You may have heard from others that investing is solely for the affluent and that you are not eligible to invest. Rest assured, those days are past; owing to digital technology, investment is becoming more accessible to more and more investors like you, and you don’t need to be concerned about not having enough finances to get started.

- Before you put your money into even the most outstanding investment plan, you need to be aware of the various investment plans accessible in the financial market.

You may learn about various investment plans such as stocks, mutual funds, gold, and so on online and select the ideal investment plan based on your demands. You may also evaluate and compare the rates of return to choose one that meets your needs while also matching your risk tolerance.

1. The Correlation between Budget and Investment?

Long-term asset appreciation occurs when the value of an asset grows – for example, a modest house or equities that you own. However, assets, such as a computer or a car (unless it’s a unique antique model), can degrade in value, making them less desirable over time.

Dividend-paying stocks, royalties, and patents are examples of income-generating assets.

- You may also come across notions of assets that include high-end products that belong to a company.

- Aside from money, one thing you must have is discipline.

- Saving and investing need dedication, but it does not have to be complicated.

- Create a budget and set goals first.

Getting everything on paper and picturing it might help you stay focused.

- Once you’ve determined your income and monthly responsibilities, you may calculate how much you can afford to lay aside each month.

- You and that you do not owe money for, such as your home or automobile.

Another straightforward saving approach is investing any staff bonuses or tax refunds you get during the year instead of indulging. Because they are often in addition to average wages, you are less likely to feel the pain if you save them. It’s a terrific approach to supplement your investment portfolio and will pay you in the long run.

It’s not rocket science to organise your finances! However, it is a fantastic mix of how you save and allocate your savings. Financial discipline is now required to have financial independence. As you may have gathered from the preceding essay, all it takes to get started is a personal budget, some investment planning, and then sticking to it.

2. How to Invest on a Tight Budget?

If you’ve saved more money than you anticipate needing shortly, consider investing it to earn more interest than your savings account now provides. There are several methods to invest your money.

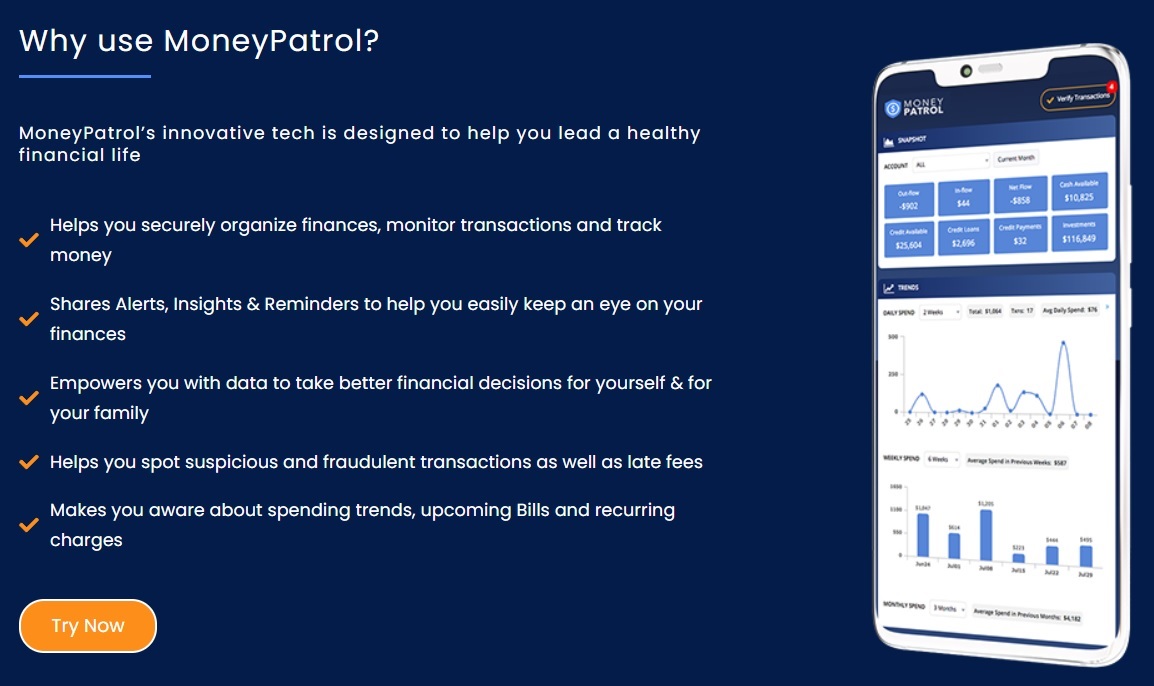

Many of us have gone past the concept of monthly chequebook balancing using pen and paper. Apps are a terrific way to budget, track your spending, manage your money, and start and track your investments. Perform a quick web and app store search to check if there have been any significant security breaches or what type of security is provided.

Essential Tips for Investments in Tight Budget:

Many financial websites provide good tools for researching the performance of particular stocks and mutual funds. Remember that a fund’s performance is simply one of several factors to consider. Be wary of high administrative costs.

- Have you considered why you want to invest?

- Investors invest for a variety of reasons.

- Do you wish to invest in making enough money to buy a house?

- Or do you want to ensure you have enough money to feel safe in your old age?

- Or are you saving to secure a comfortable retirement when you become older?

There are as many reasons to invest as there are investment instruments accessible to people interested in investing.

Other methods that might help you save money include loyalty programmes and credit cards that give cash-back benefits. Because this is money you are not receiving from your job will not influence your monthly budget. If you set it aside, you may also want to consider participating in these programmes.

After you’ve established a SMART investment goal, the next step is to educate yourself on the various types of investments offered to investors by reading all of the articles in the Personal Finance on MoneyPatrol, which range from savings accounts to corporate stock and fractional shares, and then to bonds, mutual funds, and ETFs.

- After determining your goals and risk tolerance, the next stage in investment planning is to plan your investment portfolio.

- Mutual funds, equities, real estate, fixed deposits, and other financial instruments are among the most significant long-term investment strategies or tools to examine.

- It is critical to diversify your portfolio to achieve your long-term objectives.

- Not placing all your eggs in one basket may use particular cash for emergencies while leaving others alone.

In the course of learning about these fundamentals, you will also discover that investors diversify their assets, which means that they mix several types of investments to achieve their goals depending on risks and rewards, among other things.

But, before you put your money into even the most effective investment plan, you need to be aware of the various investment plans accessible in the financial market.

- You may learn about various investment plans such as stocks, mutual funds, gold, and so on online and select the ideal investment plan based on your demands.

- You may also evaluate and compare the rates of return to choose one that meets your needs while also matching your risk tolerance.

- Once you understand the various investment plans, you may pick and invest on your own, which is an essential step in investment planning.

Safety should be your first consideration when providing app access to your financial accounts. However, when it comes to budgeting and investing applications, there are thousands of options. So how can you know which are the greatest to choose? Before you log in, here’s what you should know.

Budgeting is one method for developing financial discipline and saving for specified goals. A budget can help us manage our requirements within our current income while continuing to keep for future aspirations. As our income levels rise in the future, a budget will aid in proportionately growing savings for clearly defined goals.

Taxes, debt repayments, and other mandatory obligations must always be prioritized when spending from available money. Housing, food, education, transit, and other necessary living expenditures must also be provided. These expenditures cannot be avoided. However, they can be reduced based on your available income and savings objectives.

3. Conclusion

Passive funds, such as ETFs or index funds, are suitable for investors just beginning their financial planning journey. These can assist in obtaining returns mirrored to an index, allowing an investor to accomplish long-term financial goals.

Key Notes for Investments in Tight Budget:

- Investing is not accessible; therefore, don’t forget to include the costs of opening new accounts, stock depositories, trading, and other transaction fees.

- Remember that capital gains (earnings) from investments are taxed; educate yourself on the tax regulations of the nation where you live.

- Understand your risk profile and be satisfied with the risk of potential investments; traditionally, the smaller the risk, the lower the return, and vice versa.

- Consider interest rates and compound interest.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances