A hedge fund is a private investment partnership and money pool that employs various proprietary methods and invests or trades in complicated goods such as listed and unlisted derivatives.

The word “hedge fund” aids in telling the narrative. Any typical investment fund manager may allocate some of the available assets to a hedged bet. This is a wager in the opposite direction of the fund’s emphasis to counteract any losses in its main assets.

- Hedge fund managers have pushed the notion to its logical conclusion in current times.

- In truth, except for a few funds that adhere to the fundamental idea of the hedge fund, known as the traditional long/short stocks model, their funds have nothing to do with hedging.

Hedge funds must comply with the same trading disclosure and record-keeping standards as other publicly listed securities investors. They are also subject to additional limits and regulations, such as a cap on the number and kind of investors that each fund may have.

Under Regulation D of the Securities Act of 1933, hedge funds are restricted to raising capital only through non-public offerings and from “accredited investors,” or individuals with a least net worth of $1,000,000 or a national minimum wage of $200,000 in each of the previous two years and a realistic chance of trying to reach the same income level in the current year.

1. What is the meaning of Hedge Fund Investment?

Investment in hedge funds is best suited to skilled and institutional investors with the resources, skills, and aptitude to understand the dangers fully. These investors are best equipped to make their own decisions about the appropriateness of hedge funds.

- High net worth individuals (HNIs) and households, institutions and pension funds, insurance firms, and banks are everyday hedge fund investors.

- These funds operate as either private equity partnerships or offshore investment firms.

- They are not needed to be listed with the securities markets authority. They are not subject to reporting requirements such as periodic NAV disclosure.

Many hedge funds are unlikely to be ideal investments for small or ordinary investors, who often lack the resources to comprehend the nature and hazards of hedge fund investment properly. To safeguard investors’ interests, hedge funds offered to retail investors should give a high level of product transparency.

Alfred Winslow Jones, an Australian businessman and financial writer, is credited with establishing the first hedge fund in 1949 through his company, A.W. Jones & Co. Jones changed his fund from a partnership agreement to a limited partnership in 1952. He included a 20% incentive fee as remuneration for the managing partner.

Jones is known as the “Father of the Hedge Fund” because he was the first money manager to integrate short selling, leverage, and a performance-based incentive scheme.

A hedge fund can earn returns using a variety of tactics. Global macros are one strategy in which the fund maintains short and long positions in broad financial markets depending on economic patterns. Some funds pursue a market-neutral strategy. In this case, the fund manager’s purpose is to reduce market risk by investing in long/short equity funds, debt instruments, arbitrage funds, and fixed-income products.

ESSENTIAL POINTS TO THINK BEFORE INVESTING IN HEDGE FUNDS:

Hedge funds may contain difficult-to-sell and difficult-to-value investments.

- You should be familiar with the valuation process and the extent to which third-party sources appraise a fund’s holdings.

- Assets and liabilities of hedge funds should be appraised using commonly accepted valuation standards and techniques.

- Hedge fund managers should be utterly transparent with investors on any valuation models.

Hedge funds often limit your ability to redeem, or cash out, your shares to four times per year or fewer and frequently impose a “lock-up” period of one year or more during which you cannot cash out your shares.

- Hedge fund investors and regulators expect detailed disclosures on the funds handled.

- Transparency allows investors to analyze their fund holdings correctly and will enable supervisors to monitor for the accumulation of hazards.

Hedge firms sometimes borrow money to boost their returns and pursue aggressive short bets.

- Leverage, as shown during the 2008 financial crisis, has the potential to wipe out hedge funds as well as other large segments of the economy.

- Hedge funds are also barred from public offerings under the Investment Company Act of 1940.

- They are subject to the anti-fraud provisions of the Securities Act of 1933 and the Securities Exchange Act of 1934.

- Once high-return funds have been found, it is critical to determine the fund’s strategy and evaluate its returns to those of other funds in the same class.

- These requirements might be absolute, such as returns of more than 20% per year over the past five years, or relative, such as the most significant hedge funds in terms of the assets in management.

An investor can develop criteria by conducting a peer study of comparable funds. For example, the 50th percentile might be used as screening money guidelines.

Check to see if hedge fund managers are competent to manage your money and if they have a disciplinary past in the securities sector.

- The SEC’s Investment Adviser Public Disclosure (IAPD) website allows you to look for and examine a firm’s Form ADV.

- This information may be obtained by studying the adviser’s Form ADV and the investment adviser’s licensing Form.

- If the investment advisor company is not included in the SEC’s IAPD database, contact your state securities authority or check FINRA’s BrokerCheck database.

Independent service providers analyze hedge fund disclosures regularly to ensure that the fund in issue adheres to agreed standards of presentation and performance computation. It gives fund investors confidence that the data on which they make their judgments is correct and dependable.

2. What is the Takeaway?

Funds managed by hedge fund managers should also have rules and processes to control the fund’s liquidity risk, so that fund investors are not inconvenienced while redeeming their investments.

Critical Notes on Hedge Fund Investment:

- Hedge funds are intended to produce significant returns.

- They are not as strictly regulated as mutual funds, allowing them to make investments that may carry a higher risk of loss.

- Hedge funds are only available to wealthy individuals and institutions due to the exorbitant fees charged to their managers.

- Hedge funds were initially designed to maintain long and short stock positions, reducing risk by being “hedged.”

- Later, the word was broadened to encompass all pooled capital arrangements.

- Regardless matter whether the market rose or fell, investors may profit. The moniker stayed.

A hedge fund manager gets money from outside investors and invests it according to the method they have committed to follow. An operating agreement will outline how a hedge fund will be operated. It will contain the fee structure, typically a management charge of 1% to 2% of assets plus a performance fee of 20%, which means the fund manager will receive 20% of any yearly gains they produce for you. The difference would be your profit.

A performance fee incentivizes fund managers to take risks for increased profits. The more money the fund earns, the more capital the investors and the fund management get to keep.

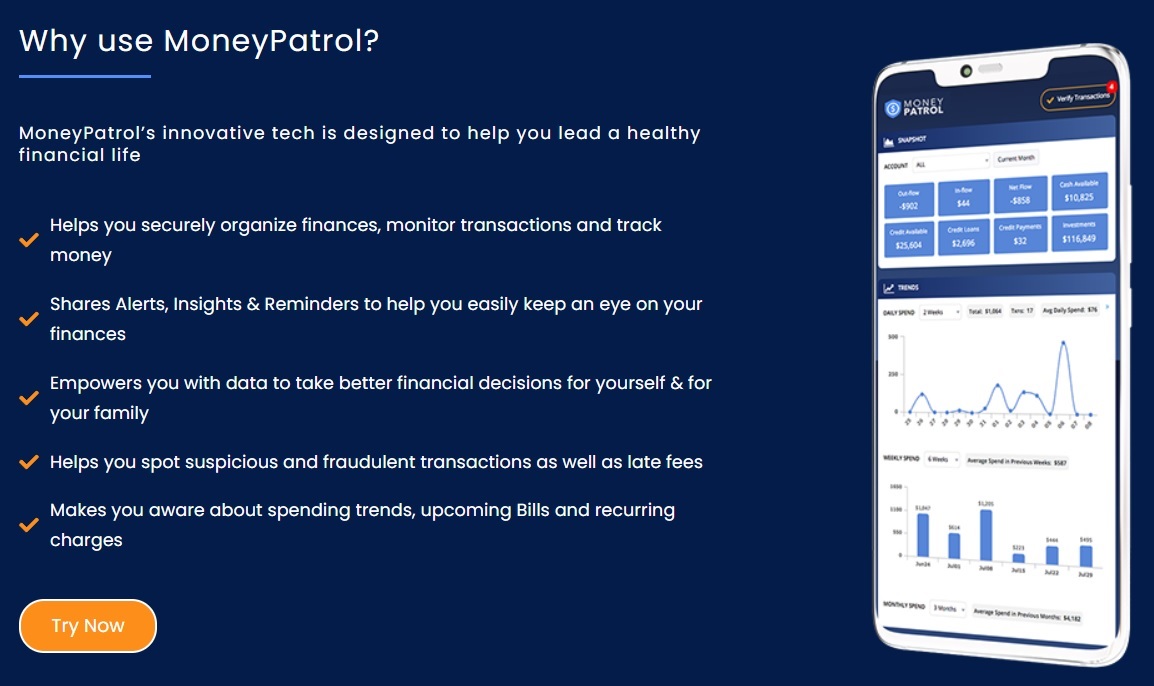

free budgeting app best free budgeting app budgeting app best free budgeting apps budgeting app free money management app manage money app family budget app personal finance tracker track personal finances budgeting app for couples

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances