Investment portfolio may appear daunting, but there are measures you can take to make the process less painful. No matter how involved you want to be with your investment portfolio, there is an option for you.

With the global economy primed for a speedy rebound following the successful delivery of a Covid-19 vaccine, investors are looking to their portfolios once more. Those who were patient through the spring downturns were rewarded. At the same time, the swift economic rebound has spurred many new investors to purchase equities shares for the first time.

Whether you’ve been investing for a long time or are just starting, these are the actions you should take to prepare your investment portfolio for the new normal.

- An investment portfolio is a collection of assets that may include stocks, bonds, cash, and other assets.

- Investors seek to maximize returns by combining these securities to fit their risk tolerance and financial objectives.

Building an investment portfolio might be frightening for people just starting in the investment world. It might be challenging to save aside adequate income each month while still planning for numerous costs such as rent, EMIs for automobiles, and other commitments. However, the earlier you start investing, the more time your portfolio has to develop and expand.

What is an Investment Portfolio?

An investment portfolio is a grouping of assets that may include stocks, bonds, mutual funds, and exchange-traded funds. An investment portfolio is an idea rather than an actual location, especially in the age of digital investing. Still, it can be helpful to conceive of all your assets as being housed under one metaphorical roof.

You must remember to prioritize diversification throughout the portfolio creation process. Make sure your holdings in a specific asset class are distributed among various subclasses and industrial sectors. Owning assets from each asset class is not enough; you must diversify within each category.

Benchmarks frequently measure a portfolio’s allocation, risk, and return. Almost any period may be compared.

Standards are often built using unmanaged indices, exchange-traded funds (ETF), and mutual fund categories to reflect each asset class.

The wisdom of diversity is an essential notion in portfolio management, which means avoiding putting all your eggs in one basket. Diversification attempts to decrease risk by spreading assets among various financial instruments, sectors, and other categories.

It seeks to optimize profits by investing in many industries that might respond differently to the same occurrence. Diversification may be accomplished in a variety of ways. It is entirely up to you how you do it.

1. Determine Your Risk Tolerance

In investing, the risk is the degree of uncertainty or potential financial loss you accept while making any economic choice. Even maintaining your cash savings is dangerous, as inflation will gradually erode your purchasing power.

You’ve probably heard of asset allocation if you’re thinking about investing. It illustrates how to divide an investment portfolio into asset classes. An asset class is a grouping of several securities. Equities, for example, are stocks you hold as a piece of a corporation and do not provide guaranteed returns. Meanwhile, fixed-income investments might comprise bonds and certificates of deposit (CDs).

Types of Risks in Investment Portfolio Management:

Sovereign risks arise when a government or country is unable or unwilling to pay its obligations or loan arrangements. It may risk safe assets such as government securities.

The danger of losing the entire, or at least a portion of the initial Investment made by the investor, is referred to as direct loss. Many conservative investors want to invest in low-risk assets to reduce the danger of principal loss.

However, it is critical to remember that this type of risk exists in all purchases.

Inflation risk is the possibility that an investment portfolio’s returns may be less than its projected value owing to inflation.

It affects the rate of actual investment returns and is most typically connected with fixed income instruments and bonds.

This is just your risk tolerance, which is impacted by your current income, existing debts and other commitments, and, to a lesser extent, your age.

Risk must be taken. The need to take risks is determined mainly by your financial objectives and the rate of return necessary to attain those objectives.

- Willingness to take chances. Willingness to take risks refers to your comfort level with risk. This behavioural element is more difficult to quantify than the previous two.

The investment time horizon is critical in evaluating your risk tolerance. The ability to take risks decreases as the investing time horizon shortens.

Risk and reward are usually negatively connected. Risk and reward are traditionally negatively related. The more the risk taken by investors, the greater the possible reward. Individual stock shares are generally riskier than government assets; cash, on the other hand, carries little to no risk other than the possible loss of buying value over time.

- Equity shares have higher potential rates of return to reflect their higher level of risk than government assets, which offer lower yields but considerably more stable prices.

- Identifying your risk profile is the first step in picking a benchmark model.

A risk profile is determined by several factors, including age, the length of time the funds will be invested, and your pay. And other financial resources, such as a cash reserve. Several tools are available to assist you in measuring your risk profile, most of which score you on a scale.

2. Establishing the Benchmark

Creating a custom benchmark necessitates the use of the software. Many organizations provide software subscriptions that allow you to manage portfolios and develop models. You may create several portfolios and benchmarks and calculate statistical metrics like the Sharpe ratio, standard deviation, and alpha.

When building a portfolio from the start, looking at model portfolios can provide a foundation for how you might wish to place your assets.

Examine the samples below to see how aggressive, moderate, and cautious portfolios might be built.

However, you may create a benchmark and get a lot of information using the free software tools provided by several ETF providers. Furthermore, suppose you have an investing account. In that case, many of the major brokerage firms allow you to choose from various indexes and mutual funds to compare the performance of your portfolio.

Rebalancing a portfolio entails altering the weightings of your investment portfolio’s various asset groups. This is accomplished by purchasing or selling assets, which changes the weighting of a specific asset type.

3. Rebalance Your Investment Portfolio

The best frequency of portfolio rebalancing is determined by transaction costs, personal preferences, and tax concerns. Such as the kind of account from which you are selling and whether your capital gains or losses will be taxed at a short-term or long-term rate. It also varies depending on your age.

For example, if you are relatively young, say in your twenties and thirties, you may not want to rebalance your portfolio as regularly as you would when you are approaching retirement and need to optimize your gains.

One of the pillars of wise Investment is risk diversification. It is founded on the premise that various assets have varying levels of risk. And it entails investing across several assets to reduce the effect of risks associated with any particular asset class.

Poor-risk investments often provide low returns, but high-risk investments frequently yield more significant returns.

When you invest, you are constantly taking a risk. Risk is the possibility that your investments may lose money if the market or a specific asset class performs poorly. If you cannot afford to lose your money, you should place it in a savings account or the most OK CD you can locate.

4. Monitor Investment Performance and Invest Regularly

You must follow the success of your Investment after analyzing your risk profile, diversifying your portfolio, and deciding on the best asset allocation choice accessible to you.

In a portfolio, risks are inescapable. As a result, wise investing emphasizes risk management to reduce an investor’s exposure to uncertainty through risk diversification. It is the most successful technique for dealing with all three risk categories.

Evaluating your portfolio’s performance regularly helps ensure that you are on track to meet your financial aims. If your portfolio’s performance falls short of your hopes, you must investigate and determine why.

Furthermore, consistent and disciplined Investment helps keep you on pace to meet your financial objectives. You can benefit from rupee-cost averaging if you invest regularly. When you invest consistently, you buy at all market levels, which helps reduce the average purchase cost.

An investment portfolio’s goal is to assure your financial security and independence. It enables you to plan for crises, confirm consistent income, and have the financial freedom to pay your expenses. By putting money away each month, we build fiscal discipline and the self-confidence to make wise financial and future planning decisions.

5. How to Choose Investment?

Impact investing is an investment in which you select assets based on your values. Some environmental funds, for example, solely invest in firms with minimal carbon footprints. Companies having more women in leadership roles are among the others. Consider impact investing if you want your help to have an effect outside of your investment portfolio.

Select equities that satisfy the risk you wish to take in your equity portfolio; sector, market cap, and stock type are all considerations.

- Analyze the firms using stock screeners to narrow down potential purchases.

- Then do more in-depth research on each potential buyer to identify its future chances and hazards.

Bonds are loans made to firms or governments repaid with interest over time.

- Bonds are considered safer investments than stocks, although their returns are often smaller.

- Bonds are fixed-income investments because you know how much interest you’ll earn when you buy them.

- Bonds having a set return rate might help balance out riskier investments like equities in an investor’s portfolio.

You may invest in various mutual funds, but their main advantage over buying individual equities is that they provide instant diversity to your portfolio.

- Mutual funds enable you to invest in a portfolio of assets comprised of investments such as stocks or bonds.

Investing in ETFs (Exchange-Traded Funds) If you don’t want to invest in mutual funds, ETFs might be a good option.

- ETFs are mutual funds that trade similarly to equities.

- They are comparable to mutual funds in that they represent a big basket of equities, which are often classified by sector, capitalization, nation, and other factors.

They vary, however, in that they are not actively managed and instead track a specific index or basket of companies.

Conclusion

Regardless of your financial expertise, now is an excellent time to ensure that your investment portfolio is aligned with your goals, timeframe, and risk tolerance.

- Consider your asset allocation carefully when you develop your investment portfolio. Check that it is within your risk tolerance. This metric measures your ability to deal with market ups and downs.

Remember that volatility and uncertainty may be opportunities rather than detractors to Investment when you develop your strategy. A solid investing strategy considers these moments to position you to grow wealth.

Consider your time horizon or the amount of time you have to invest until you need the money.

Stocks, for example, are widely seen as more volatile asset types. Meanwhile, fixed-income assets such as bonds and CDs are widely seen as safer investments.

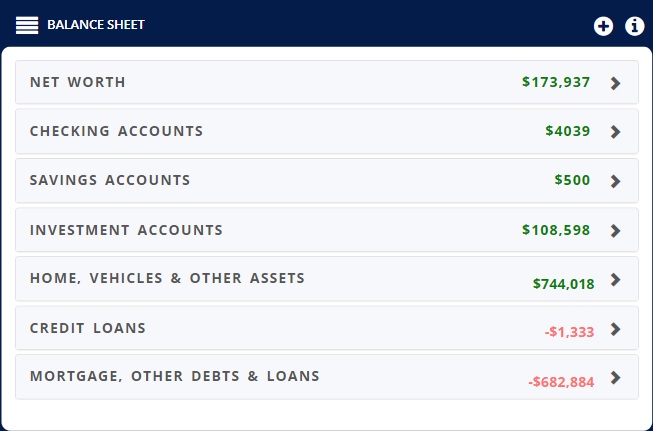

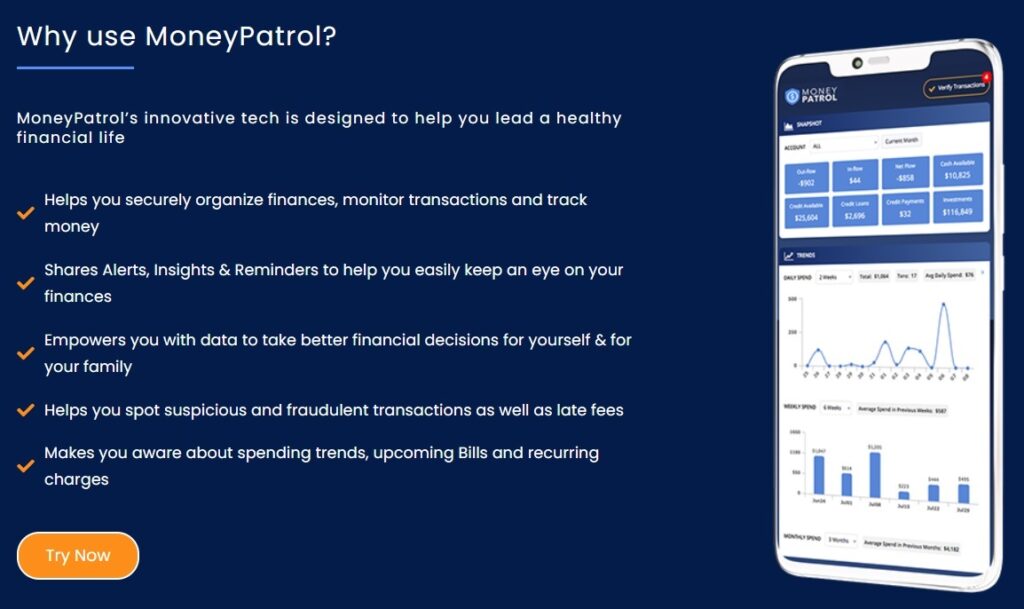

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances