Financial decisions and planning might seem like a priority in your 40s as it can be a hectic period. However, making sure that you’re on the right track to accomplish your goals will give you a better chance of gaining financial security for the future by planning your time on your finances.

- The 40s can be the busiest decade of your life, filled with opportunities, challenges, and financial decisions that will affect you and your family for the years to come.

- It is the timer when you approach your most significant career opportunities and enter your highest-earning years.

Retirement feels closer than it was a few years ago. Family life gets more expensive, especially if you have kids, so you have more responsibility at work. You’re also quite ready to make changes and even begin a new job. It’s essential to have an evolving financial plan that helps you navigate this decade confidently, as you still have some of your best professional years ahead.

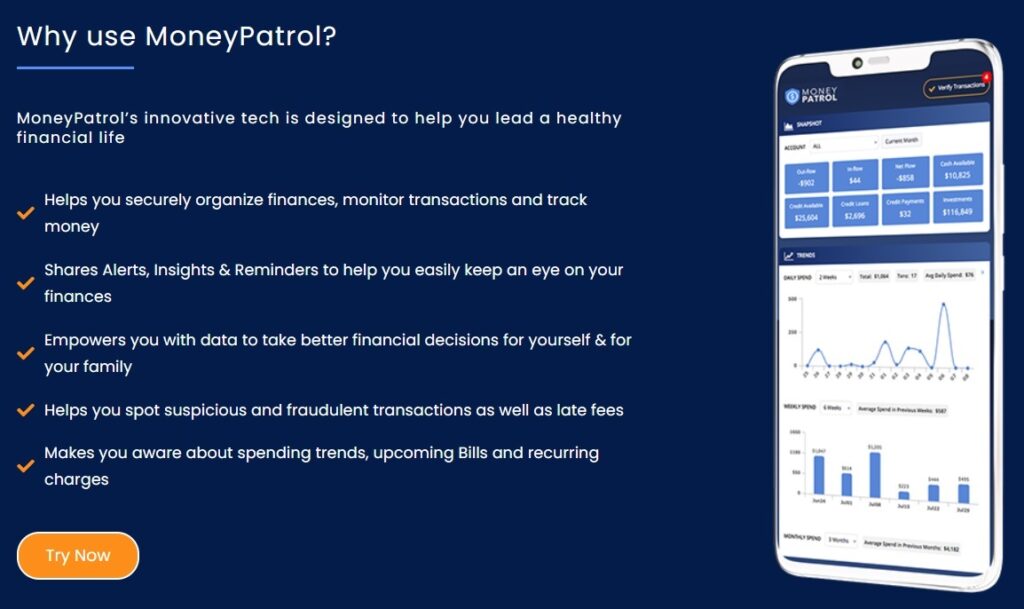

- A solid awareness of one’s financial condition allows one to be accountable for how they utilize and distribute the money they make.

- Regardless of age, job, or salary, it is critical to understand how much money we have and how we spend it.

Personal finance includes having enough money to pay required monthly payments to prepare for retirement. The phrase also refers to the many financial institutions that provide financial services to individuals throughout their lives. Budgeting, banking, and planning are other aspects of personal money.

Table of Content:

1. Making Financial Decisions in ’40s

- You should Re-evaluate and Revisit your Financial Goals

- You must Start Investing in Your Health

- You should be on the same Financial Page as your Partner

- You should plan Children-related Expenses

- Think and Plan for your Death

2. What are the Minor but Important Financial Decisions in the ’40s?

3. Conclusion

1. Making Financial Decisions in '40s

Your forties are the busiest decade of your life, complete with difficulties, opportunities, and financial decisions that will have long-term consequences for you and your family.

You’re also reaching your prime earning years, or perhaps you’re ready to make a professional move and start a new work. You have your most significant career years ahead of you, so developing a financial strategy is critical to help you successfully traverse this decade.

Financial planning is frequently postponed until all of the family’s duties are accomplished. Children’s education, home ownership, and medical costs appear to be significantly more important than saving.

Retirement seems to be a long way off, and specialist advice from financial managers will be required.

At 40, you should establish your objectives and save for your many requirements. It is a poor idea not to have a financial strategy in place. We provide easy ideas to help you securely plan your financial future. Do not put off saving for more than 40 days.

Here are a few things that you need to consider for Financial Decisions when you are turning 40:

a. You should Re-evaluate and Revisit your Financial Goals

Even if you have set financial goals, now is the best time to re-evaluate them and follow them diligently.

You must set long-term goals (5+ years), mid-term goals (2 to 5 years), and short-term goals (1 to 2 years) to keep yourself on the right track.

By 40, most people have some or the other retirement plan in place.

Now is the perfect time to scrutinize your finances and establish how much money you need to retire. Then calculate whether your current investment plan can get you closer to that goal. If not, then you need to make other plans to get there.

b. You must Start Investing in Your Health

Health investment is a must for evaluating and preparing for your overall health. Begin by scheduling annual check-ups, committing to healthy eating, and working out. You should spend money and time to be beneficial in the future.

You’ll stay fit without spending a fortune if you take care of yourself in your 40s. This also comes under wise financial choices as money saved on medical expenses is also earned.

c. You should be on the same Financial Page as your Partner

It is always better to be on the same financial page as your partner. Hiding about finances, your goals, dreams, or aspirations is also a form of cheating. When you share your life with someone, it is only fair to share all aspects of your life with them.

d. You should plan Children-related Expenses

If your kids haven’t reached college, there’s still time to decide on strategies for paying for college education funds. You can come up with a plan now and contribute to their education. Look how much you’ve already set aside and how much more you need to do this comfortably without disturbing your other plans.

e. Think and Plan for your own Death

Death is inevitable, but the 40s doesn’t automatically mean you must keep thinking about it. You most likely have a partner, children, or other dependents, and your demise would have a substantial financial impact on them.

However, you must plan for it ahead as you have more responsibilities than a decade ago. A plan makes things easy, as you will have adequate finances to support your family if something happens to you. This will ensure that your loved ones are well protected even when you’re gone.

2. What are the Minor but Important Financial Decisions in the '40s?

Everyone in their 40s must know that there is still time on their side, but not for long. Hence, your financial health needs to be on your list of priorities. You can still save money and also invest more. You’re at the tipping point between needing to spend less and being able to save more. However, this is also the time to prioritize financial independence and savings.

Good personal finance management abilities can assist us in effectively managing our money and ensuring a prosperous financial future.

While we may have a job that covers our everyday costs, large medical bills or any other event might cause economic devastation if left neglected.

Financial literacy is similar to mastering any other language in that one must use and apply their knowledge. Practice, like any other work, helps improve awareness of financial concerns. Specific terminology and concepts, as well as how to employ them, must be on our radar.

For people turning 40, you can take vital financial steps to set you straight for the rest of your life.

You appear to be fit and fine at 40, and while you will always be youthful in heart, you cannot disregard the need to plan for an emergency, which may be anything.

If an emergency strikes, your financial plan should contain a liquid fund to cover all of your emergency demands.

A vehicle loan, a housing loan, a loan for a foreign trip…everything appears to be an imminent demand at the age of 20. The number 20 is all about spending and living in the present. However, 40 is all about directing your earnings toward savings and investments.

As a result, you should make a concerted effort to pay off all of your debts as soon as possible.

At 40, your ultimate aim should be to grow your savings.

As a result, making a budget is the best way to cut down on unneeded luxury spending. Make sure that all of your spendings are for requirements.

Every individual should, ideally, make an educated decision about their retirement. At 40, you still have a lot to do professionally and set career milestones.

However, 40 is possibly the earliest and ideal age to begin contributing to your bright retirement future. To fulfil your old-age demands, your returns should be able to outperform inflation.

The most satisfactory security you can provide for your loved ones is to secure their future in your absence. Invest in life insurance to ensure your family’s independence even if you die.

Go for insurance plans such as health insurance, disability insurance, house insurance, and vehicle insurance to ensure that you have the best possible coverage in the event of an unexpected incident.

When you are making more money, it is also essential to save your income and spend what is left. This is known as investing in your future self first. It’s the best way to steer clear of runaway lifestyle expenses that hamper your ability to save.

Personal finance plays an integral part in achieving financial freedom. Paycheck to paycheck is a complicated way of life. We must plan for and manage money at all stages of our life. We would be enslaved if we did not plan ahead of time.

3. Conclusion

In a person’s financial life, the forties represent a watershed time. The majority of people reach an economic tipping point in their forties. It is also when income is increasing, and expenditures are levelling off. The 40s, like every other stage of a financial life cycle, offers its own set of opportunities and challenges.

Since there is only so much time for repairs, the opportunity to correct errors is limited. To do so, you must be aware of the inevitable typical financial faults that you must be aware of and correct as soon as possible.

Your forties are complete with fresh chances, major financial decisions, and problems. The 40s may also be a good decade with the correct amount of financial forethought. To confidently discover the proper path, you need a dynamic and individualized financial strategy that caters to all aspects of your life.

- Incorrect investment.

- Having insufficient equity.

- Uncontrolled expenditure.

- Failure to prioritize objectives.

- Ignoring emergencies.

- Panic selling when markets crash.

Our users have reported an average of $5K+ positive impact on their personal finances

Our users have reported an average of $5K+ positive impact on their personal finances