Smart Finance, Simplified Tracking

Make Us Stand Out

Essential Features You’ll Love

Organize Finances

Connect All Your Financial Accounts - attach Credit Cards, Checking, Savings, Loan, Investments, Mortgage, and Reward Accounts.

Monitor Transactions

Understand Your Money In-flow and Out-flow. See Your Spending Patterns by Merchants & Categories. Get Trends by Day, Week, Month and Quarters.

Alerts and Insights

Receive Alerts such as Money In-flow & Out-flow; Interest Charges; Overdraft & Late fees; Recurring, Duplicate, Fraudulent & Suspicious Charges.

Track Investments

Connect and Track your Investment accounts, such as Stock investments, 401K, and Roth IRA contributions, along with overall portfolio breakdown.

And much more...

Set and Manage Budgets, Receive Bill Reminders, Save Receipts & Documents, Check Cash Flow , Generate Reports and much more...

Key Features

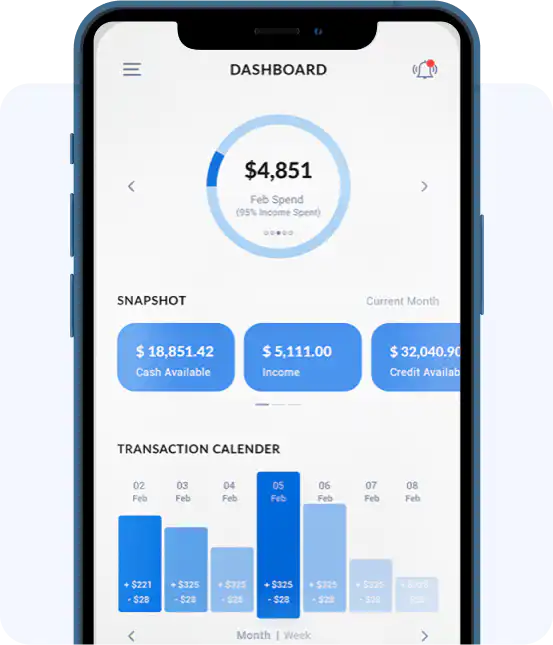

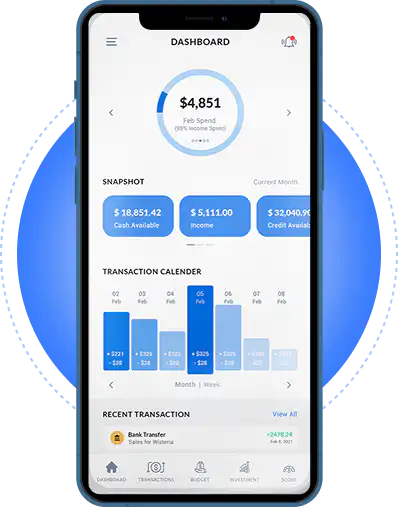

- Advanced Dashboard with data drill down facility

- Get latest transactions along with 1 year data history

- Get informed about Money Out-flow and Money In-flow

- Know your Credit Usage, Rates, Balances and Payments

- Track your available Money and Investment holdings

- See your spend Trends and Patterns over time

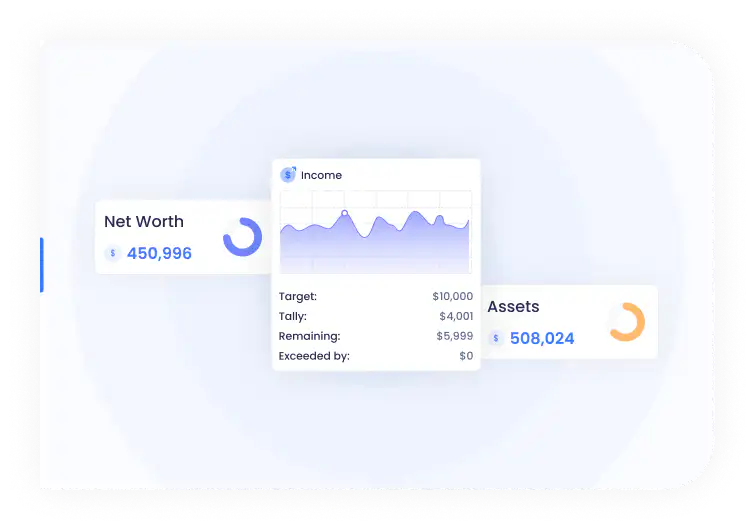

- Use Our Best-In-Class Net Worth Tracker

- Know your top Merchants and Categories by spend

- Get weekly, monthly and yearly summaries

- Create Budgets to manage your expenses

- Receive detailed Text and Email alerts & insights

Connectivity You

Can Count On

MoneyPatrol’s syncs with multiple financial data providers, more than other apps, to connect with 13,000+ financial institutions and keep them in sync.

Amazing App Features

Advanced Security

We securely transmit data from your financial institutions using 256-bit Military grade data encryption

Money Management

Makes you aware about spending trends, upcoming Bills and recurring charges

Budget Planner

Create weekly & monthly Budgets to track your spending by Categories and Merchants. Receive timely Alerts & Insights using the best budget planner.

Expense Tracking

See your Income and Expense calculations at one place to easily understand your monthly Cash Flow and create a workable Savings plans for the future

Financial Goals

Empowers you with data to take better financial decisions for yourself & for your family

Credit Goals

Know your Credit Usage, Rates, Balances and Payments and Improve your credit score

Calendar View

See your spend Trends and Patterns over time. Get weekly, monthly and yearly summaries

Bills Management

Upload and save your receipts of business transactions (for tax purposes) to the secure document vault.

Reminders

Get Reminders in advance about upcoming and recurring Bills so that you don't miss any payments or default on your important Bills.

Transaction History

Get Reminders in advance about upcoming and recurring Bills so that you don't miss any payments or default on your important Bills.

Download the App on your favorite Desktop and Mobile platforms

The Most Comprehensive Money Management Application

Organize Finances

Connect All Your Financial Accounts – link Credit Cards, Checking, Savings, Loan, Investments, Mortgage, and Reward Accounts.

Monitor Transactions

View all transactions in detail and accurately track income, expenses, bills and transfers. Easily spot unauthorized and fraudulent transactions.

Get Money Alerts and Insights

Get alerts about money coming in and going out of your accounts. Receive detailed insights about your spending and expense patterns.

Set and Manage Budgets

Create detailed budgets to track your spend by Merchants, Categories, and Tags using this best app for budgeting and stay within your Budgets.

Receive Bill Reminders

Track your Bills and get reminders about upcoming payments and recurring subscriptions so that you don’t miss any payments.

Save Receipts & Documents

Upload and store all your receipts, invoices, and important documents in a secure document vault. Extract data from Receipts.

Track Investments

Connect and track your Investment accounts such as Stocks, Crypto, 401K and Roth IRA contributions with overall portfolio breakdown.

Check Net Worth

Check your Net Worth by tracking the value of your assets and outstanding liabilities including various loans, mortgages and debts.

Generate Reports

View detailed weekly and monthly trend reports to see your money patterns; download these reports in pdf and excel file formats.

Lower Your Debts

Track all your debts including Credit Cards, Student Loans, Car Loans and Mortgages. Create and follow debt payoff plans.

Reconcile Accounts

Perform account reconciliation to ensure all your transactions are in the system so that you can trust the accuracy of the data.

Improve Credit Score

Download Equifax Credit Reports and understand in detail your Credit Score along with the reported debts and liabilities.

Perform Cash Flow Analysis

Understand your Cash Flow by seeing in detail the Inflows and Outflows happening across all your bank and credit card accounts.

Categorize Transactions

Add custom categories and create rules to auto-categorize transactions including the auto-update of merchant names.

Integrate With Excel

Use the MoneyPatrol Excel Add-In to download your transactions directly into Excel to perform additional analytics on your financial data.

Review Transactions

Review and accept every transaction as they come into the MoneyPatrol system. Change categories, cleand merchant names, apply rules, add tags, record memos, attach receipts, split transactions and do much more.

Plan And Forecast

See your fixed and variable expenses by month, plan for the entire year and forecast how much money you will need to meet expected and unexpected life events so that you can be prepared financially when those events happen.

View Calendar

See all your transactions, utility bills, recurring subscriptions and credit card and loan payments by day in a Calendar format so that you can clearly see what is going to hit your accounts and when and plan accordingly.

File Taxes

See how much refund you can get and the file for your personal taxes directly through the MoneyPatrol platform at a much cheaper rate compared to other tax filing software.

Access Calculators

Access 100+ financial calculators to calculate for any financial situation and prepare for life events. Calculate your interest payments, money needed to retire, investment growth MORE...

Research Investments

Perform research on stock market, stock quotes and crypto currency performances. Create bookmarks to track and follow news and performances of any company as well MORE..

Why MoneyPatrol is the best Bills Tracker, Bills Manager and Bills Organizer App?

In today’s fast-paced world, managing bills and staying on top of financial responsibilities can be a daunting task. However, with the advent of user-friendly apps like MoneyPatrol, taking control of your bills has never been easier. MoneyPatrol serves as a comprehensive bills tracker, organizer, and manager, empowering users to effortlessly manage their finances. MoneyPatrol is one of the best bill tracking app.

MoneyPatrol is a comprehensive bills management app that helps you stay organized and in control of your finances. With MoneyPatrol, you can easily track, organize, and manage your bills, ensuring that you never miss a payment and maintain a healthy financial life. MoneyPatrol is one of the best bill tracking app.

Let’s explore the key features and benefits of MoneyPatrol, showcasing how this app and software can revolutionize your bill management and ensure financial peace of mind. MoneyPatrol is one of the best bill tracking app.

Streamlining Bill Tracking:

One of the primary functions of MoneyPatrol is to streamline bill tracking, making it a breeze to monitor your financial commitments. The app allows users to add and track all their bills in one centralized location. Whether it’s recurring expenses such as utilities, rent, mortgage, or credit card payments, or even irregular bills, MoneyPatrol enables you to input the necessary details and due dates of each bill. MoneyPatrol is one of the best bill management app.

Never Miss a Payment with Reminders and Notifications:

With MoneyPatrol, you can bid farewell to missed payments and late fees. The app offers a robust reminder and notification system that ensures you stay on top of your bills. Customizable reminders can be set according to your preferences, allowing you to receive timely notifications before a bill is due. Whether it’s a gentle reminder a few days in advance or a more urgent notification on the day of the payment, MoneyPatrol keeps you informed and accountable. MoneyPatrol is one of the best bill management app.

Effortless Payment History and Tracking:

Keeping track of your payment history becomes effortless with MoneyPatrol. The app maintains a comprehensive record of all your bill payments, providing you with a transparent overview of your financial commitments. By accessing your payment history, you can easily review past payments, monitor your spending patterns, and ensure you’re effectively managing your cash flow. MoneyPatrol is one of the best bill management app.

Smart Bill Categorization for Better Insights:

MoneyPatrol goes beyond simple bill tracking by offering smart bill categorization options. You can categorize your bills based on different criteria, such as type, due date, or amount. This feature allows you to gain valuable insights into your expenses and budget. By analyzing your bills across different categories, you can identify areas where you may be overspending and make informed decisions to improve your financial health. MoneyPatrol is one of the best app to keep track of bills.

Comprehensive Expense Analytics and Reports:

To gain a deeper understanding of your financial landscape, MoneyPatrol provides detailed analytics and reports on your bills and expenses. Visualizing your spending habits through interactive charts and graphs, the app offers invaluable insights into your financial behavior. These analytics empower you to identify areas where you can cut back, allocate resources more efficiently, and achieve your financial goals. MoneyPatrol is one of the best app to keep track of bills.

Security and Privacy Assurance:

MoneyPatrol understands the importance of privacy and security when it comes to personal finance. The app employs robust encryption measures to safeguard your financial data, ensuring that your information remains secure and confidential. You can trust MoneyPatrol to handle your sensitive financial information with the utmost care and protect it from unauthorized access. MoneyPatrol is one of the best app to keep track of bills.

Sync Across Devices for Enhanced Accessibility:

MoneyPatrol provides seamless synchronization across multiple devices, ensuring that your bills and payment information are always at your fingertips. Whether you’re using a smartphone, tablet, or computer, you can effortlessly access your MoneyPatrol account and stay up to date with your bills. This feature offers unmatched convenience and accessibility, allowing you to manage your finances anytime, anywhere. MoneyPatrol is one of the best best app to keep track of bills.

Below is a quick summary of the key features of MoneyPatrol as a Bills Tracker, Bills Manager and Bills Organizer: MoneyPatrol is one of the best best app to keep track of bills.

1. Bill Tracking: MoneyPatrol allows you to manage and track all your bills in one place. Whether it’s utilities, rent, mortgage, credit card payments, or any other recurring expenses, you can easily see the details and due dates of each bill.

MoneyPatrol is one of the best best bill tracking app.

2. Bill Reminders: MoneyPatrol sends you timely reminders and notifications before your bills are due. You can customize the reminders according to your preferences, ensuring that you stay on top of your payments and avoid late fees or penalties.

MoneyPatrol is one of the best best bill tracking app.

3. Payment History: The app keeps a record of all your bill payments, allowing you to track your payment history and stay aware of your financial commitments. You can easily view past payments and monitor your spending patterns.

MoneyPatrol is one of the best best bill management app.

4. Bill Categorization: MoneyPatrol provides the option to categorize your bills based on different criteria such as type, due date, or amount. This categorization helps you analyze your expenses and budget effectively.

MoneyPatrol is one of the best best bill management app.

5. Payment Tracking: Once you’ve made a payment, you can mark it as paid within the app. MoneyPatrol keeps track of your paid bills, giving you a clear overview of your outstanding payments and helping you manage your cash flow.

MoneyPatrol is one of the best best bill management app.

6. Expense Analytics: The app offers detailed analytics and reports on your bills and expenses. You can visualize your spending habits, identify areas where you can cut back, and make informed financial decisions.

MoneyPatrol is one of the best manage bills app.

7. Secure and Private: MoneyPatrol takes your privacy and security seriously. Your financial data is encrypted and protected, ensuring that your information remains safe and confidential.

MoneyPatrol is one of the best manage bills app.

8. Sync Across Devices: MoneyPatrol allows you to sync your bills and payment information across multiple devices. You can access your account from your smartphone, tablet, or computer, ensuring that you have your bills at your fingertips wherever you go.

MoneyPatrol is one of the best manage bills app.

MoneyPatrol simplifies the process of managing your bills, helping you avoid missed payments, late fees, and financial stress. With its intuitive interface and powerful features, it’s an essential tool for anyone seeking to stay on top of their finances. MoneyPatrol is one of the best manage bills app.

MoneyPatrol is the ultimate solution for anyone seeking to take control of their bills and achieve financial harmony. With its intuitive interface, robust features, and emphasis on user-friendly bill management, MoneyPatrol empowers individuals to track, organize, and manage their finances effectively. By leveraging this app’s capabilities, you can bid farewell to missed payments, late fees, and financial stress. Embrace the power of MoneyPatrol and experience a newfound sense of financial control and peace of mind. MoneyPatrol is one of the best expense manager app.