Budgeting Apps will help you stay on track with your personal finances and help you gain control you’re your spending. But, it is absolutely important that you will have to stay disciplined by staying within your budgets. Taking control of your finances will require you to completely change your financial lifestyle and incorporate new habits like creating a budget that you can stick to, tracking your expenses, setting financial goals, getting rid of unnecessary expenses, and paying off your debts. All of these will require time, discipline, and commitment. If you’ve been moving back and forth with managing your finances and nothing has worked for you, then we highly recommend that you try free budgeting app such as MoneyPatrol. Fortunately, there are many budgeting apps currently in the market, and, MoneyPatrol is the best budgeting app amongst all of them. MoneyPatrol has the best budgeting app for Android.

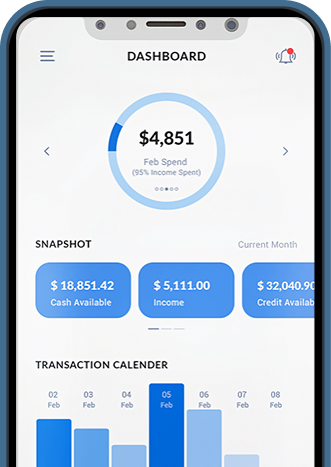

Helps you securely organize finances, monitor transactions and track money

Empowers you with data to take better financial decisions for yourself & for your family

Makes you aware about spending trends, upcoming Bills and recurring charges

Shares Alerts, Insights & Reminders to help you easily keep an eye on your finances

Shares Alerts, Insights & Reminders to help you easily keep an eye on your finances

Budgeting apps such as MoneyPatrol can help you stay on track with your personal finances and gain control of your spending. However, it is absolutely necessary that you remain disciplined by sticking to your budget. Taking control of your finances while using budgeting apps will necessitate a complete change in your financial lifestyle and the incorporation of new habits such as creating a budget that you can stick to, tracking your expenses, setting financial goals, eliminating unnecessary expenses, and paying off your debts. All of these will necessitate time, discipline, and dedication. A top budget app such as MoneyPatrol will certainly help if you’ve been struggling to manage your finances and nothing has worked. We strongly advise you to try MoneyPatrol, the best app for budgeting.

By Subscribe And Enjoying Our Newsletter, You Can Make The Send And Receive Payments Easier & Faster.

© 2025 MoneyPatrol.com, all rights reserved. MoneyPatrol®, and the MoneyPatrol logo are trademarks of Kevali Tech LLC. Milpitas, California, the USA