MoneyPatrol is a great tool to use if you're looking at ways to improve your financial management.

User Guide - MoneyPatrol Documentation

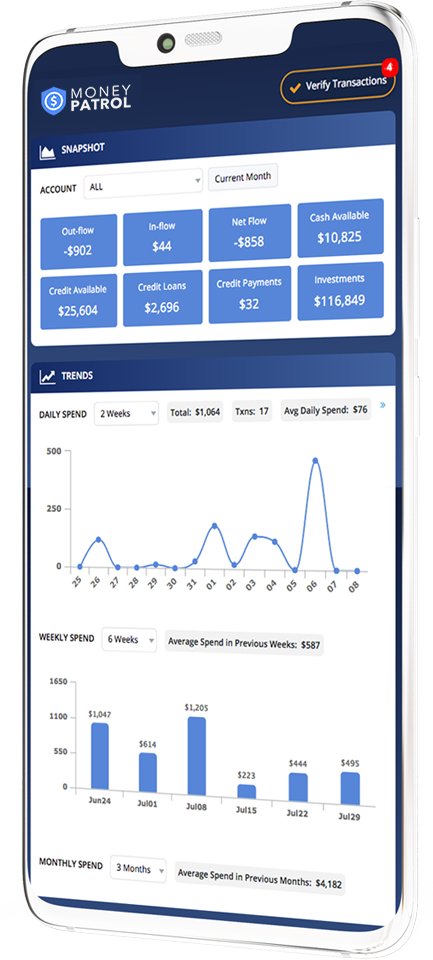

To provide you with the best experience in your financial journey, we have following tools on dashboard. You can take total control of your money in simple steps.

Alert ticker:

Alert ticker is a quick insight to the user. It helps them to know the updates based on credit loans, cash out-flow/In-flow, etc.

Review Transactions:

When you click on the Review Transaction tab, It will render you to the Transaction Summary page. It will give a complete transaction summary to the user. You can manage the categories, add the transaction, add the Categories/Merchant/Tag rule, edit the merchant and add the transaction tags through the transaction summary page.

Recent Transaction:

Recent transactions will show you the transactions processed in the course of last month.

Snapshot:

Snapshot provides a glance view of Expenses, Income, Net flow, Cash available, Credit available, Credit loans, Credit usage and Investments.

Expenses:

It shows the amount spent by the user per institution within the current month.

Income:

It shows the income transactions details done within the current month.

Net Flow:

It displays the cash In-flow, cash Out-flow and cash Net flow statement of the current month.

Cash available:

It is nothing but the balance in checking/ savings accounts.

Credit Available/Credit Loans/Credit Usage:

It provides the credit limit, credit available and credit loan details of the current month.

Investments:

It shows your portfolio and its value.

Insights:

It is the graphical insights of your spend share by merchant and category.

Balance Sheet:

A balance sheet gives the net worth statement. It shows your financial position at a given point in time. It is like a “financial snapshot” that shows the dollar value of what you own and what you owe. The balance sheet is based on the following fundamental equation:-

Netflow = Inflow - (minus) Outflow.

It could be positive or negative. A balance sheet shows the balance of Checking accounts, Savings accounts, Investments account, Other assets, Credit/Loan accounts, Mortgage, Other debt and Loans.

Budgets:

It helps out the user to stay on track with your spending and savings goals.

Credit Card and Usage:

The credit card and usage on dashboard provide the user with all his credit cards details. The customer can view the total available credit limit, credit loan, credit available and credit usage of each individual card on the dashboard.

Trends:

Trends displays the daily spend and monthly flow. It informs the user about money Out-Flow and money In-Flow.

Credit Score:

MoneyPatrol comes up with Equifax credit score, an educational credit score developed by Equifax. Equifax credit scores are provided to consumers for their use to help them estimate their available credit position. To get the score, users need to sign in with First name, Last name and SSN. Users will have to verify their identity by providing answers to security questions or using the auth code sent on the user's mobile phone.

Recurring Merchants:

Recurring merchants widget shows the details of recurring transaction occurrence date, its merchants and amount.

Utility Bill Reminders:

Utility bill reminders remind you before the due date.

Transaction calendar:

The transaction calendar defines an accounting year and the periods it contains. It preserves the records of Expenses made, Incomes, and Cash Flow. Users can see Money In-Flow/Out-Flow day wise and monthly Cash-flow in the calendar view.

Are you exhausted by checking all sections and finding it difficult to understand? Do you want any personal help? Please reach out to us using the mentioned email address:

support@moneypatrol.com. One platform to track all your finances. Simple and easy to use. Alerts Insights to understand your finances better.

One platform to track all your finances. Simple and easy to use. Alerts Insights to understand your finances better.